Bitcoin Drops Below $109K as Profit-Taking and ETF Slowdown Weigh on Market

Bitcoin’s rally is showing signs of fatigue after a sharp sell-off pushed prices under $109,000. Long-term holders have realized billions in profits while exchange-traded fund inflows slow, raising concerns that the market may be entering a cooling phase similar to past cycle tops.

In brief

- Bitcoin drops to $108,700, breaking key support levels as long-term holders take profits.

- Glassnode reports 3.4M BTC in realized profits, mirroring patterns seen at previous cycle tops.

- Short-term holders under stress as SOPR nears 1 and NUPL approaches zero, raising risk of liquidations.

- Analysts warn BTC must reclaim $115K to restore bullish momentum as sentiment stays in fear zone.

Profit-Taking Signals Cycle Exhaustion For Bitcoin

Bitcoin dropped to $108,700 on Coinbase late Thursday, its lowest in three weeks, slipping past key support around $112,000. Even though the asset has yet to retest $107,500, the low from September 1, momentum remains weak.

According to Glassnode, long-term holders have realized 3.4 million Bitcoin in profit—levels consistent with previous market peaks. Profit-taking exceeded 90% of coins moved three times this cycle, a pattern that has historically marked cycle tops.

Analysts caution that this level of realized gains points to market exhaustion after the Federal Reserve’s recent rate cut failed to boost sustained demand. More so, Markus Thielen, head of research at 10x Research, warned that prices hovering near this zone could trigger another wave of stop-loss selling.

Short-Term Holders Face Rising Pressure

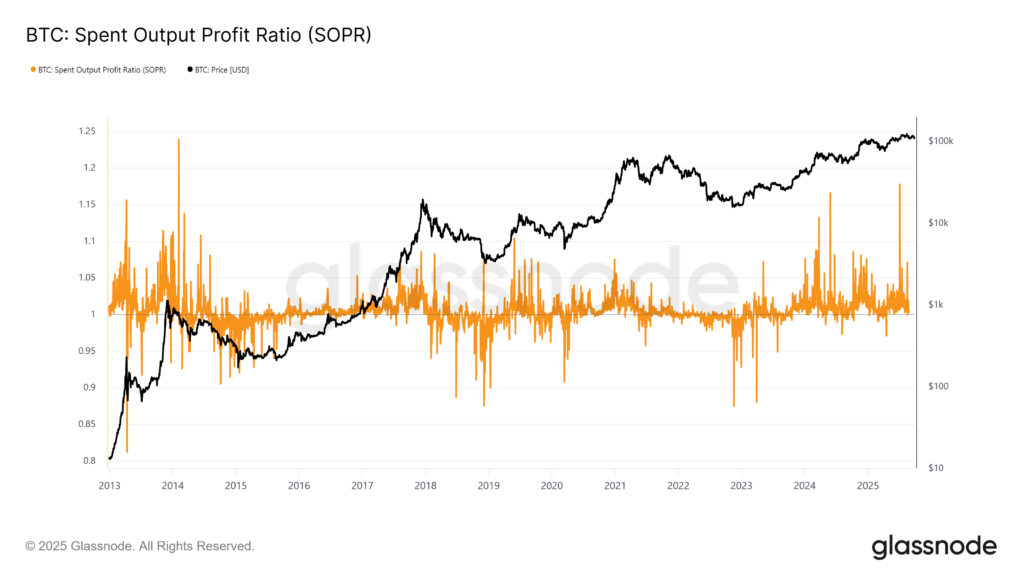

Indicators suggest growing stress among short-term market participants. Glassnode data shows the Spent Output Profit Ratio (SOPR) at 1.01, meaning some investors are already selling at a loss.

Historically, this ratio can mark key turning points, as dips below 1 during bull markets often signal seller exhaustion and rebounds. At the same time, rejections around 1 in bearish conditions can lead to further downside.

Meanwhile, the Short-Term Holder Net Unrealized Profit/Loss (NUPL) is nearing zero. Thielen noted this raises the risk of liquidations as newer investors move quickly to cut losses. Without renewed demand from institutions and retail buyers, Glassnode said the chance of a deeper correction remains high.

Outlook: Neutral to Cautious

At the time of writing, Bitcoin was trading at $109,178, down over 5% in the last seven days.

Other notable market data include:

- Bitcoin sentiment stays bearish, with the Fear & Greed Index holding at 33.

- Over the past year, the asset has surged 67%, showing strong upside momentum.

- BTC outperformed 87% of the top 100 coins

- Still, the coin was outpaced by Ethereum during the same period.

- It trades above the 200-day simple moving average—signaling a positive long-term signal.

- In the last month, the asset posted 16 green days.

For now, some analysts remain cautious about the OG coin’s future trajectory. Thielen suggested that Bitcoin would need to reclaim $115,000 to restore a convincing bullish case. Glassnode echoed that the current structure resembles “exhaustion” and favors a cooling phase.

Still, not all sentiment is bearish. MicroStrategy’s Michael Saylor voiced optimism earlier this week. He predicted Bitcoin could strengthen in the fourth quarter as macroeconomic pressures ease.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.