Bitcoin Eyes $113K Breakout as Fed Rate Cut Expectations Fuel Market Optimism

Bitcoin entered the week on a strong note, climbing toward $113,000 as traders positioned for further gains ahead of a critical U.S. Federal Reserve meeting. With market sentiment buoyed by expectations of an imminent rate cut, optimism spread across crypto markets, reinforcing Bitcoin’s short-term uptrend.

In brief

- Bitcoin tests the $112,000–$114,000 zone, with analysts eyeing a breakout that could spark a rally toward $123,000 or higher.

- Open interest in BTC options surges to $63B as traders bet on a bullish continuation toward $120,000–$140,000 targets.

- Fed expected to cut rates by 0.25% on Oct 29, fueling optimism across risk assets and strengthening Bitcoin’s outlook.

- Diverging opinions remain as some analysts warn of a 50% correction, despite projections of over $200,000 by 2025.

Bitcoin Tests Critical $112K Zone: Analysts See Path Toward $123K and Beyond

The cryptocurrency challenged the $112,000 level into Sunday’s weekly close, marking a renewed push higher after several days of consolidation. The move followed a late rebound on Friday that lifted Bitcoin to the upper end of its weekly range, supported by favorable U.S. inflation data.

Market participants anticipate that Bitcoin could set new local highs if momentum holds at the start of the week:

- Key Resistance in Focus: Traders are zeroing in on the $112,000 resistance level, considered a critical point that could shape Bitcoin’s next major move in the market.

- Bullish Breakout Potential: Market analyst Crypto Caesar believes that a clean break above $112,000 would likely confirm a bullish continuation, setting the stage for a potential rally toward $123,000.

- Momentum Building: Bitcoin has posted four consecutive daily gains, a sign of consistent accumulation by larger investors and growing confidence among market participants.

- Critical Trading Zone: Caesar identifies the $112,000–$114,000 range as a pivotal zone; reclaiming this territory could trigger stronger upward momentum and extend gains in the near term.

- Short-Term Outlook: Supposing momentum holds, Bitcoin could quickly advance toward the $118,000 mark, reinforcing the bullish sentiment driving current market activity.

Analytics account Frank Fetter identified $113,000 as a crucial level corresponding to the short-term holder cost basis—the average entry price of investors holding Bitcoin for less than six months. According to Fetter, reclaiming this threshold could reinforce the uptrend and open the door to a move toward the $130,000–$144,000 range.

Derivatives Market Signals Renewed Optimism

Open interest in Bitcoin options hit $63 billion, one of the highest levels recorded this year, according to CoinGlass. Meanwhile, bullish sentiment dominates the derivatives market, with traders aggressively building long positions as Bitcoin holds above key resistance zones.

Investors now eye strike prices between $120,000 and $140,000, reflecting growing confidence that Bitcoin’s rally could accelerate toward new highs in the coming weeks. This wave of leverage underscores a broader shift toward risk-taking, driven by signs of easing macroeconomic conditions.

The Fed Poised to Cut Rates

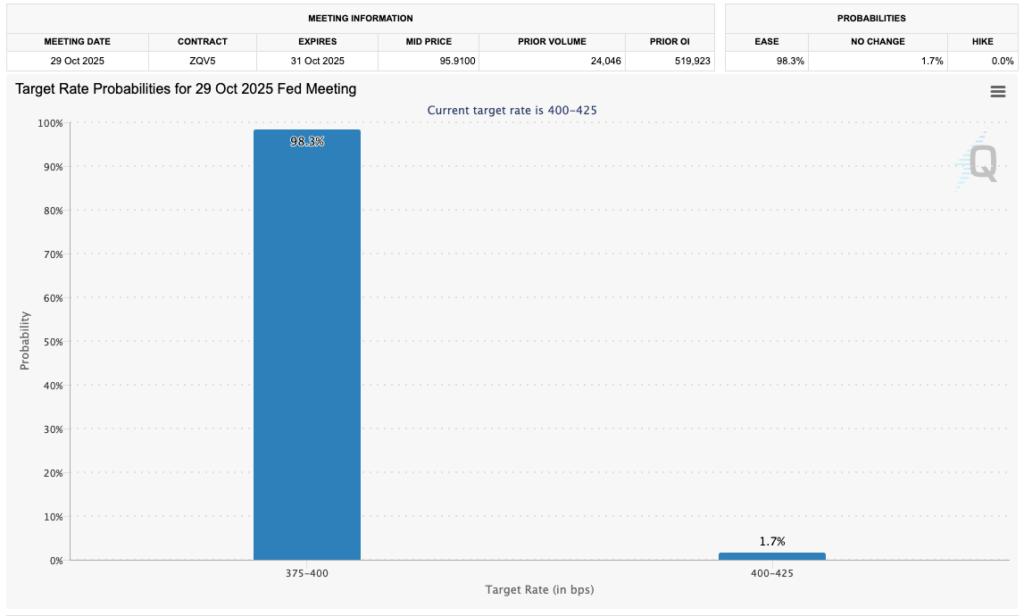

The coming week holds particular importance for Bitcoin and other risk assets. The Federal Reserve, following softer-than-expected inflation data, is widely expected to cut interest rates by 0.25% at its meeting on October 29. According to CME Group’s FedWatch Tool, the probability of that outcome now exceeds 98%.

Such a move would mark the latest step in a global monetary easing cycle. According to market research firm The Kobeissi Letter, around 82% of the world’s central banks have lowered interest rates over the past six months—the highest proportion since 2020.

The report noted that the current pace of global rate cuts is comparable to levels typically seen during recessions, signaling that monetary easing is now widespread across major economies.

Adding to the week’s significance, the Fed hosted its first official conference explicitly focused on cryptocurrencies and stablecoins. Major participants—including Chainlink, Circle, Paxos, Coinbase, BlackRock, and JPMorgan—took part in the discussions, signaling a notable shift after years of limited engagement from the central bank.

Diverging Views on Bitcoin’s Outlook

Despite the bullish setup, not everyone expects a smooth trajectory. Tom Lee, president of BitMine, cautioned that Bitcoin could face a 50% correction due to its continued correlation with traditional markets. He warned that broader market weakness could still drag crypto prices lower—even amid strong institutional inflows and the success of Bitcoin ETFs.

Still, Lee remains confident in Bitcoin’s long-term potential. He maintains a bullish forecast, expecting the cryptocurrency to reach between $200,000 and $250,000 in 2025, supported by growing institutional interest and broader market adoption.

As the Fed’s decision approaches, Bitcoin’s resilience may hinge on whether bulls can secure a decisive break above $113,000—a move that could set the stage for a broader rally toward new all-time highs.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.