Bitcoin Holds Above $107K as On-Chain Data Signals Healthy Trend

Bitcoin’s recent 12% pullback has drawn attention, but on-chain data indicates that this correction is a normal phase in the market. Analysts say the decline is within historical patterns and reflects a healthy reset rather than the end of the ongoing bull cycle.

In brief

- Bitcoin’s 12% pullback mirrors past bull cycles, signaling a healthy market reset.

- Strong support at $107K and oversold signals suggest potential for renewed momentum.

- Resistance near $110K remains key, with a breakout above $111K needed to shift trend.

Correction Within a Bull Market

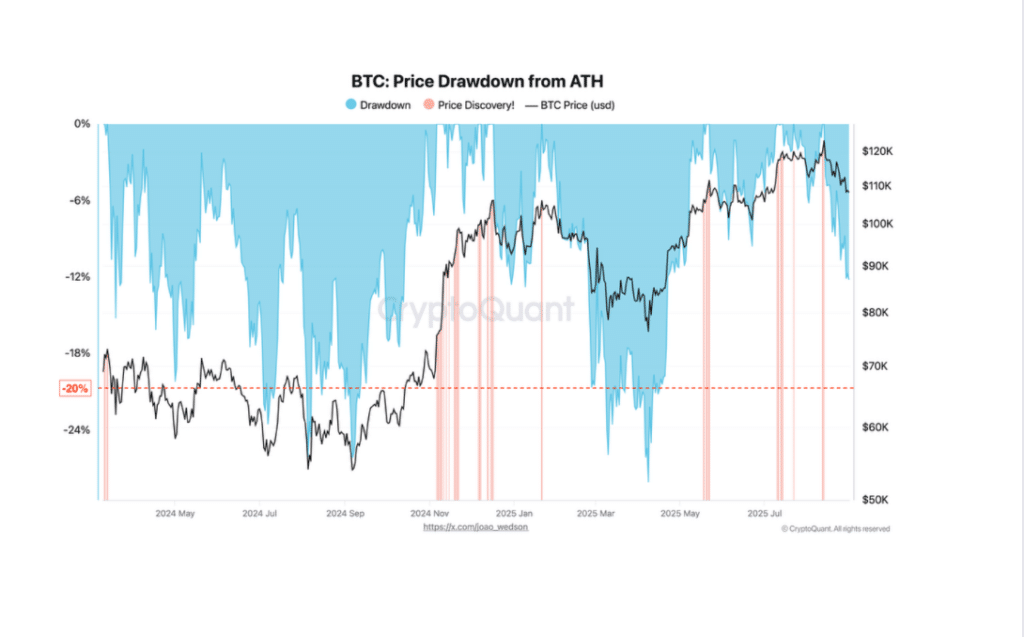

Bitcoin’s CryptoQuant on-chain analysis shows that the fall from its all-time high of $123,000 to near $108,000 is in line with past corrections. The study points out that such moves help the market adjust after periods of strong growth. Historical data shows that corrections of 20–25% are often recorded even during strong rallies.

CryptoQuant analyst Darkfost noted that Bitcoin has seen price drops of nearly 28% since breaking previous highs in March 2024. He explained that these pullbacks are common events in bull markets and serve to reduce excess leverage in derivatives trading. Analysts believe this process provides opportunities for investors with a long-term outlook.

Signs of an Oversold Market

Other data suggests that Bitcoin is now in an oversold state, which may set the stage for renewed momentum. The price has repeatedly tested the $107,000 area without breaking lower, indicating strong buying interest at that level. Some market watchers anticipate a recovery once Bitcoin surpasses key resistance levels.

Quant investor Frank noted on X that an oversold signal appeared in the short-term holder MVRV bands. He compared it to three previous instances: during the yen carry trade unwind in 2024, the tariff conflict earlier in 2025, and the current correction. Each of those moments preceded renewed activity in the market.

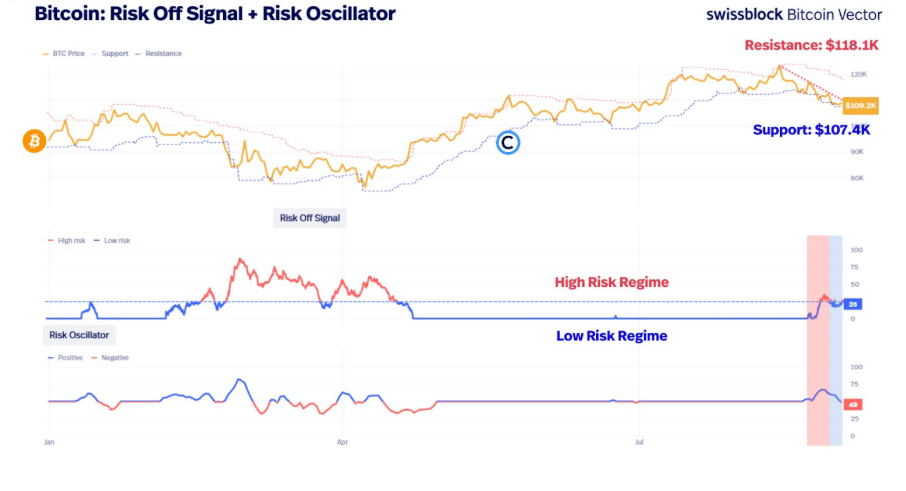

Bitcoin Resistance at $110,000

Analysts also point to $110,000 as a strong resistance area, keeping Bitcoin within a narrow range. Crypto analyst Bitcoin Vector explained on X that Bitcoin remains compressed under this price point. He noted that downward pressure has eased, but the market still needs a decisive move to break higher.

According to his view, a daily close above $111,000 would signal a change in momentum and allow the structure to recover. He added that if Bitcoin stays below resistance, the market may continue consolidating within the current range. This compression reflects a market waiting for a trigger to shift direction.

The ongoing correction appears to be part of a healthy cycle, as data suggests it is removing excess leverage and stabilizing risk levels. Analysts agree that such corrections are a common feature of bull markets and often serve as a reset for future moves. The current pattern affirms Bitcoin’s long-term upward path remains intact while the short-term phase focuses on stability and consolidation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Peter is a skilled finance and crypto journalist who simplifies complex topics through clear writing, thorough research, and sharp industry insight, delivering reader-friendly content for today’s fast-moving digital world.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.