Bitcoin: Institutional Wallets Strengthen Their Position Despite Price Drop

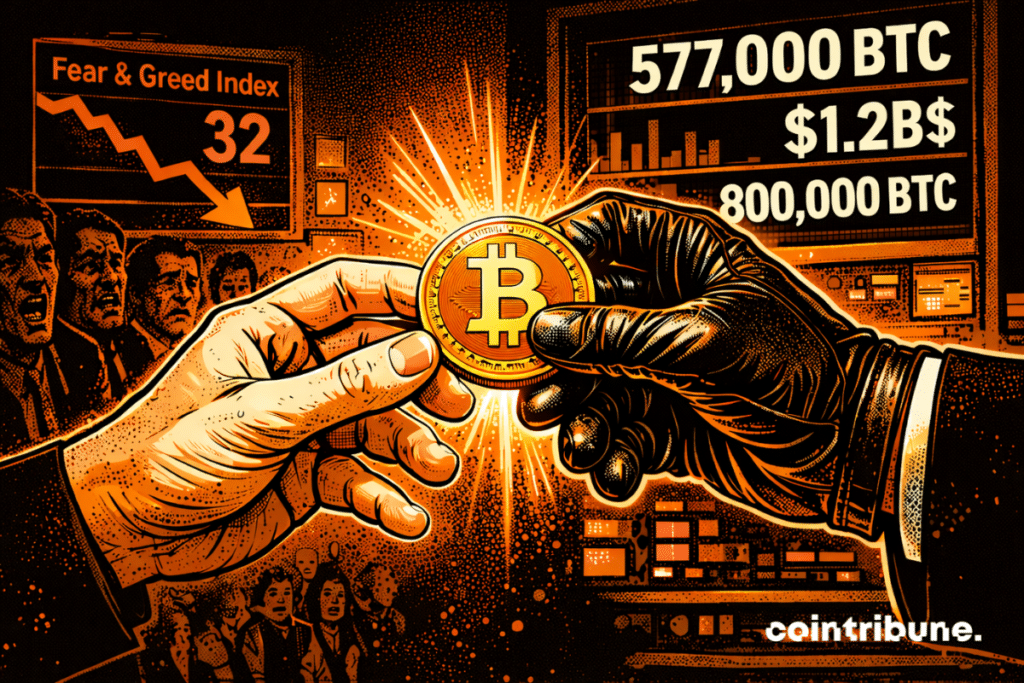

The data confirms it: while retail investors are wary of bitcoin, institutional investors are rushing in. In one year, they have accumulated the equivalent of 53 billion dollars in bitcoin, or 577,000 BTC. A figure that illustrates a silent turning point within the crypto market.

In Brief

- Institutional investors have accumulated 577,000 BTC, confirming a massive long-term strategy.

- Despite retail fear, Bitcoin ETFs strengthen institutional adoption and market stability.

Institutional Wallets Strengthen Their Grip on Bitcoin

Institutional wallets group entities holding between 100 and 1,000 bitcoins, excluding crypto exchanges and miners. They include funds, Bitcoin ETFs, as well as treasuries such as those managed by Michael Saylor. His company Strategy, which has just relaunched purchases, now holds over 260,000 BTC.

This trend has accelerated since the approval of spot Bitcoin ETFs in the United States at the beginning of 2024. These digital assets have attracted more than 1.2 billion dollars since January. The total held by Bitcoin ETFs today exceeds 800,000 BTC. These figures reflect a long-term strategy based on diversification and growing confidence in bitcoin.

According to CryptoQuant CEO Ki Young Ju, institutional accumulation continues. And this is just the beginning! One indicator confirms this: the Fear and Greed Index has dropped to 32. This signals dominant fear among retail investors. A perfect climate for crypto whales, who buy against the trend.

Signals of a Bitcoin Locked by Strong Hands

While the BTC price drops from $95,000 to $91,000, buying continues. Whales practice DCA (regular buying) and now control a growing share of the circulating supply. Result: bitcoin is increasingly in the hands of holders with strong conviction.

This development changes the structure of the crypto market. Less exposed to panic selling, BTC could eventually show more stable movements. But this dynamic has a downside: price-setting power shifts to the most capitalized entities, relegating small holders to the background.

Meanwhile, bitcoin options reveal a bearish bias. Derivative markets anticipate a drop below $80,000 by the end of June. A tension between long-term accumulation and short-term speculation that highlights the current complexity of the crypto market!

In any case, institutional investors seem to be reshaping the future of bitcoin. The crypto landscape will never be the same.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.