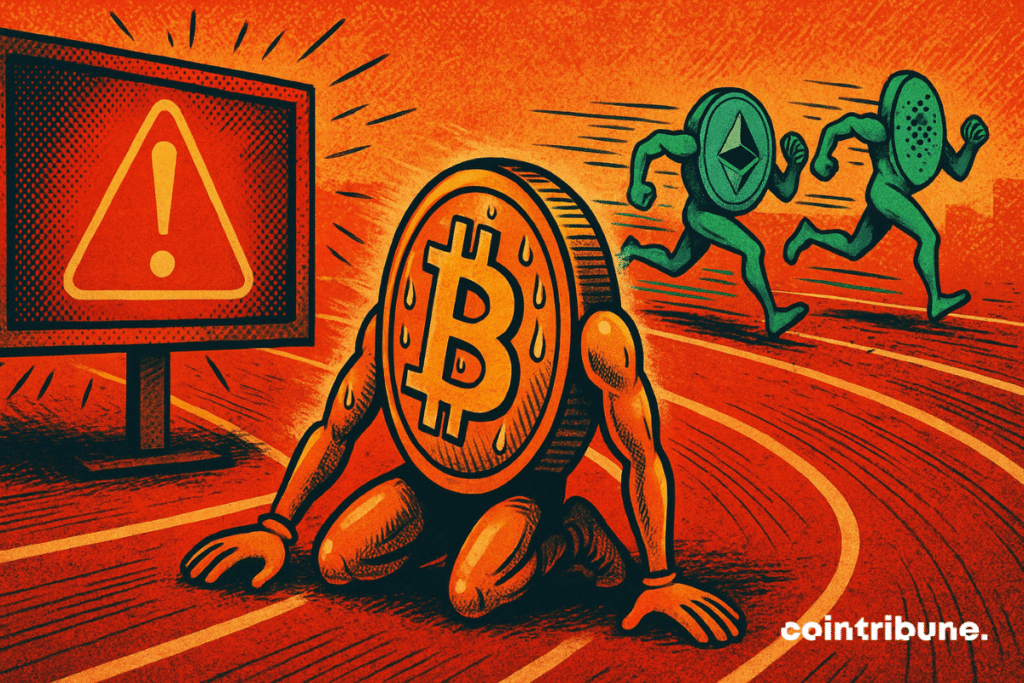

Bitcoin Loses Momentum as Investors Flock to Altcoins

The bullish momentum of bitcoin seems to be fading. After reaching a peak above $124,000, the queen of cryptos shows signs of fatigue. At the same time, retail investor interest is shifting towards altcoins, starting with Ethereum. Does this capital rotation signal a new phase in the crypto cycle?

In Brief

- Bitcoin drops below $117,000 after a recent historic high.

- The crypto sentiment index rose from 0.23 to 0.91 in one week.

- Google searches for Ethereum and altcoins reach multi-year highs.

- Analysts anticipate an altcoin rally starting in September.

Bitcoin Buyer Exhaustion Confirmed

Warning signs are accumulating around bitcoin. For Max Shannon, researcher at Bitwise, the market shows a “classic behavior soaked in foam,” a well-known pattern that generally precedes buyer exhaustion.

Concretely, this happens when buy orders are no longer enough to absorb selling pressure, paving the way for a sharp correction.

The digital asset sentiment index perfectly illustrates this gap. In one week, it jumped from 0.23 to 0.91, reflecting a sudden optimism that contrasts with bitcoin’s lukewarm performance.

This divergence between investor sentiment and price movement is often interpreted by seasoned analysts as a serious warning.

Meanwhile, retail interest is shifting. Google searches for “altcoins” and “Ethereum” are reaching levels not seen in years.

This shift recalls previous cycles: when bitcoin’s momentum weakens, investors turn to alternatives considered more dynamic. History seems to be repeating itself with troubling accuracy.

The recent drop of bitcoin below $117,000 reinforces this fragile picture. Contradictory statements from Scott Bessent, US Treasury Secretary, only added to the confusion.

After assuring that the government was not considering additional purchases for its strategic bitcoin reserve, he backtracked a few hours later. This wavering highlights the uncertainty still surrounding the crypto strategy of the Trump administration.

Altcoins in Ambush for September

Despite the current market fragility, September could mark the strong return of altcoins. David Duong, head of research at Coinbase Institutional, anticipates a potential shift towards a large-scale altcoin season.

This phase is characterized by the outperformance of at least 75% of the top 50 cryptocurrencies against bitcoin over a 90-day period.

The altcoin season index is already rising, moving from 33 to 42 in one week. Although the decisive threshold of 75 remains distant, this trend reflects renewed interest in alternatives to bitcoin, notably Ethereum. In this movement, stablecoins hold a prominent place.

Major financial institutions are strongly positioning themselves. Citigroup has just strengthened its strategy by targeting custody of the reserves backing stablecoins, a market estimated at $250 billion by McKinsey. The bank also aims to challenge Coinbase, which currently concentrates over 80% of crypto ETF custody.

JPMorgan, for its part, points out that Ethereum could come out a big winner from this dynamic. The network now hosts 51% of stablecoins in circulation, nearly $138 billion. The bank projects a global stablecoin market of $500 billion by 2028.

In this context, some analysts express marked optimism. Michaël van de Poppe, founder of MN Trading Capital, mentions a potential increase of 100% to 150% for altcoins, provided bitcoin and Ethereum stabilize their prices.

The current weakness of bitcoin buyers occurs, moreover, in the full month of August, traditionally a slow period in financial markets. This seasonality could accentuate the ongoing correction and hasten capital rotation towards altcoins. The battle for crypto supremacy is far from settled.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.