Bitcoin Options Overtake Futures as Structured Risk Takes Hold

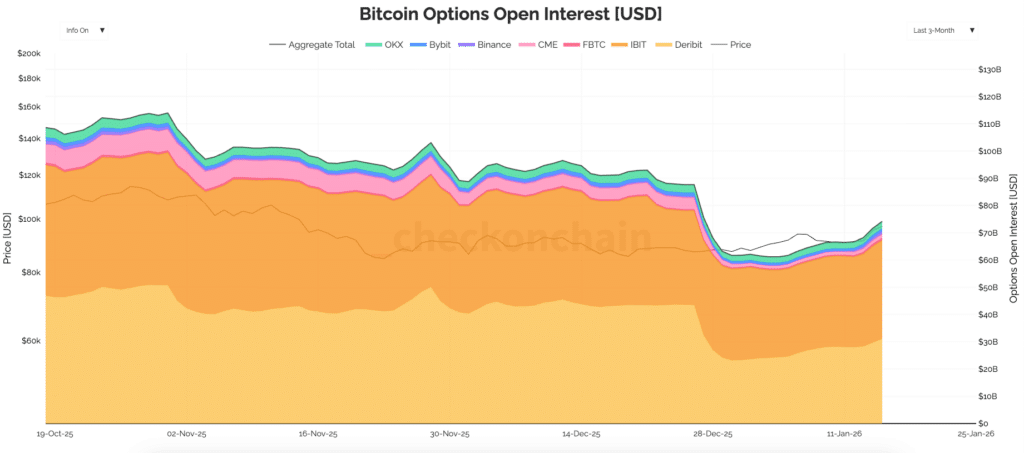

Bitcoin options open interest has overtaken futures for the first time, marking a shift in how risk is held across crypto markets. By mid-January, options open interest climbed to about $74.1 billion, edging above roughly $65.22 billion in futures. The change points to a market relying less on short-term directional trades and more on structured positions that manage risk and volatility over time.

In brief

- Bitcoin options open interest rose to $74.1B, moving above futures and signaling a shift away from short-term leverage trades.

- Options positions persist longer due to expiry-based structures, shaping volatility around key strikes and calendar roll periods.

- Growth in ETF options has split Bitcoin volatility between US market hours and 24/7 crypto-native trading venues.

- Futures still guide directional risk, but options now play a larger role in how volatility and hedging flows affect price.

Bitcoin Options See Strong Rebuild After Year-End Expiry Cycle

Open interest tracks outstanding contracts that remain open, rather than daily trading volume. When options inventory rises above futures, positioning tends to favor defined payoff structures such as hedges and yield programs instead of pure price bets. That change affects how price reacts around expiries, major strikes, and periods of thin liquidity.

Futures contracts remain the most direct way to take a view on Bitcoin price direction. Traders post margin and manage funding costs that shift with market conditions. Positions can be adjusted quickly, but they also respond sharply to changes in funding rates or basis returns.

Calls and puts allow market participants to cap downside, define upside, or position around volatility rather than price alone. More complex structures, including spreads and collars, often sit on balance sheets longer because they align with hedging mandates or scheduled yield programs.

Options positions frequently remain open through their stated expiry, which makes open interest more stable by design. Futures positions, by contrast, tend to fluctuate as traders respond to funding pressure or step away during risk-off periods.

Data from Checkonchain shows a clear pattern around the turn of the year. Options open interest dropped sharply in late December, then rebuilt through early January as new contracts replaced expired ones. Futures open interest followed a steadier path, reflecting ongoing adjustments rather than forced clearing.

Options Open Interest Becomes a Key Signal for Hedging Flows

Options are often tied to longer-term strategies that roll forward on a calendar. That makes the inventory more persistent, even when price action looks mixed or choppy.

- Futures positions face ongoing carrying costs through funding or basis shifts.

- Options positions lock in a payoff profile until expiry.

- Many options trades sit inside hedging or yield programs.

- Positions often roll on fixed schedules rather than reacting to headlines.

- Expiry mechanics clear risk in batches instead of continuously.

Because of these traits, open interest in options can remain high even as futures traders reduce exposure. That persistence also shapes volatility around expiry dates, especially when large positions cluster at specific strike prices.

As options inventory grows, market makers play a larger role in shaping short-term price moves. Dealers who sell options often hedge their exposure using spot markets or futures. Those hedges can either smooth price moves or add momentum, depending on how positions are distributed.

When large strikes sit near the current price, hedging flows can increase sharply as expiry approaches. Thin liquidity during certain hours can amplify those effects, while deeper liquidity may absorb them. Options open interest therefore acts as a map of where hedging pressure could rise.

Bitcoin Options Divide Alters Trading Rhythms Across Market Hours

Bitcoin options no longer sit inside a single ecosystem. Alongside crypto-native venues, listed ETF options have become a growing part of the picture. Checkonchain’s breakdown shows increasing activity tied to products such as IBIT.

Crypto-native platforms operate around the clock and use digital asset collateral. Participants include proprietary trading firms, crypto funds, and advanced retail traders. Listed ETF options trade during US market hours and clear through systems familiar to equity options desks.

That divide changes trading rhythms. A larger share of volatility risk now sits inside regulated, onshore markets that close overnight and on weekends. Offshore venues still drive price discovery outside US hours, especially during global events.

Over time, this split can make Bitcoin trading feel closer to equities during US sessions, while retaining crypto-style behavior during off-hours. Traders active across both worlds often use futures as the link between them, adjusting hedges as liquidity shifts.

ETF Options Push Bitcoin Toward Portfolio-Style Risk Management

Clearing rules and margin standards also affect who can participate. Listed ETF options fit within systems many institutions already use, opening access for firms that cannot trade on offshore exchanges.

Those firms bring established strategies into Bitcoin markets. Covered calls, collar overlays, and volatility targeting programs now appear through ETF options and repeat on set schedules. That repetition can keep options open, interest high, even when speculative demand fades.

Crypto-native venues continue to dominate continuous trading and specialized volatility strategies. What changes is the mix of motives behind options positions, with more inventory tied to portfolio overlays rather than short-term speculation.

When options exceed futures, market stress often shows up differently. Funding spikes and liquidation cascades tend to matter less, while expiry cycles and strike concentration take on greater importance.

- Expiry dates can influence price paths more than single headlines.

- Strike clustering can guide short-term support or resistance.

- Dealer hedging may dampen or extend moves.

- Inventory rebuilds often follow major expiries.

- Futures still signal appetite for directional risk.

Watching options open interest by venue helps separate offshore volatility trades from onshore ETF-linked programs. Futures open interest remains useful for tracking how much directional risk traders are willing to carry.

Options open interest near $74.1 billion versus futures around $65.22 billion sends a clear signal. More Bitcoin risk now sits inside instruments with defined outcomes and scheduled roll behavior. Futures still serve as the main tool for price direction and for hedging options exposure.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.