Bitcoin Sees $3.2B Capitulation as Markets Reset on Fed Uncertainty

Bitcoin and the broader crypto market posted modest gains over the past 24 hours, even as fresh U.S. labor data complicated expectations for near-term rate cuts. January’s jobs report showed that hiring remained firm, but growth across several sectors appeared restrained. Markets had hoped for weaker data to strengthen the case for monetary easing. Instead, traders were left facing mixed signals.

In brief

- Realized losses hit $3.2B, marking one of Bitcoin’s largest capitulation events.

- Futures open interest dropped sharply as traders reduced leverage exposure.

- Selling pressure came mainly from newer holders, not long-term investors.

- Rate-cut odds fell to 7% as markets now await key U.S. CPI data.

Market Reset? Bitcoin’s Vertical Drop Triggers Historic On-Chain Flush

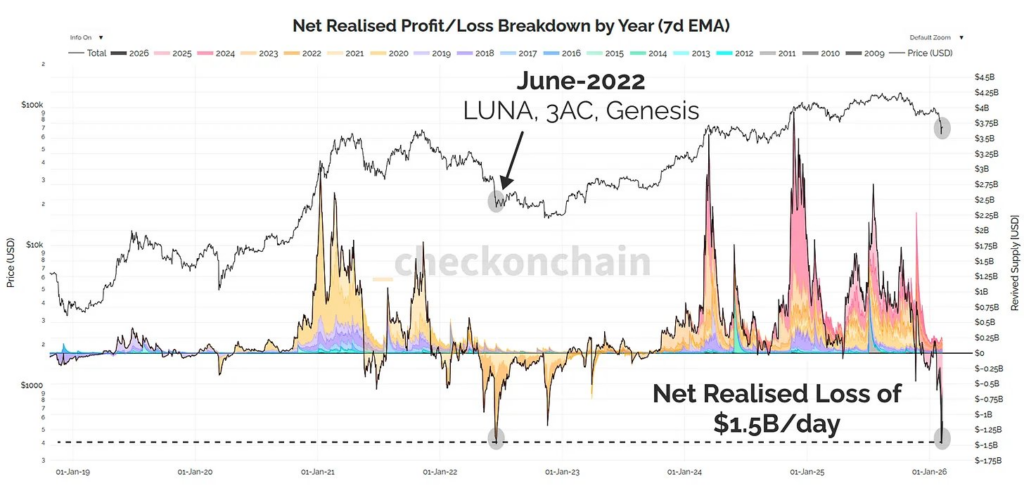

Bitcoin (BTC) rose 1.25% on the day after last week’s sell-offs dragged BTC close to $60,000. Moreover, the fall triggered one of the largest loss events in the asset’s history. On-chain data shows realized losses reached $3.2 billion during the drop, surpassing the losses recorded during the 2022 Terra collapse, according to Glassnode.

Data platform Checkonchain described the move as a “textbook capitulation event,” marked by rapid selling, heavy volume, and forced exits by low-conviction holders.

Net Realized Profit/Loss (7-day EMA) plunged toward negative $1.5 billion per day, producing one of the deepest downside prints ever recorded for Bitcoin. The move was both sudden and vertical, resembling structural washouts such as June 2022, though larger in nominal dollar terms.

Coin age data indicate that most of the losses originated from recent buyers, particularly the 2024–2026 cohorts. That pattern suggests newer participants bore the brunt of the selloff.

Historically, loss spikes of this scale have been associated with rapid balance-sheet resets rather than long-term structural breakdowns. Similar events in March 2020 and June 2022 occurred after heavy deleveraging and were later accompanied by relief rallies or extended consolidations. Current market behavior carries similar traits, including forced unwinds and weakened speculative positioning.

Capitulation Confirmed as Derivatives Positioning Unwinds

Several structural factors shaped the recent decline:

- Net realized losses exceeded $1.5 billion per day at the peak of the move.

- Selling pressure came mainly from newer holders rather than long-term investors.

- Leverage across derivatives markets was aggressively reduced.

- Volumes across spot, futures, options, and ETF markets surged to extreme levels.

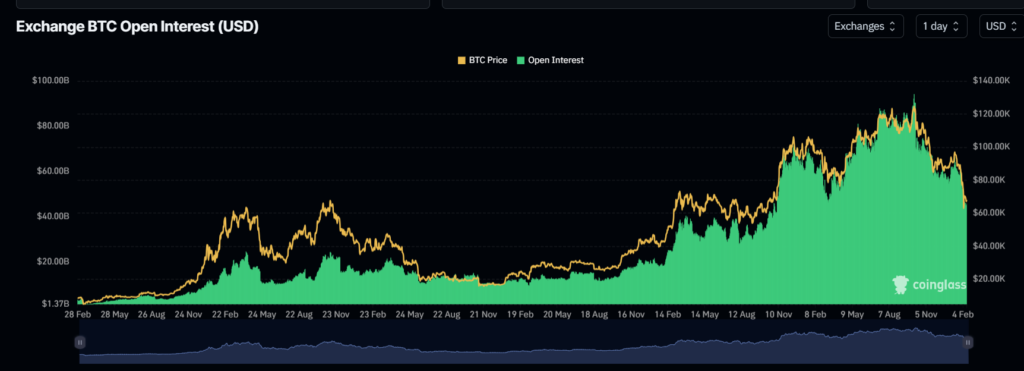

Derivatives data further support the capitulation narrative. According to CoinGlass, total Bitcoin futures open interest dropped sharply alongside price. After peaking near $100 billion during the rally toward six-figure prices, aggregate open interest rolled over as BTC declined. Both forced liquidations and voluntary long unwinds contributed to the contraction.

Price (tracked in yellow on the chart) and open interest (green) fell together, signaling broad deleveraging rather than fresh short positioning. When open interest rises into weakness, it often points to new bearish bets.

Instead, traders reduced exposure across the board, clearing excess leverage from the system. Comparable contractions in past cycles marked high-volatility resets before markets found a new equilibrium.

Extreme Fear Returns to Crypto as Bitcoin Attempts Recovery

Despite fading hopes for immediate rate cuts, remaining market participants appear reluctant to sell further. Prediction market data shows that the odds of a 25-basis-point cut next month have dropped sharply.

On Polymarket, expectations fell to 7% from 18%. Kalshi shows a similar decline, from 20% to 7%. Reduced rate-cut expectations typically weigh on risk assets, as higher yields make fixed-income products more attractive.

Still, Bitcoin’s positive reaction suggests that selling pressure may be exhausting itself. Crypto Fear & Greed Index readings recently reached levels not seen since the collapse of FTX in 2022, indicating extreme pessimism.

Attention now turns to the upcoming U.S. Consumer Price Index report. Inflation data could provide clearer guidance on the Federal Reserve’s next steps. For now, markets appear to have completed a rapid reset, leaving traders watching closely for signs of stabilization or renewed volatility.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.