Bitcoin Slips Below $90K Again as Short-Term Holders Exit and Risk Appetite Fades

Bitcoin’s fall under $90,000 on Wednesday revived market fear and extended a sell-off that has already lasted several days. Prices slipped to levels not seen since earlier periods of stress this year. Traders responded by stepping back from risk and reducing exposure across both spot and derivatives markets.

In brief

- Short-term buyers exit quickly as BTC slips under $90K, leaving most recent holders at a loss and adding to panic-driven selling.

- Nearly $3B in ETF outflows drains demand while volatility jumps, mirroring levels last seen during major liquidation events.

- Futures open interest declines as traders unwind exposure, signaling caution and weak confidence in near-term recovery.

- Negative funding rates across top assets signal defensive positioning, narrowing the chances of a swift rebound amid weak demand.

Capitulation Picks Up Among Recent Buyers as Bitcoin Tests Sub-$90K Range

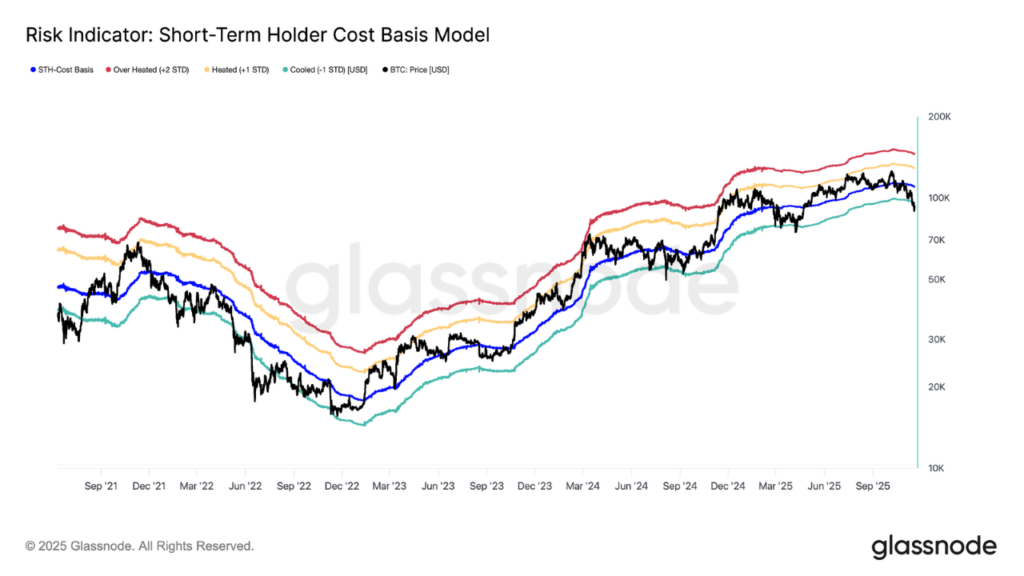

Short-term holders were rattled again by the quick drop below $90K. Data from Glassnode shows that recent buyers have been exiting positions at a faster pace than during earlier 2024 pullbacks.

Wednesday’s decline marked the third time this year that Bitcoin traded below the lower band of the short-term holder cost-basis model. The current reaction appears more intense, with Bitcoin having hovered near $104,000 in mid-June—leaving nearly all short-term buyers underwater at current prices.

Pressure has been building across several areas. Weak demand, steady ETF outflows, rising volatility, and a shift from speculation toward hedging have added to the decline. US-listed Bitcoin ETFs recorded nearly $3 billion in net outflows this month, according to Sosovalue.com.

In derivatives markets, traders have been pulling back as well. Many are closing positions and seeking protection rather than adding new exposure. Implied volatility has risen to levels last seen during the October 10 liquidation event, showing how quickly expectations have changed since the break below $90K.

Derivatives Market Softens as Bitcoin Slips and Traders Cut Exposure

Unless stronger demand steps in to absorb distressed sellers, Glassnode warns that the market may drift into a deeper accumulation phase. Without a shift in sentiment, the downturn could last longer.

Bitcoin fell to $89,106 on Wednesday, extending a 12.17% weekly loss. Prices ranged between $88,760 and $93,549 during the session, as daily trading volume dropped 36.54% to $73.68 billion.

Market capitalization slipped to $1.87 trillion, while Bitcoin’s dominance rose to 59.35%, indicating that BTC is holding up better than many altcoins on a relative basis.

Futures markets also softened, with open interest falling 1.16% to $65.77 billion, according to Coinglass. Liquidations totaled $144.60 million over the past day, down from $359.12 million on Tuesday. Longs absorbed most of the losses at $124.82 million, while short liquidations remained low at $19.78 million.

Risk appetite continues to weaken as futures open interest declines in line with price. Traders are unwinding exposure rather than adding during weakness, leaving derivatives markets thinner than in earlier downturns. This shift aligns with the broader retreat among risk-seeking groups.

Caution Dominates as Traders Protect Capital and Bullish Momentum Evaporates

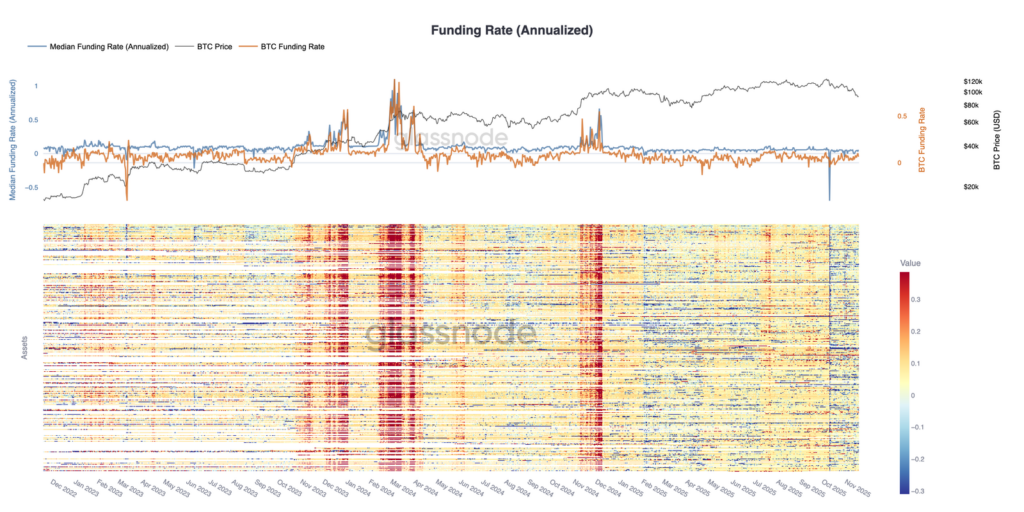

Funding rates across major assets have also moved into neutral or negative territory. Earlier in the year, several large-cap assets carried positive premia as traders favored long positions. That trend has reversed, and current conditions indicate a more defensive posture.

The main pressures on the market include:

- ETF outflows are draining spot demand and adding steady sell pressure

- Short-term holders are underwater and speeding up exits as prices fall below key cost-basis levels.

- Volatility spikes increase hedging demand and reduce speculative long exposure.

- Shrinking futures interest is showing reduced leverage and limited confidence in a rebound.

- Negative funding rates signal a broad shift away from bullish positioning.

Combined, these trends point to a risk-off environment with few signs of returning confidence.

Recent funding and positioning behavior suggest that traders prefer to protect capital rather than pursue reversals. Weak demand in both spot and derivatives markets reflects ongoing hesitation even after sharp declines, limiting the chances of a swift recovery.

Glassnode notes that markets will need a clear rise in buyer activity to stabilize near current levels. Without that support, Bitcoin may continue searching for a firmer footing as distressed holders exit and volatility remains elevated. For now, traders appear willing to wait for better visibility before taking on additional leverage.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.