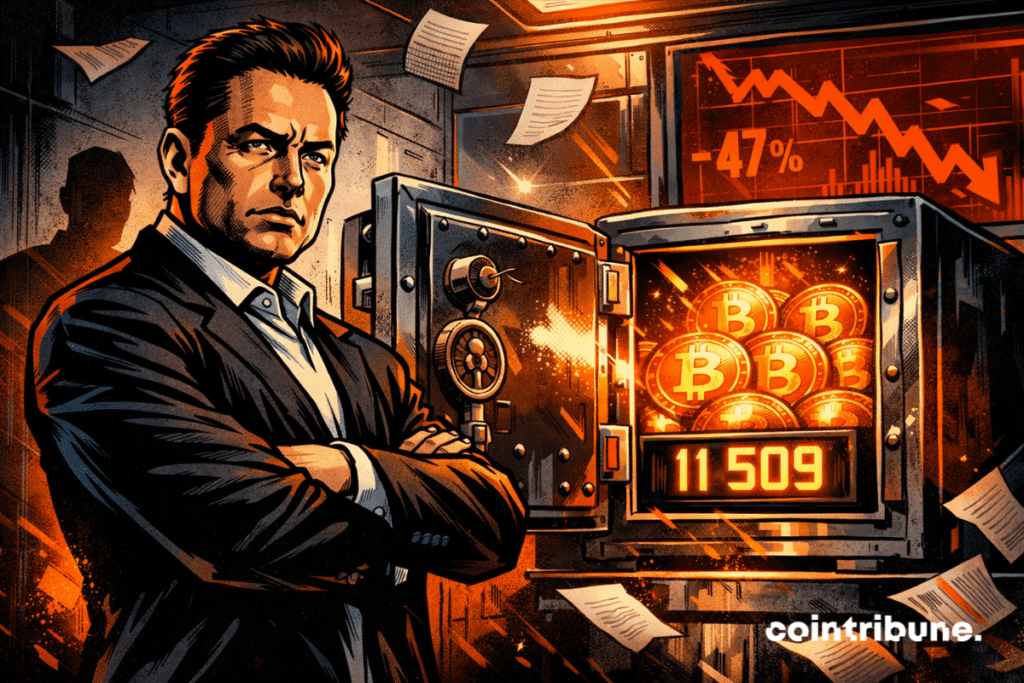

Bitcoin: Tesla Holds 11,509 BTC Despite a Heavy Accounting Loss

Tesla did not touch its bitcoin reserves in the fourth quarter of 2025. Yet, the company had to record a “digital assets” loss of about 239 million dollars after taxes, simply because the BTC price declined over the period.

In brief

- Tesla kept its 11,509 BTC in Q4 2025. The bitcoin decline over the quarter resulted in an accounting loss of about 239 M$ after taxes

- With the new rules, BTC volatility flows more directly into reported results.

A stationary Bitcoin, a very mobile loss

Tesla keeps 11,509 BTC. The number does not move. This amount appears in the company’s recent financial documents, with an acquisition cost stated at 386 million dollars. What moves is the valuation.

Over the quarter, the bitcoin decline triggered a loss entry from about 114,000 $ down to 88,000 $ over the period, hence the accounting charge. This point was revealed with the publication of Q4 and 2025 annual results, posted online on January 28, 2026, on Tesla’s Investor Relations site.

This is the kind of situation that always surprises the general public. Nothing was sold, nothing was bought, yet the income statement takes a hit. This is exactly where modern accounting for crypto-assets becomes a full-fledged player.

Since the adoption of the new crypto standard (ASU 2023-08), certain cryptos must be measured at fair value, with variations flowing into results every period. Tesla explicitly mentions this in its reports.

In other words, bitcoin’s volatility is more directly “plugged” into the financial statements. This does not necessarily tell a cash flow story. But, it tells a presentation story. The market, however, loves to confuse the two when pressed.

For its part, Tesla has even adjusted how it presents certain non-GAAP indicators by neutralizing gains and losses related to digital assets. The quarterly deck notes these adjustments and also recalls that 2024 periods have been “recast” after adopting the standard.

Why Tesla does not move a satoshi

Keeping the same bitcoin stock despite an unfavorable quarter is not passivity. It’s a choice. Tesla shows it treats BTC as a strategic reserve, not as a trading line to arbitrage along the candles.

There is also a communication logic. Tesla knows that every move on bitcoin becomes a mini-world event. Doing nothing is sometimes the loudest decision. It avoids fueling panic or euphoria narratives.

Keeping a fixed position simplifies the message to investors. The debate shifts. Indeed, it is no longer about the timing of buying or selling. It is about the accounting framework and bitcoin’s role in a corporate treasury. And that, paradoxically, makes the subject more serious.

Even a company that does not touch its bitcoin can show a notable quarterly loss. This reinforces the idea that the results of companies exposed to BTC have become, in part, an indirect reading of volatility.

Moreover, “digital asset losses” are not necessarily an operational deterioration. Tesla’s revenues and margins have their own story. Bitcoin can add a layer of noise, sometimes very visible. Transparency improves. But volatility more clearly intrudes into the reported results. It must be assumed, and especially explained, or the market will make the comment for you.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Enseignante et ingénieure IT, Lydie découvre le Bitcoin en 2022 et plonge dans l’univers des cryptomonnaies. Elle vulgarise des sujets complexes, décrypte les enjeux du Web3 et défend une vision d’un futur numérique ouvert, inclusif et décentralisé.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.