Bitcoin: The rally is losing steam despite institutional appetite

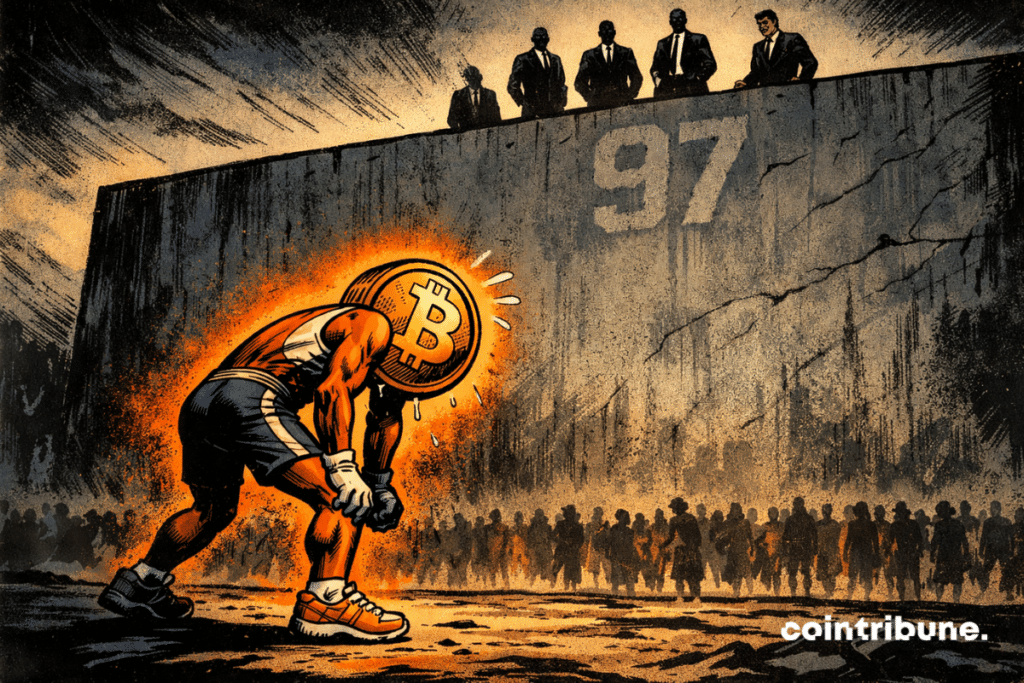

The symbolic milestone of 100,000 dollars still inspires dreams, but for now, it remains out of reach. After its big surge, bitcoin has lost its breath approaching 97,000 dollars. The queen of cryptos seems exhausted, suspended between caution and hope. In a changing crypto industry, popular enthusiasm has evaporated, giving way to a much colder engine: that of major institutions and investment funds.

In brief

- Bitcoin stalls at 97,000 dollars after an institutional rally without popular euphoria.

- Spot Bitcoin ETFs exceed 120 billion dollars in assets under management, according to Bloomberg.

- The funding rate remains low at 4%, reflecting a marked lack of speculative appetite.

- The Fed, under political pressure, directly influences the trajectory of the global crypto market.

Bitcoin without fever: the rally the crowd forgot

BTC remains above 95,000 dollars, but the atmosphere no longer resembles the turmoil of past bull runs. The funding rate caps around 4%, far from the 8 to 12% observed during euphoric periods. Retail investors have disappeared from order books, preferring to bet on other trends: artificial intelligence, robotics, or green energy.

The numbers speak for themselves. Google searches for the word “crypto” stagnate at 27 out of 100, almost at the year’s lowest. The crypto community has withdrawn, fearing that the Fed and the American political climate will destabilize markets again. The arrest of the former Venezuelan president Maduro and tensions with Iran have not helped.

This lethargy is not an end of cycle. According to Kaiko, bitcoin is winding up for a decisive move. It remains to be seen if the relaxation will come from retail investors… or Wall Street powers.

Institutions take back control of the crypto-sphere

Behind the apparent market fatigue, major maneuvers continue. Spot Bitcoin ETFs have recorded record inflows: over 120 billion dollars in assets under management, according to Bloomberg. In a single day, 843.6 million dollars were invested in these financial products, a record noted by Eric Balchunas on X. Financial institutions — BlackRock, Fidelity, and Bitwise leading the way — now lead the dance.

Even listed companies are following the path set by Michael Saylor: over 105 billion dollars in Bitcoin held on their balance sheets. Traditional finance players have redefined the rules of the game.

For André Dragosch, research director at Bitwise, this trend is promising:

I think continued institutional adoption could eventually be the bullish catalyst that propels Bitcoin in 2026.

The figures impress, but the reality is clear: the crypto market’s momentum is no longer spontaneous. It is organized, structured, professionalized. A new age of bitcoin is being written — slower, but stronger.

A broken cycle, a more mature Bitcoin

For a long time, crypto lived to the rhythm of “halvings”: euphoric ascent, peak, then sharp drop. This mechanism seems broken. Stable and strong ETF flows erase the rollercoasters of retail investors. Bitcoin no longer reacts to the moods of the crowd but to the long-term strategies of asset managers.

Greg Magadini, Derivatives Director at Amberdata, explains this radical change:

The catalysts for a new Bitcoin high will revolve around the Federal Reserve’s loss of independence. Without an independent will to fight inflation, the Fed risks reacting too “accommodatingly” to support public spending. This will weaken the US dollar and propel tangible assets, like BTC, much higher.

The correlation with tech markets is intensifying, but volatility is fading. Bitcoin is becoming a macro asset, less a speculative bet than a strategic position.

Key takeaways

- Current BTC price: 95,545 dollars;

- Spot Bitcoin ETF volume: over 120 billion dollars in assets;

- Record inflow in one day: 843.6 million dollars;

- Share of listed companies in BTC: 105 billion dollars;

- Google interest for “crypto” : 27/100, indicating retail disinterest

The next surge might come from higher up. For CZ, bitcoin is heading towards 200,000 dollars, and this time, the altcoin season will follow. The breath is still lacking, but the flame still burns.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.