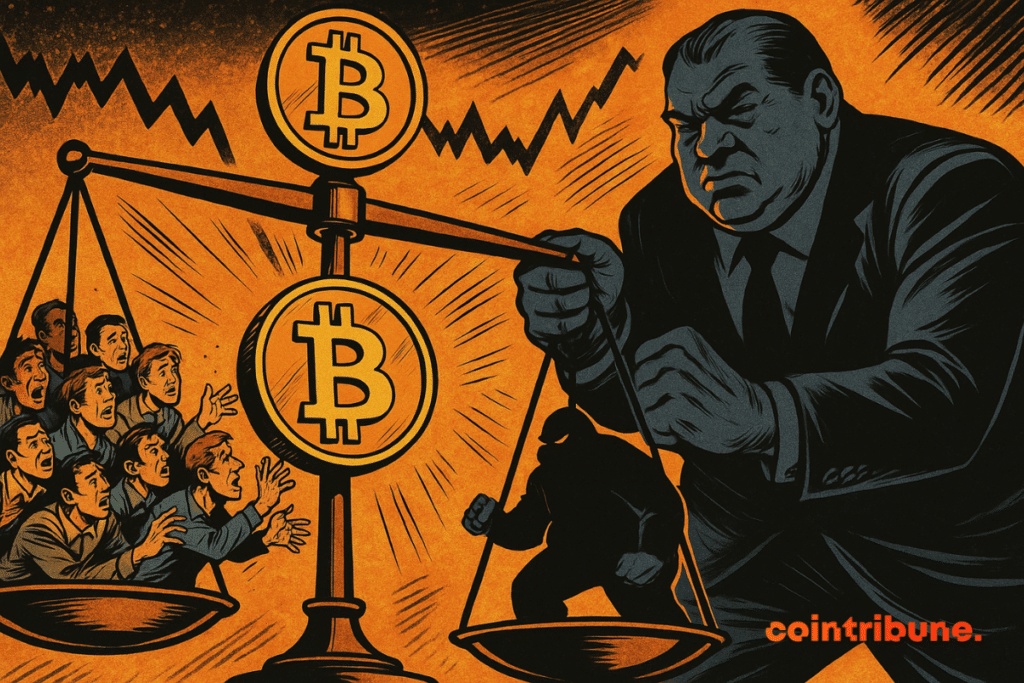

Bitcoin trapped between small hodlers accumulation and massive whales sales

Every week, the crypto world turns into a playground for emotions: euphoria, panic, hope, and betrayal. Bitcoin remains the heart of this theater, oscillating between dizzying highs and icy plunges. And once again this week, it didn’t disappoint. Beneath the surface, however, something else is happening. Before diving headfirst into your wallets, a breath is necessary. Because in crypto, traps appear where shortcuts are thought to be found.

In brief

- An OG sold 22,769 BTC switching to 472,920 ETH, triggering a crypto storm.

- Small holders continue accumulating, while mid-size wallets take profits quickly.

- The 105,000 $ threshold becomes critical for bitcoin; a breakout could sow panic in the market.

- $611 M positions liquidated in 24 hours remind that volatility remains a constant for bitcoin.

Brutal slide of bitcoin: between liquidation and disillusion

On Sunday, the mood in crypto markets switched from excitement to chaos. While Ethereum set a new record at $4,957, bitcoin collapsed below 111K$, briefly reaching 110,671$. A lightning-fast drop caused by a volatile mix: tight liquidity, leverage effect, and an avalanche of liquidations. In total, 611.81 million dollars were wiped from derivatives, including 445 million in bullish bets.

The reaction was immediate. The price of Solana dropped by 3.29%, Dogecoin by 4.4%. Even XRP gave in. And eyes turned to the gaps left on CME contracts.

BTC opened with a wide CME gap today. It’s the biggest in several weeks. Most of these gaps usually get filled early in the week.

Gaps scare. And attract. Like magnets for volatility.

Whales selling off, small hodlers on an accumulation mission

Behind this movement, one player intrigues. A Bitcoin OG, holder of 100,784 BTC for 7 years, emptied their vaults. 22,769 BTC, roughly 2.6 billion dollars, were transferred to Hyperliquid for sale. In return, the entity acquired 472,920 ETH in spot and opened a long of 135,265 ETH. A massive conversion from BTC to ETH, contrary to the historical trend.

Vijay Boyapati’s comment resonates as a philosophical explanation: “The price stagnated because several whales hit their magic threshold and are selling. It’s healthy; their supply is limited, and their selling is necessary for bitcoin’s full monetization. Large wealth masses are redistributed to the population. This cycle is one of the greatest monetization events in history“.

In the shadows of these titanic movements, another dynamic sets in. According to CryptoQuant, wallets holding less than 10 BTC are still accumulating. Conversely, those between 10 and 100 BTC started taking profits from 118,000$. The psychological boundary is real. And Willy Woo emphasizes:

Why is BTC progressing so slowly? Because the OGs still hold most bitcoins. They bought them at 10 $ or less. It takes 110,000 $ of new capital to absorb each BTC sold.

Three major threats to bitcoin to watch

As bitcoin tries to stabilize, several elements could tip the trend. For better or worse. Three of them deserve urgent attention:

The Fed interest rates

The next PCE index will be released on Friday. It’s the Fed’s favorite inflation measure. If the number drops, markets will see it as confirmation of rate cuts in September. But according to Mosaic Asset, abandoning the average inflation strategy might mean the Fed will tolerate fewer excesses. Betting on multiple rate cuts seems unwise.

Nvidia’s financial results

The AI giant could electrify or cool markets. A good quarter would strengthen tech assets… thus crypto.

The critical 105,000 $ level

CryptoQuant states this threshold has become the pivot point. If broken, fear will spread. And small players could let go.

Numbers and facts to keep in mind:

- $611 M of crypto liquidations in 24 h, including $445 M on BTC;

- One single actor sold 22,769 BTC in 5 days;

- Hodlers <10 BTC continue buying;

- Wallets 10–100 BTC turn to selling;

- The psychological threshold at 105,000 $ becomes the front line.

Even if recent shocks give vertigo, some analysts see beyond the fog. For them, bitcoin’s bull run continues, fueled by a belief that the strongest tremors often precede the most beautiful flights. Those who hold their line could well reap what others let go too early.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.