Bitcoin Under Pressure as Whales Turn Defensive and Liquidity Thins

Bitcoin’s price remains under strain as selling pressure continues to weigh on the market. The OG coin fell to an intraday low of $72,945 in the previous session as market pullback continues across risk assets. While retail traders have largely maintained bullish positions, institutional investors have begun to retreat. Current data points to a growing divide between these two groups, raising questions about where Bitcoin may head next.

In brief

- Bitcoin remains under strain as whales reduce long exposure while retail traders stay largely bullish.

- Short-side activity dominates derivatives markets despite funding rates remaining slightly positive.

- Institutional demand weakens as Bitcoin-linked products trade at discounts to spot prices.

- Falling spot volume and stablecoin supply signal limited liquidity to support a sustained rebound.

Large Holders Turn Defensive While Retail Optimism Persists

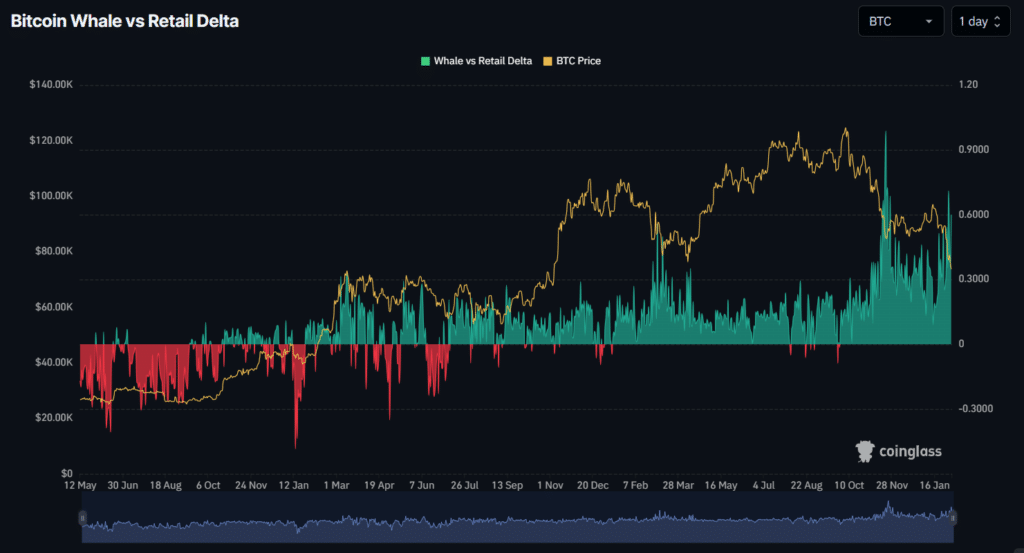

Recent price action followed a noticeable shift in trader positioning. Large holders, often referred to as whales, reduced exposure to long positions and increased short activity in the perpetual futures market.

Retail traders, by contrast, showed little sign of retreat, keeping optimism elevated despite falling prices. Such divergence often signals rising uncertainty, especially during periods of declining liquidity.

Whales tend to move quickly as conditions shift. Access to deep liquidity allows them to enter and exit positions with fewer constraints, while smaller traders often rely on shorter-term signals and limited capital.

Whales vs. Retail Delta—which tracks whale versus retail behavior—shows that large players closed long positions over the past day and opened fresh shorts. This trend suggests preparation for further downside or sideways movement.

João Wedson, founder of Alphractal, described this behavior as part of a broader trading pattern tied to volatility. According to Wedson, whales frequently build long and short positions aggressively during unstable phases, then scale back once momentum slows. Past cycles show that such pullbacks often precede consolidation or renewed selling pressure.

Price paths following similar setups have varied, but two outcomes stand out. Bitcoin may pause within a narrow range as traders wait for clarity, or sellers may push prices below the low-$70,000 area if pressure intensifies. Earlier whale-driven exits have sometimes led to sharp drops before stability returned.

Bitcoin Shorts Rise Even as Funding Rates Remain in Bullish Territory

Despite growing caution, derivatives data shows that long positions still hold a slight edge. Bitcoin funding rates, which reflect the cost of holding leveraged trades, remain marginally positive at around 0.0040%. This reading suggests long traders continue to pay shorts, though the balance remains fragile.

Several forces currently shape Bitcoin’s short-term outlook:

- Whale accounts have reduced long exposure while building short positions, signaling defensive positioning.

- Short-side trading volume in perpetual futures continues to exceed long volume.

- U.S.-based demand has weakened, based on declining price premiums.

- Institutional appetite shows signs of cooling as investment products trade below spot prices.

Bearish pressure remains active even with funding rates in positive territory. Rising short volume suggests sell-side activity dominates market flow. A sharp move higher under such conditions could trap late buyers, increasing the risk of sudden reversals if momentum fades.

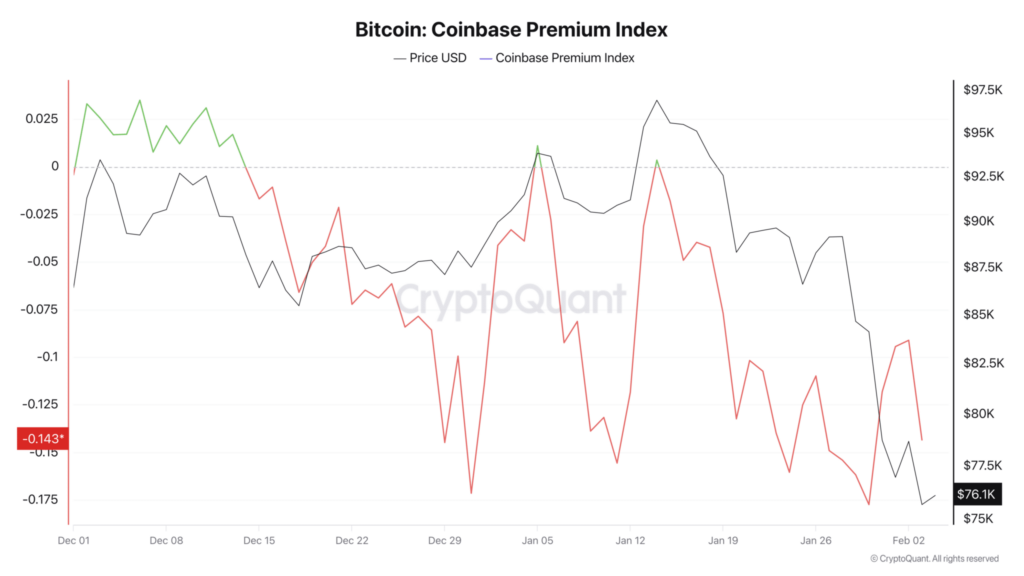

Spot market signals add to the cautious tone. The Coinbase Premium Index has slipped closer to levels seen on offshore exchanges, pointing to softer demand from U.S. investors. Such behavior often reflects hesitation among buyers who previously supported rallies during periods of stress.

Liquidity Pullback Signals Limited Near-Term Upside for Bitcoin

Institutional indicators also show limited support. Price differences between Bitcoin-linked funds, trusts, and exchange-traded products versus spot markets have turned negative. A reading near -0.2 indicates these products are trading at discounts, suggesting reduced interest from larger capital pools.

Broader market activity has weakened as well. Spot trading volume across crypto markets has dropped sharply, with hundreds of billions of dollars in activity leaving since October 2025. Fewer active participants mean less demand to absorb selling pressure, making price swings more pronounced.

Stablecoin supply trends reinforce this picture. A recent $10 billion decline in stablecoin market value signals hesitation to deploy fresh capital into digital assets. Since Bitcoin often attracts returning liquidity first, reduced stablecoin availability could slow any recovery attempt.

A lack of spot demand and thinning liquidity could limit Bitcoin’s ability to sustain upside momentum. Under current conditions, price action is likely to remain highly responsive to sentiment shifts among large holders and broader capital flows.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.