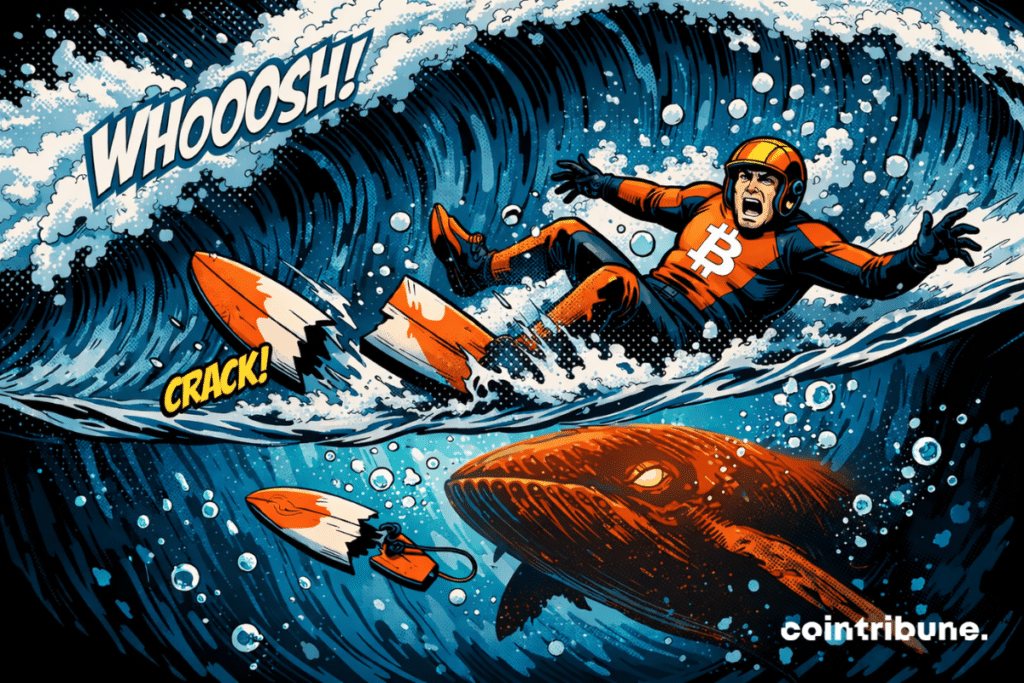

Bitcoin: Whales Anticipate a Dip Before a New Rise

At the beginning of each year, the crypto-sphere buzzes in the prediction room. Traders watch for signals, analyze charts, and debate possible bitcoin trajectories. In 2026, this tradition is even more intense. Some already saw new highs, others predicted a pause. The climate seems favorable for the crypto industry, but behind the numbers and emotions, real technical battles are fought. The question remains open: is BTC ready for a new ATH?

In Brief

- Bitcoin stagnates around $90,701, between bullish hopes and caution from long indicators.

- Whales await a return towards $87,500 before betting on a rebound.

- Without a close above $101,500, macro signals remain fragile despite short-term optimism.

- Long-term signals show bearish probabilities, despite a macro-economically favorable context.

Bitcoin and crypto: the battle of invisible supports below $91K

At $90,701, the bitcoin price serves as a balance point between short-term optimism and macro caution. While some observers see bullish signals, the whales—those large influential holders—have not yet validated a sustainable recovery. They seem to anticipate a lower support test, around the Yearly Open at $87,500.

On X, Material Indicators published an analysis illustrating this struggle:

The bulls try to defend the support at the Timescape level of January 5, 2026, but the whales appear to aim for a support test closer to the annual open, before a Golden Cross forms on the daily chart to trigger the next rally.

In other words, as long as $87,500 has not been retested, the likelihood of a sustained rebound on BTC remains uncertain. Technically, a weekly Death Cross (bearish crossover of long-term moving averages) could form—a signal traditionally interpreted as increased bearish pressure.

And yet, the weekly RSI slightly exceeds 41, a threshold some analysts watch as a potential reversal sign. But without confirmation by a weekly close above $101,500, bullish forces will struggle to prevail.

Long-term signals that temper short-term euphoria

In crypto, excitement from intraday movements can mask structural risks. For those analyzing longer timeframes, the trend is not yet clear. Keith Alan, co-founder of Material Indicators, explained this tension:

The battle for this level is ongoing right now. If it doesn’t happen in the next 24 hours, I think it will occur after a Death Cross formation on the weekly chart, around mid-month.

This tweet illustrates the tension between bullish and bearish forces. Beyond daily prices, Trend Precognition signals over 6 and 12 months show bearish movement probabilities (48 over 6 months, 42 over 12 months). This means that even if the short term looks constructive, the long-term structure remains fragile.

The crypto community knows that technical levels like the weekly RSI or the 50-week SMA are key thresholds to validate sustainable reversals. Without these confirmations, positive moves can turn into bull traps—where bullish traders get caught in a sudden reversal.

In other words, BTC may oscillate well, but only the long term truly dictates the macro cycle. The impetuous might be surprised.

Fed, macro, and illusions of a premature bull run

Early 2026 also gives the impression of a favorable macro environment. Recent movements in traditional markets—especially the drop in bond yields and Fed rate-cut expectations—have supported risk assets, including crypto. This translated into a price recovery for bitcoin and other digital assets.

Yet, this dynamic is not linear. Even if BTC remains “up” 3% for the week, it lost 2% in 24 hours according to recent data. This oscillation shows that bullish moves are sensitive to overall market volatility.

At the same time, Ethereum shows even more marked fragility than BTC. Its 3- and 6-month trend signals display high bearish probabilities—a stereotype rarely observed in historical data. This does not rule out a tactical rebound but indicates a more fragile structure.

This global context recalls a fundamental rule of the crypto industry: speculation often feeds short term, but long-term analysis wins out in the end.

4 Key Figures to Remember Today

- $90,701: current bitcoin price, reflecting a tension zone;

- $87,500: crucial support monitored by the whales;

- $101,500: 50-week SMA level to validate for a real reversal;

- 48 & 42: Trend Precognition scores for BTC over 6M and 12M (indicating possible bearish pressure).

In the crypto-sphere, predicting ATHs or ALTs is part of the game. Skeptics highlight cautious technical signals, but the most enthusiastic remain convinced that a historic bull run in 2026 is possible. Technical dips are not ends in themselves but often springboards toward remarkable rises. For the bullish, the story is not yet written.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.