Bitcoin Whales Return to Selling as Price Slips Below $116,000

Large holders of Bitcoin have resumed selling, coinciding with the cryptocurrency’s recent rise to $116,000, its highest level in nearly three weeks. Moves from long-term investors of this scale are often seen as potential signals for the wider market.

In brief

- Bitcoin whales resumed selling after price briefly peaked at $116,000, raising concerns about market pressure.

- Lookonchain reported the Bitcoin OG moved 1,176 BTC worth $136M to Hyperliquid after a prior $4B BTC-to-ETH swap.

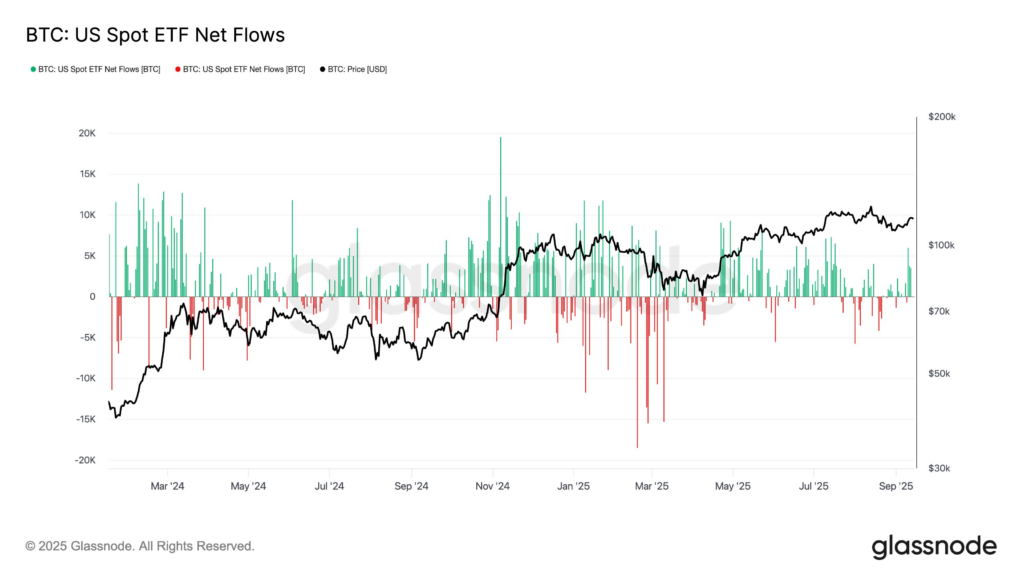

- Despite whale activity, Glassnode said US Bitcoin ETFs saw 5,900 BTC inflows, the largest since July, supporting demand.

A Veteran Bitcoin Whale Returns to Selling

According to data shared by market intelligence firm Lookonchain, a long-standing Bitcoin investor, often referred to as the “Bitcoin OG,” has begun selling again after a short pause.

Earlier this month, this investor shifted 35,991 Bitcoin valued at roughly $4.04 billion in exchange for 886,371 Ethereum worth around $4.07 billion on the Hyperliquid platform. The transaction was carried out at a rate of 0.0406 BTC per ETH.

Following a two-week break, Lookonchain confirmed that wallets connected to the same holder have now moved 1,176 BTC, valued at approximately $136.2 million, into Hyperliquid. The transfer was followed by active selling, indicating further reduction of the whale’s Bitcoin position.

When the earlier Ethereum purchase was made, Lookonchain estimated this investor still controlled 49,634 BTC across four wallets, worth about $5.43 billion at the time. With this recent round of selling, that total has declined.

Movements by such large and long-term holders are closely monitored because they can impact sentiment. Large-scale selling by whales often increases supply and can put downward pressure on prices, especially when done suddenly.

Dormant Bitcoin Wallets Reactivate After Over a Decade

This activity has not been limited to a single investor. Other large wallets, inactive for years, have recently become active:

- Blockchain tracker Whale Alert identified one address holding 479 BTC, worth more than $53 million, that became active after 12.8 years of inactivity. The sudden movement of such old coins is often seen as a signal that the holder may be preparing to sell.

- Another case involved a wallet with around 445 BTC that had been untouched for nearly 13 years. The holder transferred part of these coins to the crypto exchange Kraken.

- The reactivation of these long-dormant wallets and their transfers have raised expectations that the owners may now be preparing to liquidate at least part of their positions.

ETF Inflows Offset Whale Selling Pressure

While older holders have been moving coins onto exchanges, other forces in the market are showing strong demand. Analytics firm Glassnode reported that U.S. spot Bitcoin exchange-traded funds recorded net inflows of around 5,900 BTC on September 10. This marked the largest single-day inflow since mid-July.

The strong ETF inflows lifted weekly totals into positive territory, showing renewed investor demand as Bitcoin held steady above $114,000.

On the price front, Bitcoin touched $116,000 on Friday, reaching its highest level since August 23. However, it was unable to extend gains further at that point, as selling pressure formed resistance near that level. The price later eased back and is now trading close to $114,735.

Market analyst Rekt Capital noted that Bitcoin’s weekly close above $114,000 positions the asset closer to reclaiming what is described as its reaccumulation range. A confirmed hold above that threshold would not only allow for more upside but could also mark the end of the recent corrective phase.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.