Bitcoin’s Record-Breaking Rally Driven by Strong Market Fundamentals, Says Glassnode

Bitcoin (BTC) has once again surpassed its previous records, climbing to new heights above $126,000. Unlike earlier speculative rallies, analysts say this surge reflects a stronger market structure and increasing institutional participation. More so, on-chain and ETF data suggest that Bitcoin may be entering a more stable phase of growth.

In brief

- Bitcoin surges above $126,000 as Glassnode cites strong fundamentals behind the record-breaking rally.

- ETF holdings hit $164.5 billion, showing rising institutional confidence and steady long-term demand for Bitcoin.

- On-chain activity jumps 11%, with most investors in profit as futures open interest tops $230 billion.

- Bitcoin sustains bullish momentum, trading above key averages with a Fear & Greed Index of 70.

Market Data Points to Fundamentally Driven Rally

Bitcoin reached a new all-time high this week, with data suggesting that the latest rally is backed by solid market fundamentals rather than speculation, according to on-chain analytics firm Glassnode.

The OG crypto climbed to a record $125,559 early Sunday, surpassing its previous peak of $124,457. On Monday afternoon, the coin reached a new all-time high (ATH) of $126,200. Glassnode’s latest Market Pulse report highlights that this rally differs from previous speculative surges, emphasizing its foundation in structural growth across key market sectors.

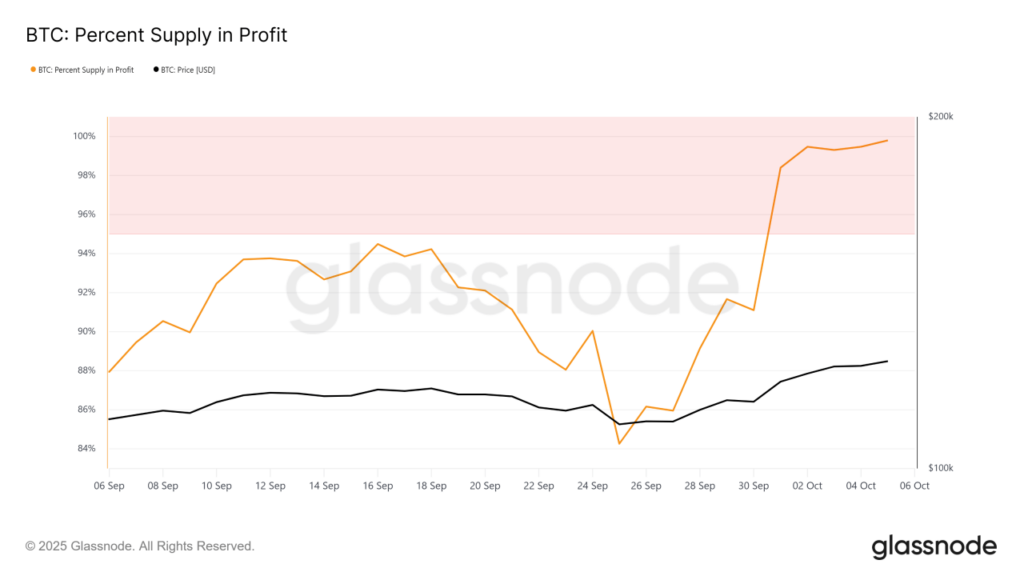

According to the report, Bitcoin’s latest all-time high reflects a coordinated expansion across spot, derivatives, and on-chain markets. Glassnode explained that improving liquidity, strong ETF inflows, and rising on-chain profitability suggest the breakout is driven by steady capital inflows and renewed investor participation rather than speculation.

ETF Inflows Highlight Growing Institutional Confidence In Bitcoin

Bitcoin exchange-traded funds (ETFs) continue to play a critical role in the ongoing market strength. The funds now collectively hold $164.5 billion in BTC, accounting for about 6.74% of Bitcoin’s total market capitalization. According to SoSoValue, cumulative net inflows into these ETFs exceeded $60 billion as of Friday, while daily retail ETF demand neared $1 billion.

This steady inflow reflects rising institutional confidence in Bitcoin’s long-term prospects. Additionally, the combination of ETF accumulation and consistent retail participation indicates sustained demand rather than short-term speculation.

On-Chain Activity Strengthens as Bitcoin Maintains Bullish Market Structure

Glassnode data indicate that on-chain activity has increased sharply, with an 11% rise in active addresses. Nearly all Bitcoin investors are currently in profit, with open futures contracts totaling over $230 billion.

At the time of writing, Bitcoin is sitting at $124,100, down 2% from its fresh ATH.

Here are other key market trends to note:

- Market Capitalization: Bitcoin’s total market value rose 0.80% to reach $2.46 trillion.

- Dominance: BTC maintains a 57.87% share of the overall crypto market.

- Annual Performance: The price of Bitcoin has surged 95% over the past year.

- Technical Strength: BTC continues to trade above its 200-day simple moving average, indicating sustained upward momentum.

- Monthly Performance: The asset recorded 19 green days in the past 30 days.

- Market Sentiment: Bitcoin’s outlook remains bullish, with the Fear & Greed Index currently at 70 (Greed).

Futures markets likewise reflect heightened participation. Data from Coinglass indicate that total Bitcoin futures open interest has climbed to $232.63 billion. Despite the surge, liquidations remained moderate at $356.46 million, with shorts comprising roughly 52% of the total.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.