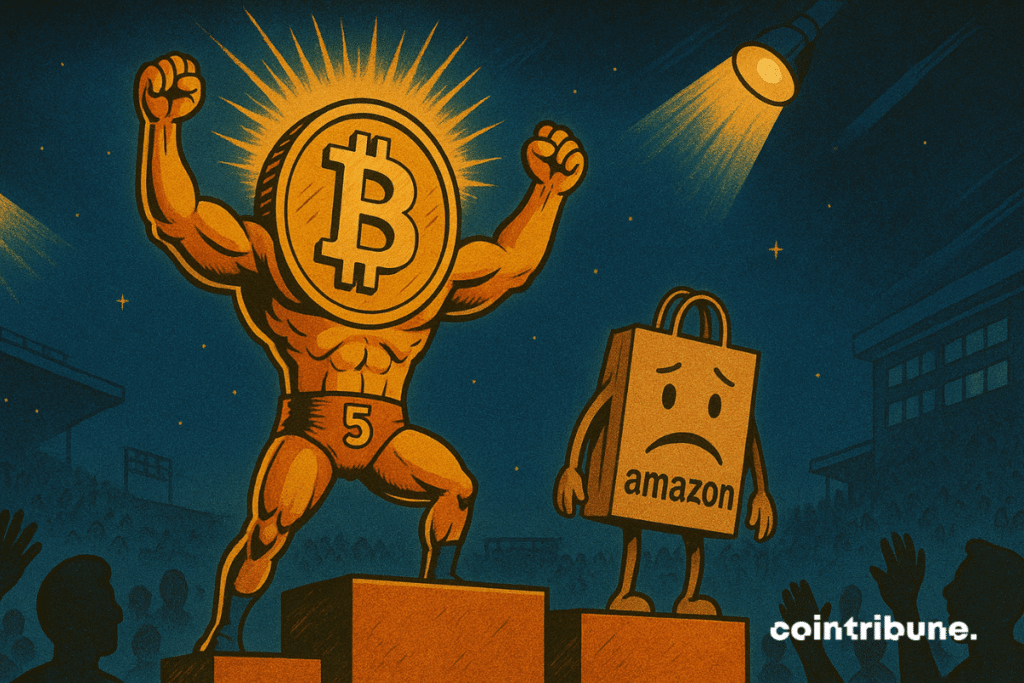

Bitcoin’s Rise Pushes Amazon Down To Sixth

A turning point has just been reached in the history of global assets. On May 8, Bitcoin surpassed Amazon in market capitalization and entered the top 5 of the largest valuations in the world. This milestone not only reflects a market performance. It crystallizes the rise of a decentralized network facing a giant of traditional tech. This clash between two economic visions redefines financial hierarchies and highlights the growing anchoring of cryptos in global balances.

In brief

- Bitcoin surpasses Amazon in market capitalization and becomes the fifth most valued asset in the world.

- Bitcoin’s market capitalization exceeds 2.03 trillion dollars, compared to about 2.012 trillion for Amazon.

- Bitcoin joins the ranking dominated by Apple, Microsoft, Saudi Aramco, and Alphabet, which it may soon challenge.

- Surpassing Amazon reinforces Bitcoin’s legitimacy as a strategic asset in financial portfolios.

Bitcoin surpasses Amazon in market capitalization

On May 8, 2025, Bitcoin officially surpassed Amazon to become the fifth most valued asset in the world. In clear terms, Bitcoin’s market capitalization exceeded Amazon’s, placing the crypto queen in fifth place in the global ranking of the largest assets across all categories.

Bitcoin had a market capitalization exceeding 2.03 trillion dollars, compared to roughly 2.012 trillion for Amazon. This milestone comes in a context where Bitcoin reaches historically high levels, supported by a combination of technical and macroeconomic factors.

To fully grasp the significance of this event, it is important to place Bitcoin within the ecosystem of global assets. Here are some key points to remember :

- The current ranking (May 2025) : Bitcoin is now the fifth most valued asset in the world, just behind Alphabet (Google) ;

- The assets ahead of Bitcoin : Apple, Microsoft, Saudi Aramco, and Alphabet maintain the top four spots in the global ranking ;

- The nature of the asset : Bitcoin remains unique, without revenue, no board of directors, no physical product, but endowed with a mathematical protocol, a supply limited to 21 million units, and global liquidity ;

- A symbolic signal: surpassing an industrial giant like Amazon marks a change in how the market values innovation, technology, and scarcity.

Thus, this surpassing is not merely a market fact. It reflects a shift in values perceived by investors, favoring decentralized assets.

The consequences of a structural shift

Behind this historic surpassing, underlying dynamics are emerging. Bitcoin’s rise in the global asset ranking is not an isolated fact. It fits into a continuous upward trajectory where Bitcoin successively surpassed the market caps of Tesla, Meta (Facebook), and now Amazon.

The media echo of this progression is amplified by Bitcoin’s special status : Bitcoin is not issued by a state, not backed by a company, but has a global market and growing liquidity. According to the current trend, the next implicit target would be Alphabet (Google), currently the fourth in this same ranking.

This surpassing marks a turning point, as it grants Bitcoin a now central place in institutional portfolios, far beyond the mere speculative asset it represented a few years ago. By surpassing Amazon, Bitcoin becomes, de facto, an essential strategic parameter for asset managers, sovereign funds, and macroeconomic analysts. The dynamic is all the more spectacular as it follows the latest halving, a technical event known to exert upward pressure on the BTC price due to the reduced new supply.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.