Blockchain revenues down 16% in September according to VanEck

The crypto market moves, but not always in the expected direction. While the blockchain universe is often associated with soaring increases, September 2025 cooled down the enthusiasm. Less noise, less speculation, but also less revenue for networks. A lull that, instead of signaling decline, could indicate a deeper transformation. Fewer highlights, more maturity? That’s what the latest VanEck report suggests, which examines the health status of the blockchain sector.

In brief

- Blockchain revenues dropped 16% in September according to VanEck.

- Tron generated 3.6 billion dollars over the year thanks to stablecoins.

- Ethereum is preparing an update to speed up transactions and reduce costs.

- The ASTER token exploded by +1667%, driven by farming on Binance Chain.

Less volatility, less cash: blockchain digests its growth

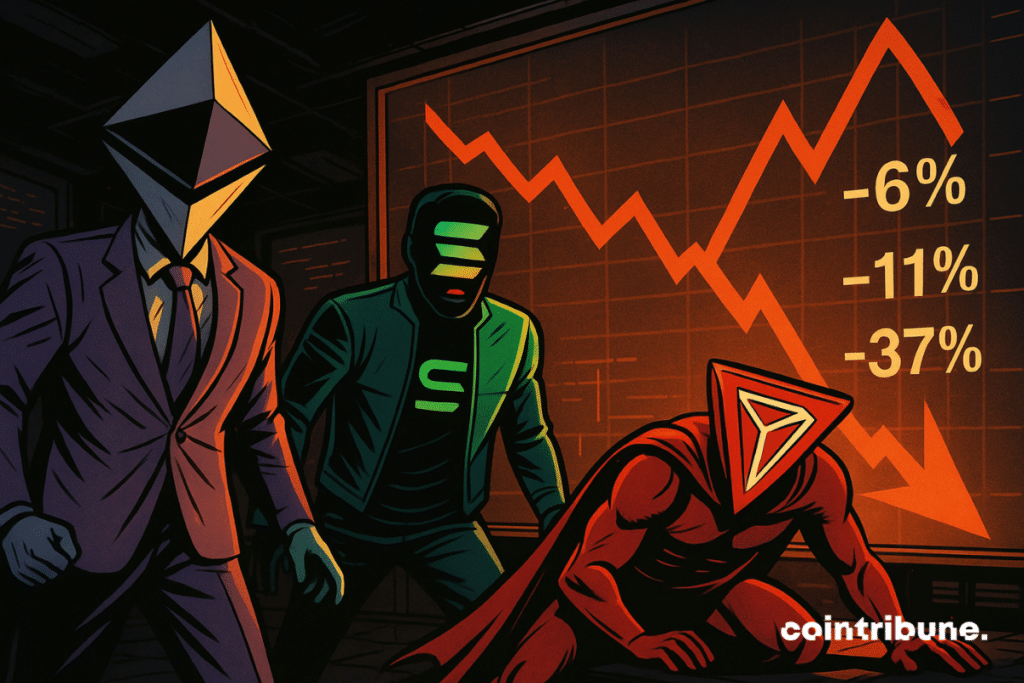

According to VanEck’s report, the combined revenues of major blockchains dropped 16% in September. Ethereum, Solana, and especially Tron saw their performance decline amidst decreasing token volatility. For example: Ether’s volatility fell by 40%, Bitcoin’s by 26%.

Result? Fewer arbitrage opportunities and therefore fewer high fees paid by traders.

VanEck explains it like this:

With lower volatility of digital assets, there are fewer arbitrage opportunities prompting traders to pay high priority fees.

VanEck Crypto Monthly Recap, Sept. 2025

Is this decrease worrying? Not necessarily. It can also mark a shift from speculative crypto to utility crypto. This is what some analysts call “the economic normalization of blockchains.”

Tron and stablecoins: the hidden face of blockchain success

While most networks suffered, Tron stands out. Despite a 37% revenue drop this month (following a fee reduction imposed by governance), the blockchain posts impressive annual figures: 3.6 billion dollars in revenue in one year, more than the 1 billion generated by Ethereum. And this, with a market cap 16 times smaller.

The reason? Stablecoins, which today make up a massive share of crypto activity. Tron hosts 51% of all circulating USDT. Used for fast, low-cost payments without banking intermediaries, stablecoins have transformed Tron into a financial logistics hub.

This central role in stablecoin settlements gives Tron a definite strategic advantage, especially in areas where access to banking infrastructure remains limited. While other blockchains seek their model, Tron capitalizes on a concrete use, grounded in the real needs of a transitioning economy.

The rise of stablecoins shows one thing: blockchain is no longer just speculation, but is woven into daily uses, from cross-border payments to informal finance.

Ethereum, Layer 2, enterprises: crypto restructures its foundations

In response to this transformation, giants like Ethereum and Solana are reorganizing. Ethereum is preparing “Fusaka,” an update that will ease the scalability of Layer 2s, thanks to a new lightweight validation method. Goal: lower costs, accelerate transactions, attract activity.

Solana, for its part, deployed the Alpenglow upgrade, reducing finality time by 80 times (from 12 seconds to 150 milliseconds). Another innovation: switching to a new token format, the P-token, which cuts computational load by 95%.

And enterprises? They are returning, but differently. After failed experiments in 2018-2020, players like J.P. Morgan, Société Générale, Circle, and OpenAI are relaunching private, targeted blockchains connected to public blockchains.

Figures reshaping the landscape

- Tron generated $3.6 billion in revenue in one year, versus $1 billion for Ethereum;

- 51% of circulating USDT are issued on the Tron network;

- Stablecoins exceeded $292 billion in market cap in October 2025;

- The ASTER token rose by +1667% since its launch in September;

- Coinbase recorded a 10.8% increase over the month, according to VanEck.

This overall revenue decline does not signal the end of the blockchain era but its reshaping. Adoption is diversifying, infrastructures adapting. Yet, a recent technical dossier reveals that Ethereum is undermined by invisible flaws at the very heart of its architecture. Further evidence that, in crypto, nothing is ever definitively secured.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.