BONK Remains Under Pressure as Bearish Structure Limits Recovery Attempts

BONK continues to face steady selling pressure, with price action offering no clear signs of a rebound. Recent moves reflect hesitation rather than strength, leaving traders cautious. As expected, the market remains without a clear direction, and volatility stays muted.

In brief

- BONK trades sideways after a sharp drop, with weak momentum and cautious sentiment keeping the price locked in a narrow range near support.

- Daily charts show lower highs and lows, with bearish flag consolidation suggesting downside risk still dominates for traders in the short term.

- Key resistance near $0.000001025 continues to attract sellers, limiting upside and favoring short-side interest over longs in rallies.

- Falling volume and open interest point to position unwinding, as traders stay sidelined awaiting clearer direction from price action.

Defensive Sentiment Keeps BONK Rangebound After Recent Decline

Following a sharp decline, BONK has entered a sideways phase, signaling uncertainty rather than stability. Selling pressure has eased slightly, but buyers have yet to show strong conviction. After leading memecoin gains in July, the asset’s short-term price action indicates a lack of momentum. As such, this has kept the token confined to a narrow range, with sentiment remaining defensive.

Although Q4 has historically been a stronger period for the memecoin, higher-timeframe charts still point to bearish conditions. Crypto analyst CryptoPulse noted that the daily structure continues to print lower highs and lower lows, with support from a series of large red candles.

The ongoing consolidation appears consistent with a bearish flag, a pattern that often precedes further downside. Quiet trading has not changed the broader trend, and patience remains limited among traders waiting for signs of a reversal.

Bearish Indicators Dominate as Price Fails to Regain Momentum

Market data continues to support a weak outlook, with multiple indicators pointing in the same direction:

- Price sentiment remains bearish, with the Fear & Greed Index at 23, reflecting extreme fear.

- The token has fallen roughly 76% over the past year and remains 84% below its all-time high.

- Performance continues to lag behind Bitcoin, Ethereum, and most top-100 crypto assets.

- Price remains below the 200-day simple moving average.

- Only 11 green days have occurred over the past 30 sessions, signaling limited buying interest.

Attempts to push above key levels have repeatedly stalled, as resistance continues to cap upside attempts. Analysts are closely watching the $0.000001025 area, which has acted as a firm supply zone.

Any move toward that level is likely to draw sellers looking for short exposure rather than long positions. More so, a failure to hold current support would confirm the bearish flag and could accelerate downside movement.

From a technical perspective, BONK trades below all major exponential moving averages, with the 20-day EMA acting as immediate resistance. Longer-term EMAs remain positioned above price, reinforcing the downtrend. The MACD stays below the zero line, and while downside momentum has slowed, no bullish crossover has emerged.

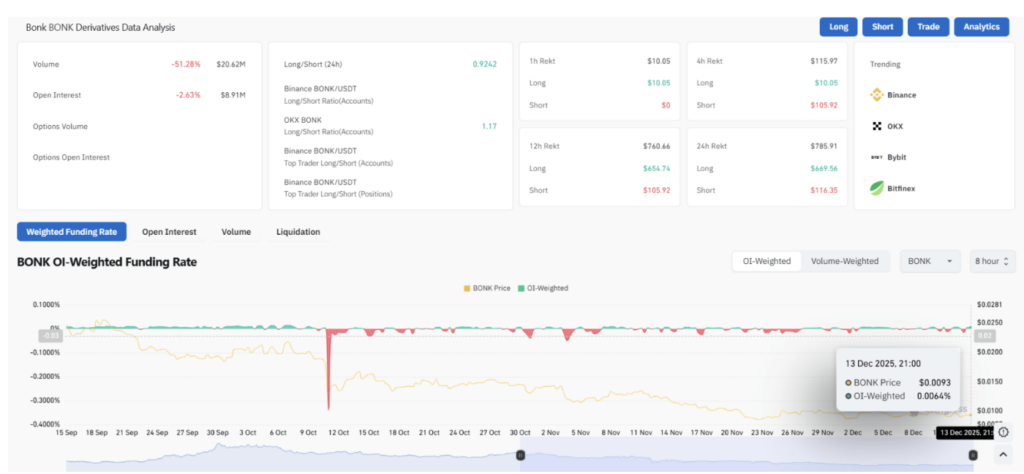

Derivatives data reflect a similar trend. Trading volume and open interest have declined, suggesting position unwinding rather than new market participation. Funding rates remain slightly positive, though long-side leverage stays limited. For now, traders appear to be on the sidelines, waiting for clearer signals before taking on risk.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.