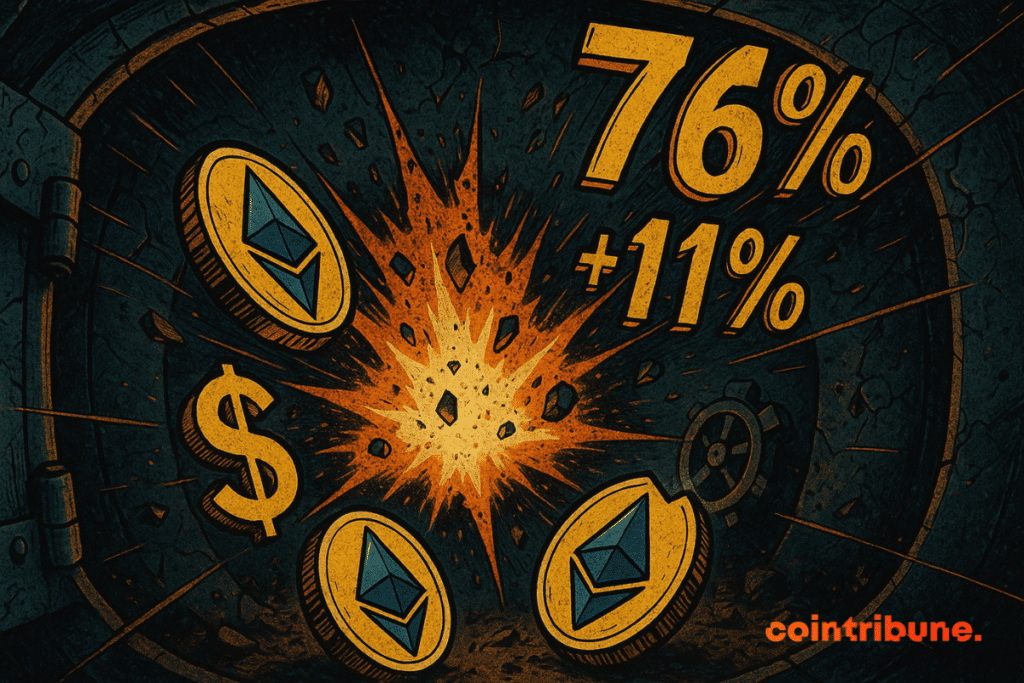

RWA Crypto Boom: $29B Tokenized After 11% Weekly Surge

The market of tokenized real-world assets (RWA) is establishing itself as one of the strongest trends in crypto. In one week, their capitalization has grown by 11%, reaching a new peak at 76 billion dollars. This surge coincides with the growing adoption of blockchain infrastructures by financial institutions.

In brief

- RWA tokens reach 76 billion dollars, marking crypto’s entry into real finance.

- Ethereum and BlackRock become the engines of a massive tokenization driven by global institutional adoption.

Crypto and real assets: a market in full mutation

Since January, the onchain value of RWA cryptos has almost doubled to exceed 29 billion dollars. The majority of tokenized assets consists of:

- private credit (50%);

- US Treasury bonds (25%).

The rest is distributed among:

- stocks;

- commodities;

- bonds;

- alternative funds.

Including stablecoins, the overall value rises to 307 billion dollars.

The interest in RWAs reflects a strategic turning point. It indeed shows that crypto is no longer just for speculation. It becomes a financial structuring tool. Interoperability, permanent liquidity, and transparency attract both fintechs and traditional banks.

Ethereum leading, Layer 2 accelerates

According to the data, more than 75% of tokenized assets circulate on Ethereum and its Layer 2 extensions. The public blockchain is indeed attractive due to its technical robustness and mature ecosystem. Crypto projects like Chainlink, Avalanche, or Ondo Finance pilot this rise with institution-focused solutions.

BlackRock, the world’s number one asset manager, confirms this trend. After the successful launch of its BUIDL fund on Ethereum, it now plans to tokenize its ETFs. An approach aligned with the vision of its CEO Larry Fink, who foresees a widespread tokenization of finance.

Beyond the numbers, the current dynamic opens the way to a new global exchange standard. Crypto is entering a phase of deep integration, at the crossroads of public finance and private markets. The coming years could therefore redefine the very foundations of the global financial system. For some, crypto-assets already threaten global stability.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.