Bybit Card: Our 2026 Review | 10% Cashback

In 2026, the Bybit card has established itself as an essential option for cryptocurrency users wishing to integrate their digital assets into everyday spending. Compatible with the Mastercard network, it allows payments online or in-store with great ease, while offering an attractive cashback program that can reach 10%. This combination of ergonomics, security, and rewards makes it an interesting solution, especially for users based in Europe. While the cashback promise draws attention, several aspects of this crypto exchange Bybit offer deserve exploration: how the rewards program actually works, what additional benefits are linked to VIP status, which cryptocurrencies are supported, and how this card compares with competitors on the market. This guide offers a comprehensive analysis of the Bybit card in 2026, focusing on its practical usefulness, concrete advantages, and key points to know before adopting it.

Cashback Program: Up to 10% Rewards

The main strength of the Bybit card remains its cashback program that can go up to 10%. Users receive their rewards as Rewards Points, convertible into cryptocurrencies or usable to get discounts and products within the Bybit ecosystem. This system particularly appeals to those wanting to make their spending profitable while staying in the crypto universe.

However, this attractive rate does not apply to all transactions. Eligible purchases focus mainly on certain categories like travel, online shopping, or entertainment services. Conversely, cryptocurrency purchases, financial fees, and transfers do not generate cashback. Moreover, a monthly cap of 200 euros limits the total amount on which rewards can be applied.

For a typical user, this program remains advantageous provided spending is focused on compatible categories. Compared to competing cards like those from Binance or Crypto.com, which often require staking tokens or reaching complex thresholds to benefit from interesting rates, Bybit stands out due to its ease of access and generosity of rates from the first levels.

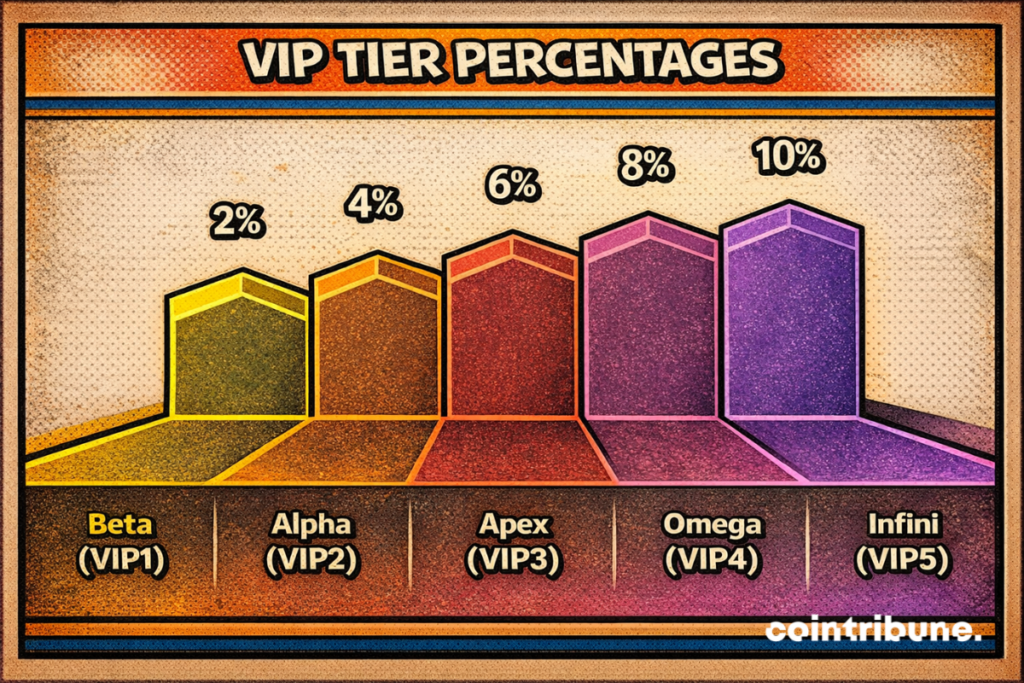

The 5 VIP Tiers: Growing Benefits Based on Your Activity

Bybit’s VIP program relies on a five-level structure designed to reward the most active users. These levels (Beta, Alpha, Apex, Omega, and Infinite) are assigned based on asset balance and monthly trading volume. Each tier unlocks progressive advantages, ranging from increased cashback to exclusive services.

- Beta (VIP1): 2% cashback

- Alpha (VIP2): 4%

- Apex (VIP3): 6%

- Omega (VIP4): 8%

- Infinite (VIP5): 10%

Beyond cashback, VIP members also enjoy discounts on trading fees, higher withdrawal and API limits, as well as access to reserved products unavailable to the general public.

This tiered system is designed to reward increasing engagement on the platform. It targets both long-term investors and high-volume traders. Users reaching higher levels benefit from a more personalized and richer experience.

100% Refunds on VIP Subscriptions

VIP users of the Bybit card enjoy an exclusive benefit: full reimbursement of certain digital subscriptions. This includes popular services like Netflix, Spotify, Amazon Prime, TradingView, as well as tools such as ChatGPT. These refunds are granted as Rewards Points, which can then be used in the Bybit ecosystem.

This benefit is particularly appreciated by regular users of these services. It not only allows compensation for certain monthly expenses but also optimizes advantages linked to VIP status. For active profiles, this feature can generate substantial savings over the year, while increasing the perceived value of the card.

Referral Program: Earn Even More with Bybit

The referral program integrated with the Bybit card allows users to increase their earnings without additional effort. By inviting others to join the platform and use the card, you can accumulate Rewards Points with each validated signup and effective use.

This system offers an interesting opportunity for active users, as it requires no additional financial commitment. The more you recommend the card to your circle, the more you are rewarded. Points earned can then be converted to cryptos or used for discounts within the Bybit ecosystem.

Practical Use in France

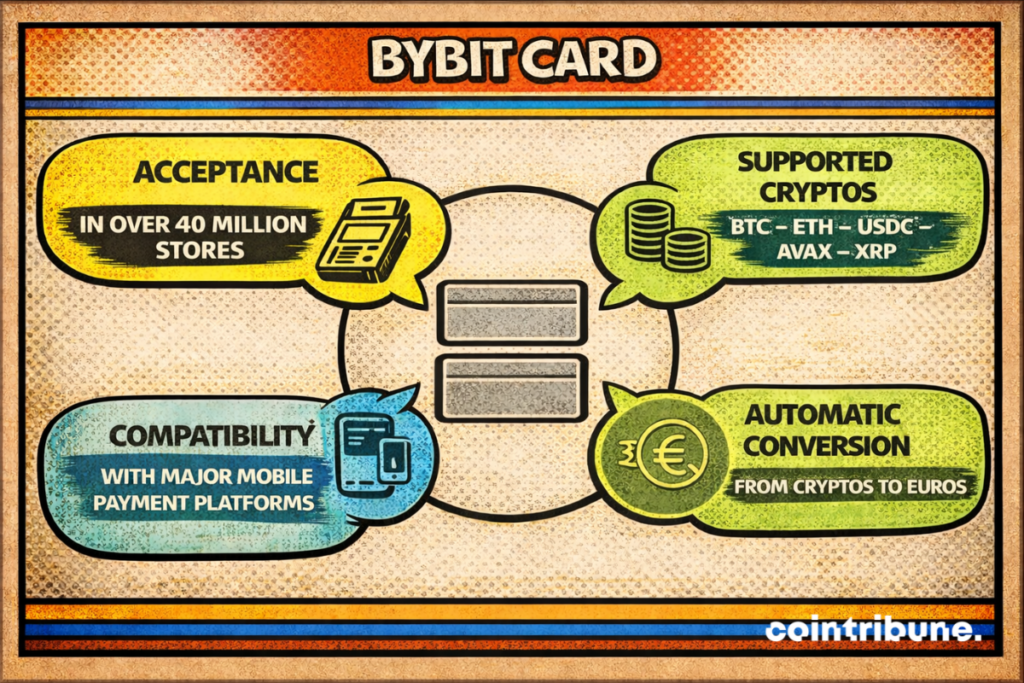

In France, the Bybit card fits perfectly with modern consumption habits. Compatible with the Mastercard network, it is accepted in over 40 million points of sale worldwide, whether physical stores or online platforms.

Its integration with contactless payment solutions like Apple Pay, Google Pay, or Samsung Pay facilitates daily use without requiring complex handling. This compatibility makes it an especially attractive option for users who want to spend their cryptocurrencies as easily as their euros.

Regarding withdrawals, users can withdraw up to 100 euros per month free of charge at ATMs. Beyond this threshold, a 2% fee applies. Even with this limit, the card maintains an excellent practical/cost ratio, especially for reasonable cash use.

Supported Cryptocurrencies

The Bybit card allows spending several of the most popular cryptocurrencies, notably Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), and Avalanche (AVAX). This flexibility lets users manage and use their digital assets without manually converting funds beforehand.

Conversion to euros is automatic at the time of payment, ensuring a smooth experience as long as the required cryptocurrencies are available in the Bybit account. The user’s crypto wallet is directly linked to the card, allowing quick payments without intermediate transfer.

It should be noted, however, that crypto-to-fiat (EUR) conversion carries a 0.9% fee. Although these fees remain moderate compared to competitors, they can represent a noticeable cost for users making frequent or large payments.

Card Fees: No Monthly or Annual Fees

One of the main strengths of the Bybit card is its transparent pricing. Unlike many competing crypto cards, it does not charge monthly or annual subscription fees. This makes it a particularly accessible solution for users wishing to integrate cryptocurrencies into daily life without recurring charges.

Some occasional fees apply, however:

- A 0.9% rate is applied when converting cryptocurrencies to euros at the time of payment.

- Cash withdrawals at ATMs are free up to 100 EUR per month. Beyond that, a 2% fee applies on the withdrawn amount.

Overall, Bybit’s fee policy remains advantageous, especially for active users seeking to maximize their cashback without being penalized by hidden or excessive fees.

Limits by VIP Level: Caps Adapted to Each Profile

The Bybit card applies spending and withdrawal limits that vary according to the user’s VIP level. This progressive system allows the most active users to benefit from higher limits, consistent with their more intensive card use.

Standard limits are as follows:

- Daily limit: 5,000 EUR.

- Monthly limit: 50,000 EUR.

- Annual limit: 250,000 EUR.

These limits can be increased for holders of the highest VIP statuses. This represents a real advantage for users wishing to carry out large transactions or manage professional expenses with their Bybit card.

Lifestyle Benefits and Bybit Earn: Combining Yield and Spending

The Bybit card is not just a simple payment solution. It fully integrates into the platform’s ecosystem, notably through the Bybit Earn program, which allows users to generate passive income while keeping flexible access to their funds.

By staking their cryptocurrencies on Bybit Earn, users can continue to earn interest while using their card for daily payments. This creates an interesting synergy between investment and consumption: your assets keep working even when you spend them.

This lifestyle aspect is reinforced by exclusive benefits offered to VIP members, such as subscription reimbursements and reserved services. In short, the Bybit card allows combining financial profitability, ease of use, and attractive rewards in a single product.

Acquisition Procedure: Fast and Compliant Activation

Getting the Bybit card in 2026 is a simple process, designed to be both fast and secure. The procedure starts with level 2 identity verification (KYC), essential to comply with European anti-money laundering and terrorism financing standards.

Once this step is validated, the card can be ordered directly from the user space. It is typically shipped quickly, and activation is done through the mobile app. The user can then start using it immediately, whether online or in-store, with integration into main digital wallets like Google Pay and Apple Pay.

This smooth procedure guarantees both regulatory compliance and a frictionless user experience. It also reflects Bybit’s willingness to make its services accessible to many, while staying aligned with European market requirements.

Transactions Not Eligible for Cashback: What to Know Before Paying

Despite an attractive rewards program, not all expenses made with the Bybit card qualify for cashback. Some transaction categories are excluded, mainly financial operations. These include, for example, bank fees, financial asset purchases, transfers, or withdrawals made on exchange platforms.

It is therefore highly recommended to check the updated list of eligible transactions in the Bybit user space before making a significant purchase, to avoid disappointment. This vigilance helps maximize your cashback gains while using your card with full knowledge.

Comparison with Competitors: Bybit vs. Other Crypto Cards

In the crypto card market, the Bybit card stands out with its attractive 10% cashback and a simple structure, without annual fees or complex requirements. But how does it compare to main competitors?

Crypto.com offers cashback from 1% to 8%, but it requires buying and locking CRO (the platform’s native token) for specific durations. The higher the locked amount, the better the benefits, which could be restrictive for occasional users.

Binance, on its side, offers up to 8% cashback through its Visa card. However, this reward depends on the number of BNB held on the platform, requiring maintaining some exposure to their native token. The program remains competitive but also more restrictive.

BlockFi, while accessible to American users, offers a card with cryptocurrency cashback, often lower than Bybit’s. The absence of a progressive VIP program also makes the offer less scalable.

In summary, Bybit positions itself as a solid option for those wanting to enjoy high cashback without complex constraints. Its ease of use combined with generous rewards makes it particularly suitable for users in Europe.

Our Verdict: A Crypto Card Made for Daily Use

The Bybit card establishes itself as an efficient solution to integrate cryptocurrencies into daily expenses. Its cashback up to 10%, ease of use, absence of subscription fees, and enhanced security make it a solid option in 2026. Although cashback caps and conversion fees should be considered, the overall advantages offered remain convincing for those wishing to optimize their crypto use. For active or regular users, as well as those who appreciate a clear and generous rewards program, the Bybit card is a relevant choice within the platform’s ecosystem.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more