Bybit EU: Complete Guide for Users

Launched in 2018, the crypto exchange Bybit quickly won millions of users thanks to robust technology, diversified services, and a high-performance trading platform. In 2025, the company strengthens its presence in France through its new European entity, Bybit EU, designed to comply with the requirements of the MiCA regulation. This European version of the platform aims to offer a secure, compliant, and tailored environment for the regulatory specificities of the French market. But for many French investors, questions remain: Is Bybit EU really usable in France? How to register and use its services legally? This complete guide reviews Bybit EU : legal compliance, local accessibility, available tools, fund security, and practical services. The goal is to enable French users to understand under which conditions the platform can be used with confidence, taking into account the specific constraints of their residence country.

What is Bybit? Origins and evolution of the platform

Since its creation by Ben Zhou in 2018, Bybit has established itself in the crypto exchange landscape as a technical and innovative platform. Originally designed to meet the needs of demanding traders, it offers a high-performance infrastructure, sophisticated tools, and significant liquidity. These elements quickly positioned it among the market leaders of digital assets.

The platform offers a wide list of digital assets, including BTC, ETH, SOL, ADA, and many others. It stands out for the quality of its order books, execution speed, and a very stable crypto trading experience. This positioning allows it to compete with major players like Binance, by offering an offering suitable for both retail investors and more experienced users.

The regulatory evolution in Europe, mainly with the entry into force of the MiCA (Markets in Crypto-Assets) regulation, pushed Bybit to adapt its model. Hence, Bybit EU was born, a dedicated entity for Europe, built to meet the expected standards for providers of digital asset services (PSAN) in the region. This version aims to provide an experience compliant with European regulations, while retaining the technical efficiency of the global Bybit exchange platform.

The creation of Bybit EU marks an important strategic step: the goal is to approach a European regulatory framework, while maintaining a rich and complete offering for users available in France.

Regulation, compliance, and situation in France

Regulation constitutes a fundamental pillar to secure the use of cryptocurrencies in France. Aware of these challenges, Bybit has structured Bybit EU as a distinct entity intended to operate in compliance with the European MiCA (Markets in Crypto-Assets) regulation, effective from 2024.

Bybit EU, the European branch of Bybit is not yet registered with the Autorité des marchés financiers (AMF), but it is actively preparing, aligning its practices with the requirements of French and European regulators. This includes personal data protection, advanced fund security mechanisms, and full transaction traceability.

To guarantee this compliance, the platform requires strict identity verification (KYC), translated into French, as well as anti-money laundering and counter-terrorism financing measures. The legal environment is thus clearly designed to meet the expectations of the French market, while anticipating the evolution of the European framework.

By strengthening its transparency and compatibility with local legislation, Bybit EU positions itself as a platform ready to meet French requirements, awaiting official registration with the AMF.

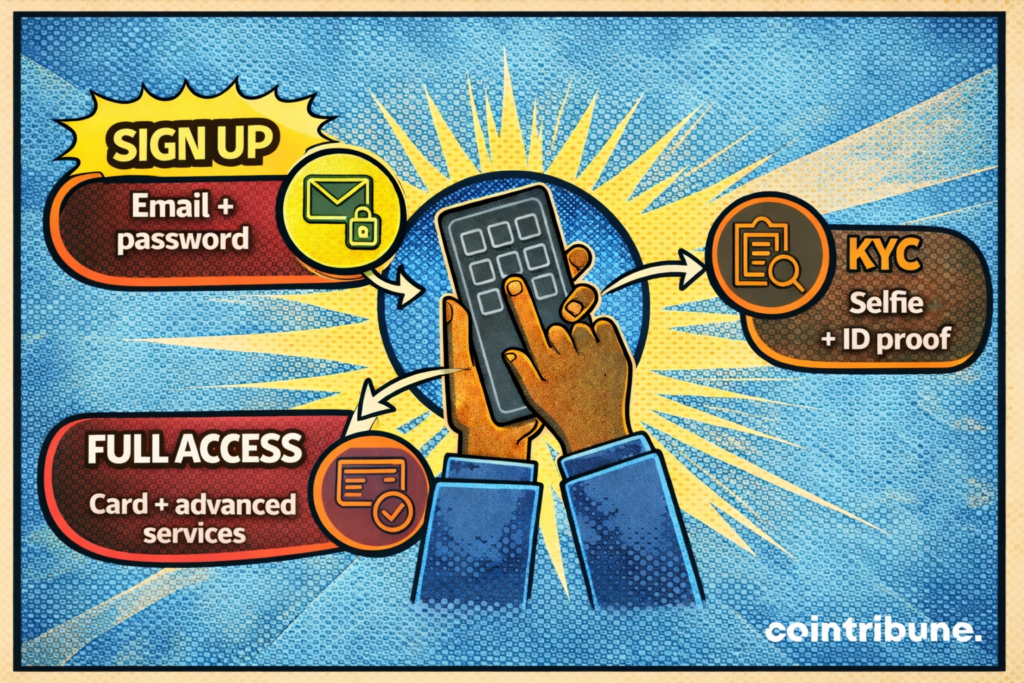

Account creation on Bybit EU: Steps and KYC

The account creation process on Bybit EU is designed to be fast, clear, and compliant with European standards. The procedure starts directly on the official website or via the mobile app, fully available in French. The registration steps are as follows:

- Enter an email address and create a secure password.

- Email validation via a code sent instantly.

- Acceptance of general terms, with display of legal documents in French.

Once initial registration is done, identity verification (KYC) becomes essential to access all digital asset financial services. The platform has structured this verification into three levels, each offering additional benefits:

- Level 1: collection of essential personal information (name, birth date, nationality). This level grants access to deposit operations, but with daily limits.

- Level 2: submission of an official ID (passport, identity card or driver’s license) with a real-time selfie. This biometric control increases withdrawal limits and access to crypto asset trading.

- Level 3: addition of a recent proof of address. This level is required for certain advanced features, like access to the Mastercard crypto card or higher deposit limits.

Documents are processed via automated systems, with validation usually completed in less than 24 hours. If difficulties arise, multilingual customer support, including French assistance, guides each step.

This progressive KYC approach, adapted to the MiCA framework, strengthens Bybit EU’s credibility and prepares the platform for possible future inclusion in the list of digital asset service providers within the European Union.

Products and services available on the Bybit platform

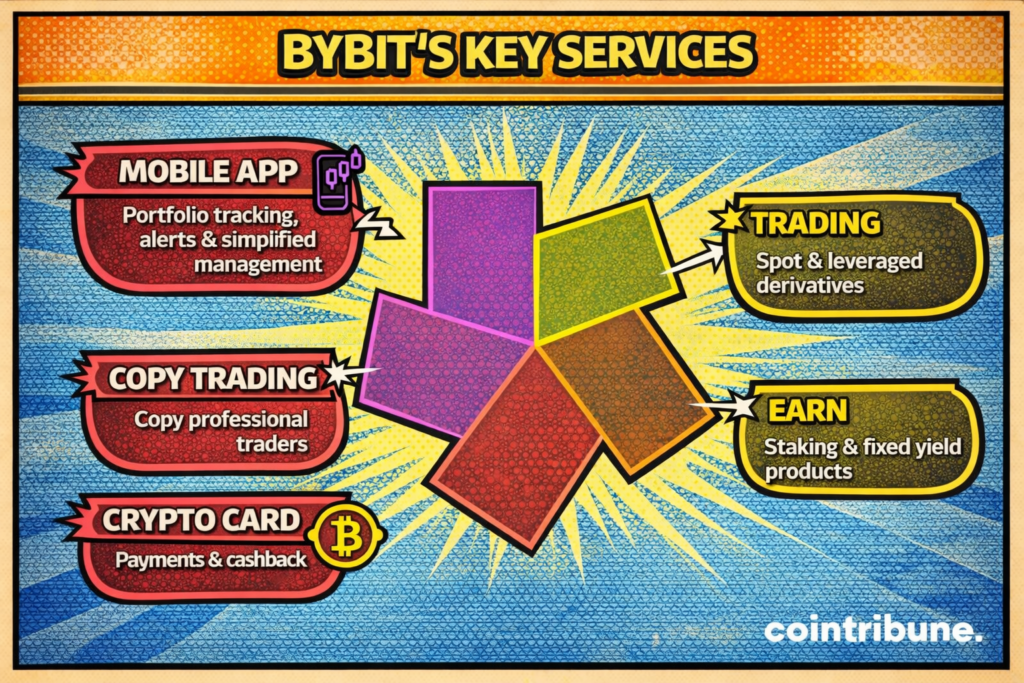

Bybit’s offering richness is one of its differentiating levers. The platform is not limited to buying and selling crypto assets; it offers a comprehensive ecosystem that supports users at different experience levels.

Spot and margin trading on Bybit EU

While Bybit’s international version has historically distinguished itself by its derivative products, Bybit EU adopts a different approach, compliant with European regulatory framework requirements. French users currently have access to classic spot trading and regulated margin trading.

Spot trading allows buying and selling cryptocurrencies like BTC, ETH, SOL, ADA, or other emerging tokens, with a smooth interface, interactive charts, and customizable technical indicators.

Margin trading, on the other hand, allows deploying a moderate leverage (up to x5 depending on available pairs) to optimize positions, while incorporating risk management tools adapted to European standards:

- Isolated or cross margin modes;

- Trigger threshold orders, take profit, and stop loss;

- Risk level monitoring and partial liquidation tools.

These features cater to a more experienced audience, but Bybit EU also offers comprehensive documentation and educational guides to help French users master margin trading. Derivative products, such as perpetual contracts, are not yet available on Bybit EU, but might be integrated once the MiCA registration is finalized.

Savings, staking, and Earn products services

For those preferring a yield-oriented approach rather than speculation, Bybit Earn groups several products:

- Flexible staking: daily remuneration with the ability to withdraw at any time.

- Fixed-yield products: time locks of 30 to 90 days for more attractive rates.

- Launchpool: participation in the launch of new cryptos.

This segment enables users to optimize their digital assets without requiring frequent active operations.

The Bybit Card

For users residing in the European Economic Area (EEA), Bybit EU offers a Mastercard crypto card, accessible after full account verification (level 3 KYC). This card allows automatic conversion of cryptocurrencies into euros when making payments at merchants.

In France, the card is available, but some features may be restricted depending on the guidelines of the Autorité des marchés financiers (AMF). Despite these limitations, standard payments and withdrawals are generally accessible.

Card features:

- BTC cashback on purchases made with the card, up to 10%, depending on the user’s VIP level.

- Expense management via the Bybit mobile app, translated into French.

- Real-time transaction history and limit configuration.

- Support for online and physical payments via the Mastercard network.

This card facilitates the daily use of cryptos, creating a smooth bridge between digital assets and traditional payments, while respecting local legal constraints.

Fees, commissions, and VIP levels

Bybit EU adopts a competitive fee schedule, designed to meet the expectations of French users, while remaining transparent. Fees are calculated based on monthly trading volume and the market role (maker or taker).

The standard applied on Bybit EU is:

- Makers (liquidity providers): 0.01%

- Takers (liquidity takers): 0.06%

These rates can be reduced via the VIP program, based on the 30-day trading volume. The more a user trades assets, the higher they progress in VIP levels, with benefits such as:

- Additional fee discounts.

- Higher withdrawal limits.

- Priority access to French-speaking customer support.

- Extra bonuses on savings products (Earn).

Fees are displayed in real-time on the user dashboard, improving transparency and helping optimize the cost of operations on the cryptocurrency trading platform.

Security, audits, and past incidents

Bybit EU places the security of French users at the core of its architecture. The platform applies strict technical standards and compliance practices aligned with the MiCA regulation, in preparation for its registration with the AMF.

The majority of digital assets are stored in multisignature cold storage, significantly reducing intrusion risks. For routine operations, users can enhance their protection through:

- Multisignature cold storage for the majority of crypto assets, reducing hacking risks.

- Two-factor authentication (2FA) and anti-phishing protection for each user.

- Withdrawal whitelist and monitoring of unusual logins.

- Mandatory identity verification (KYC) to access services, with secure data processing.

Moreover, Bybit EU enforces strict segregation of user funds from the platform’s own funds, as required by European regulation. This fund segregation guarantees client deposits are protected in all circumstances.

In 2025, a security incident affected Bybit’s global version, without impact on Bybit EU. Audits were conducted, APIs strengthened, and monitoring processes revised. Since then, regular external audits are in place, ensuring continuous transparency.

For French users, these guarantees enhance Bybit EU’s credibility as a secure platform focused on compliance and reliability.

Accessibility and user experience in France

Bybit EU strives to offer a smooth and localized experience for French users, both on desktop and mobile. The interface is fully translated into French, including menus, analysis tools, and support materials.

The mobile app, compatible with iOS and Android, enables users to:

- Track prices of major crypto assets in real-time.

- Place orders instantly on the spot market or margin trading.

- Set price alerts according to their goals.

- Manage portfolios, view history, and adjust security settings.

The personalized dashboard allows users to view at a glance KYC status, available balances, recent transactions, and security settings.

A multilingual customer support, including French, is available 24/7 via chat, email, or the online help center. French users can also rely on practical guides integrated into the platform, to assist them step-by-step in using the services.

This focus on linguistic localization, intuitive interfaces, and dedicated assistance helps make Bybit EU a crypto platform adapted to the French market, accessible to both beginners and advanced users.

Advantages and limitations of Bybit EU for French users

Bybit EU, in its European version, directly targets French users wishing to access a compliant, efficient, and service-rich crypto trading platform. Before opening an account, here is an overview of key points to consider.

Advantages

- Wide crypto offering: more than 300 asset pairs available for spot trading.

- Intuitive and localized interface: navigation in French on web and mobile.

- Competitive fees with evolving VIP structure.

- Diversified services: Earn, staking, crypto card, margin trading.

- French customer support, accessible 24/7.

- Respect of European regulatory framework (MiCA): compliance in progress.

- Segregation of client funds and regular security audits.

Limitations

- Mastercard card available only for users having completed level 3 KYC, and restricted features in France according to AMF guidelines.

- No deposit guarantee, unlike some traditional financial institutions.

- Derivative product trading not yet accessible on Bybit EU (only spot and margin at the moment).

These elements must be evaluated according to the investor profile: French users seeking both compliance, simplicity, and functional diversity will find a credible and actively developing solution.

Perspectives and Bybit roadmap 2025-2026

For the coming years, Bybit EU lays out a clear roadmap, centered around two major axes: technological innovation and regulatory integration in Europe, with special attention to the French market.

One of the platform’s strategic objectives is the obtaining of the full MiCA license, to be among providers registered with the Autorité des marchés financiers (AMF). This recognition would allow Bybit EU to operate fully and legally in France, within a secure and regulated framework. In parallel, several product developments are expected:

- Launch of Web3 features with an integrated non-custodial wallet.

- Deployment of an NFT marketplace and compatible DeFi solutions.

- Expansion of the decentralized staking offering and Earn products.

- Development of hybrid financial products, midway between traditional finance and crypto-assets.

Ben Zhou, CEO of Bybit, aims to position the platform as a reference player at the intersection of classical financial markets and Web3 technologies. In France, this implies continuous adaptation to local regulations, ongoing dialogue with authorities, and increased transparency on the services offered.

This strategic direction makes Bybit EU a serious candidate for sustainable integration into the European regulated ecosystem, capable of meeting the requirements of demanding French users, concerned about security, compliance, and innovation.

Bybit EU thus appears as an ambitious crypto platform, capable of offering a rich and technical offering to Francophone investors. Its robust infrastructure, product diversity, and user experience make it a serious alternative in the global cryptocurrency exchange landscape. It can therefore be considered a relevant option for informed or curious users.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more