Bybit Review: Our Full Test of the Platform

You are a trader, crypto enthusiast, or simply looking for a reliable platform to manage your digital assets? If Bybit is familiar to you, whether for its crypto card or its VIP program, you are probably looking for a neutral, serious and detailed review before committing. This test is here to provide you with the answers. After several weeks of use, we deliver a comprehensive evaluation of Bybit, its features, strengths, and possible limits, taking into account the European regulatory context (MiCA) and the temporary restrictions imposed in France. This feedback covers the efficiency of its spot trading engine, the convenience of its mobile app, as well as the security levels, regulatory measures, and steps needed to open an account via the European entity Bybit EU.

Can you really generate passive income with Bybit?

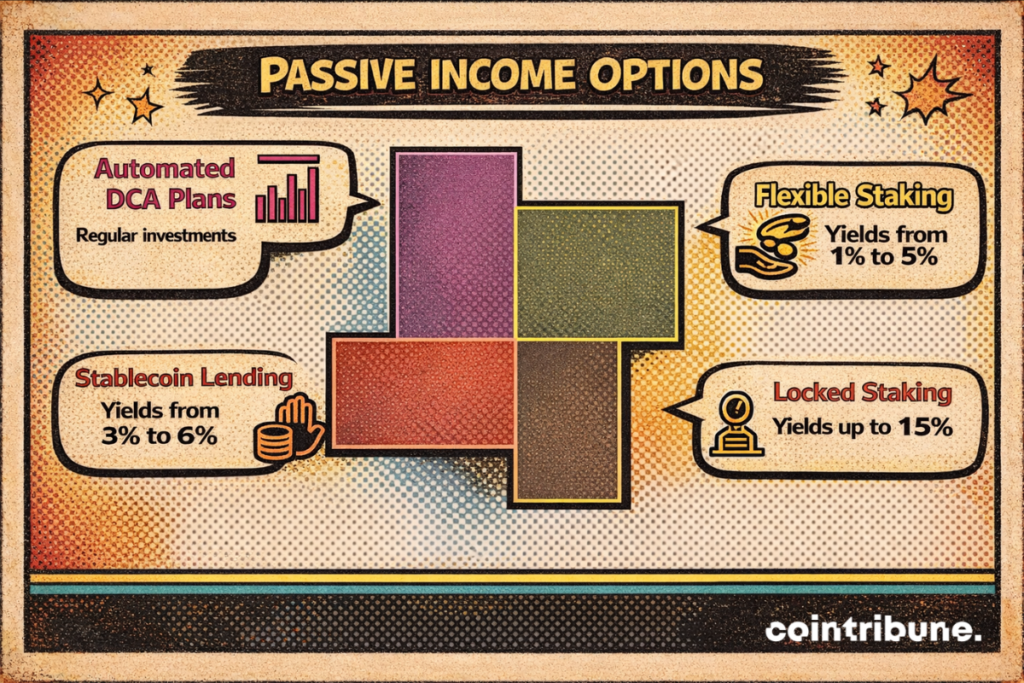

Bybit is not limited to active trading. The platform also provides a range of solutions to generate passive income: staking, lending, and programmed investment via DCA.

Flexible staking allows you to place assets such as ETH or DOT in variable-yield pools. Interests are paid daily, and funds remain available at any time. This model attracts users who want to combine yield and flexibility. Rates offered vary depending on market conditions and concerned assets.

For investors willing to lock their funds, fixed-term staking offers potentially higher yields (up to 15% on certain cryptocurrencies), in exchange for a temporary locking of funds for durations ranging from 15 to 120 days. This formula is for those who prioritize yield over liquidity.

The lending service allows lending your assets to other users, with interesting interest rates, particularly on stablecoins. Annual yields generally oscillate between 3% and 6%. For altcoins, rates can be more volatile and depend on market demand.

DCA plans (recurring purchase) offer another approach: investing a fixed amount at regular intervals on a given crypto, like BTC or ETH. This method aims to smooth out the purchase price over the long term while avoiding impulsive decisions dictated by volatility.

All these solutions are grouped in the Bybit Earn interface, which clearly indicates for each product the withdrawal conditions, yield levels and estimated risk levels. Some projects with high yields could however lack transparency about the source of interests, which calls for caution.

Bybit therefore offers a simple and structured ecosystem to generate passive income. The available solutions suit different profiles, from cautious beginners to more aggressive investors. As always in the crypto world, it is recommended to start with modest amounts according to your risk tolerance.

Is the Bybit crypto card really useful day-to-day?

The crypto card launched by Bybit, in partnership with Mastercard, allows users to spend their cryptocurrencies in euros, just like with a regular bank card. This initiative aims to facilitate the integration of cryptocurrencies into daily use.

Available in France, the card can be obtained after level 2 KYC validation (identity + proof of residence). A virtual version is available immediately after validation, followed by the physical card delivery, generally within 72 hours. The card is offered via the European entity Bybit EU and complies with regulatory requirements applicable in the European Union, enhancing the security of use for local residents.

Five cryptocurrencies are currently supported for payments: BTC, ETH, XRP, USDT and USDC. At each payment, the selected asset is automatically converted into euros at the current rate, without noticeable latency.

Limits are adapted for regular use:

- Up to €20,000 monthly payments.

- Up to €2,000 daily ATM withdrawals.

- Payments in Eurozone: no fees.

- Payments in foreign currencies: commission of 0.9%.

- ATM withdrawals: €2 per transaction.

A strong point lies in the cashback program integrated into the card. Users can benefit from refunds up to 10% depending on their VIP level on Bybit. This cashback is credited in the form of BTC. It applies to certain categories of expenses and may be subject to a monthly cap, making it all the more relevant for active users.

The Bybit mobile app allows easy card management. It allows you to

- Select the asset to debit.

- Temporarily block or unblock the card.

- Change the PIN code.

- Track payments in real-time.

- Link the card to Apple Pay and Google Pay for contactless payments.

The Bybit card offers a smooth, fast, and connected experience to the crypto world. Its BTC cashback, integration with digital wallets, and mobile management make it an attractive solution for active users. However, certain limitations may apply depending on the country or KYC status.

Are deposits, withdrawals and conversions on Bybit really simple?

Bybit offers a comprehensive management of incoming and outgoing flows, designed to be accessible, fast and secure. For cryptocurrency deposits, the operation is direct:

- A unique address is generated for each asset (BTC, ETH, USDT, etc.).

- Main blockchains are supported: Bitcoin, Ethereum, Tron, Polygon…

- No deposit fees are charged by Bybit (only network fees apply).

To deposit euros, Bybit uses external providers like Banxa, MoonPay or Mercuryo. These services allow the use of bank cards or SEPA transfers. However, fees for card payment can reach 3.5%, which can be disadvantageous for large amounts.

Withdrawals in cryptocurrencies are easy to perform, with competitive fixed fees. For example, a BTC withdrawal incurs a fixed cost of 0.0005 BTC. Processing times are generally short, except in case of network congestion.

To withdraw in euros, you must first convert your assets using the “Convert” or “Sell” function. Funds can then be transferred to the Bybit crypto card or sent to a bank account via IBAN. Euro deposits are possible thanks to classic SEPA transfers supported by Bybit EU’s partner providers. However, these operations are not always instantaneous: depending on the bank and country of residence, processing times of 1 to 3 business days may apply.

The integrated conversion tool allows you to quickly switch from one asset to another without going through an order book. It is a convenient solution for quick arbitrages or portfolio adjustments. Rates offered are close to the market, although a spread is sometimes visible on less liquid pairs.

Transaction security is strengthened by the activation of 2FA, the possibility to add withdrawal addresses to a whitelist, and the systematic validation of sensitive operations.

In summary, Bybit offers a clear and functional interface for deposits, withdrawals and conversions. These operations are overall smooth and secure. Only the high fees of external providers for euro deposits and the lack of instant transfers may limit the experience for some users.

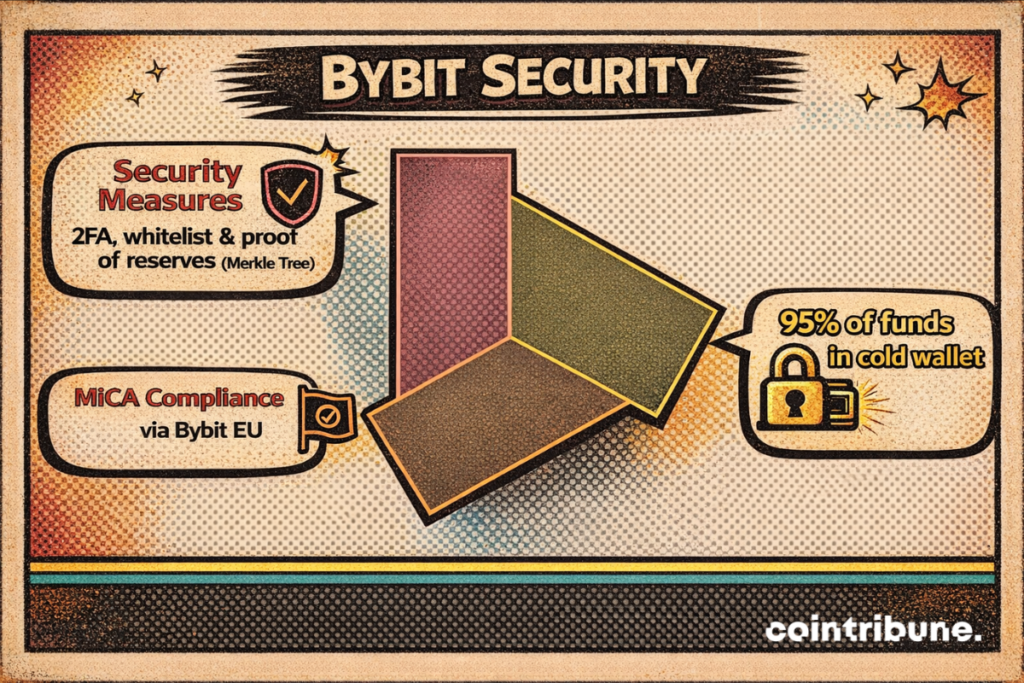

Is Bybit reliable from a regulatory and security standpoint?

In a rapidly changing regulatory context, the reliability of an exchange platform relies as much on its technical security as on its regulatory positioning. Bybit, historically active in Asia, has started a transition to Europe to comply with local requirements.

Regulation: a structured evolution

Since 2023, Bybit has started a compliance process with European standards by creating the entity Bybit EU. This framework aims to progressively meet the requirements of the MiCA regulation, with visible efforts to adapt to the regulatory environment.

To date, some services historically offered by Bybit, such as leveraged products, are not accessible via the European entity Bybit EU. However, users can follow official updates directly on the platform.

Security: high standards

Technically, Bybit applies a robust security architecture. About 95% of client funds are stored offline in multisignature cold wallets, significantly limiting hacking risks. Active wallets are strictly reserved for necessary operations.

Users have several protection levels: two-factor authentication (2FA), withdrawal whitelist, secondary password, and anti-phishing code for email notifications. Since its launch, Bybit has emphasized a robust security architecture and regularly communicates on its fund protection measures.

Proof of reserves: transparency to improve

Bybit has implemented a proof of reserves based on a Merkle tree, allowing users to verify that their assets are properly covered. Improvements are still possible in this area, especially regarding communication, to strengthen transparency for users particularly attentive to fund management.

Platform access: according to jurisdictions

Some countries like the United States, Canada or Singapore cannot access the platform due to local constraints. In France, access is possible after KYC verification, with restrictions adapted to the current legal framework. Using a VPN to bypass these rules may lead to sanctions, including account suspension.

Bybit demonstrates a clear willingness to align with European standards. Its technical security inspires confidence, and its regulatory efforts go towards sustainable integration. European users, especially French ones, can use the platform with peace of mind while staying attentive to upcoming legal developments.

Is Bybit worth it?

After several weeks of thorough use, Bybit stands out as a performant crypto platform structured for the European market. Its spot trading engine is smooth, its yield tools are accessible, and its crypto card facilitates daily use of digital assets. The Bybit EU entity strengthens its regulatory anchoring in Europe, offering a framework compliant with local requirements. For European investors seeking a clear, secure platform adapted to their legal environment, Bybit EU constitutes a solid option in 2026.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more