Bybit vs Binance: Which Platform Should You Choose in 2026?

Choosing a crypto exchange has never been more strategic. In 2026, user expectations have evolved: performance, security, ergonomics, and service diversity have become essential criteria. In this context, two names stand out in the digital asset trading universe: Binance, the historic player with a plethora of offerings, and Bybit, a rapidly rising platform, praised for its specialization and execution quality. At first glance, these two exchanges seem to offer comparable services. But when you take the time to test them in depth, the differences are significant. To this end, this article offers a complete analysis, based on practical usage of both platforms, considering regulation, security, key features, and the specific needs of European users. Our goal is to help you determine which of the two suits your profile best, whether you are an active trader, long-term investor, or simply seeking a reliable solution to manage your crypto assets.

A match between two giants of crypto trading

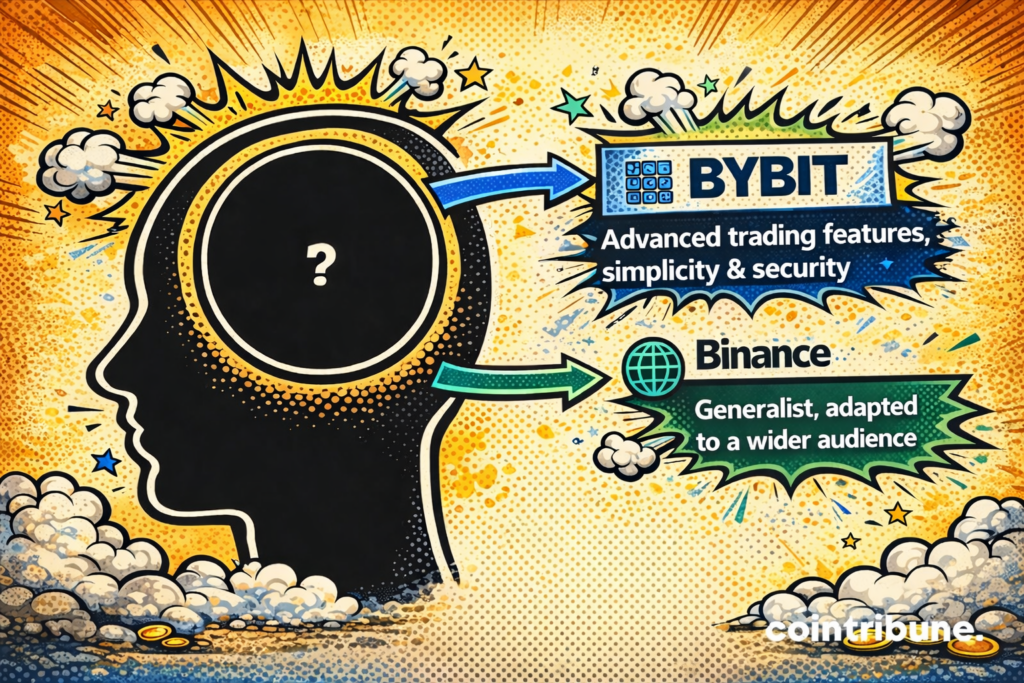

In 2026, Bybit and Binance remain two essential references for cryptocurrency investors and traders. Their global reputation attests to their central role in an ecosystem constantly evolving, characterized by innovation, volatility, and market depth. While their offerings appear similar on the surface, a finer analysis reveals distinctly different positions, suited to different user profiles.

Binance, a pioneer platform in the sector, stands out with a particularly broad offering. Beyond classic trading, it includes staking-related services, NFTs, derivatives, and yield wallets. This richness is its strength but can also make navigation complex for those who prioritize simplicity and fast execution.

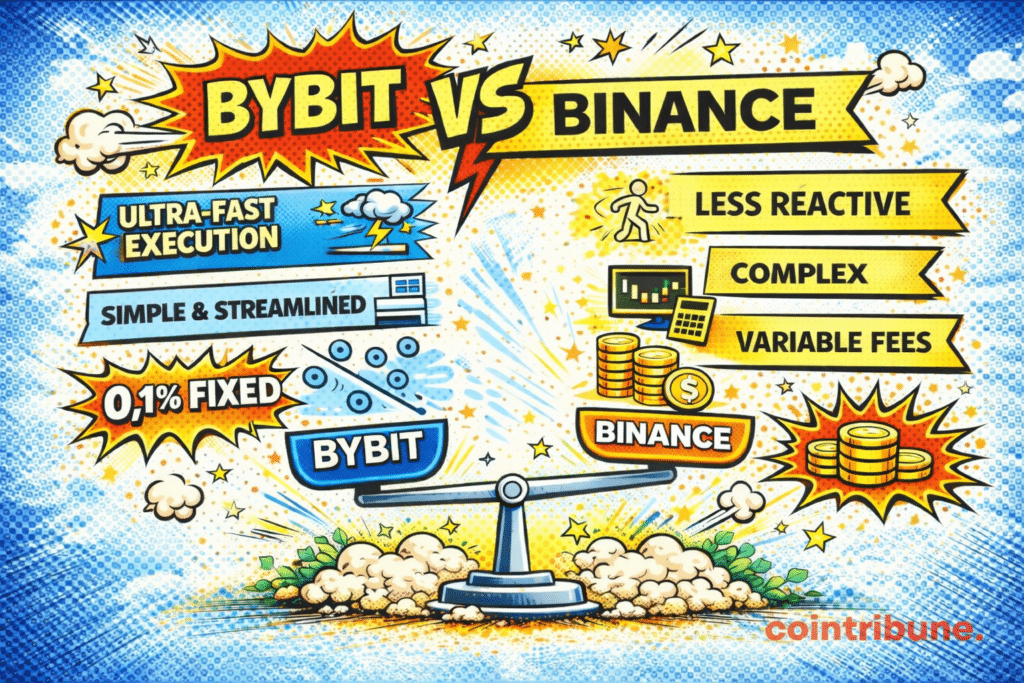

Conversely, Bybit has built its success on a targeted approach. Less generalist in its asset catalog, it primarily targets users seeking technical performance. Its matching engine is particularly efficient, even during volatility spikes, making it a platform appreciated by investors looking for fast execution on the spot market. Execution fluidity is at the core of its DNA, noticeable with every use.

Regulatory-wise, the two players adopt different strategies. Binance pursues its global expansion by obtaining various regional licenses. Meanwhile, Bybit structures itself around Bybit EU to meet European requirements, focusing particularly on compliance and security. In 2026, regulation is decisive for European investors. Bybit EU operates through an entity dedicated to the European Union, allowing it to evolve within a framework compliant with local demands. This structure enhances transparency and protection for European users.

Interface and user experience: Immersion into the platforms

Ease of use remains a central criterion in choosing an exchange. A well-designed interface improves efficiency while reducing risks linked to misuse. On this point, Bybit and Binance adopt two different philosophies.

Binance bets on functional diversity. Each section of the platform opens access to new tools, products, or programs. While this richness appeals to experienced users seeking advanced options, it can also overload the interface and complicate handling. Customization is available but sometimes at the expense of clarity.

Bybit, on the contrary, favors a clean interface. The dashboard’s organization promotes direct reading of key information and quick order execution. The integrated analysis tools, inspired by TradingView, are easily accessible without compromising readability. Every action can be done in a few clicks, allowing traders to stay focused on the market.

This visual and functional efficiency suits both experienced users and intermediate profiles wanting a responsive trading environment, without superfluous features. In summary, Bybit focuses on usage fluidity, whereas Binance prioritizes versatility.

Available products: Spot, options, NFTs, and more

The choice of products offered on a crypto platform significantly determines the strategy a user can adopt. Whether for active trading or a more passive approach, an exchange’s offer must align with each person’s objectives.

Binance provides a very complete range: spot trading, derivatives (futures, options), staking, lending, NFTs, launchpad, fixed or flexible yield wallets… This generalist positioning covers many use cases. It thus suits users wishing to explore several types of assets and services within one environment. However, this functional richness requires good familiarity with the interface to fully exploit the platform’s potential.

On the passive income side, Bybit offers a comprehensive solution via the Earn section, including flexible staking, term staking, lending, and automated investment plans (DCA). These services generate yield on assets without active trading. The crypto card provided by the platform fits this logic as well, offering up to 10% cashback. The experience is optimized to remain simple, even for less technical users.

A notable point: Bybit also integrates a copy trading service, appreciated by beginners and intermediate profiles. It allows replicating the strategies of professional traders automatically, with easily readable performance data.

In summary, while Binance bets on maximal service diversification, Bybit EU favors a more structured approach centered on the spot market and yield solutions suited for European investors. This specialization allows better readability and enhanced risk management.

Trading fees: Who offers the best conditions?

Fees are a central criterion in choosing a platform, especially for active traders who multiply transactions. A clear, competitive, and adapted pricing structure allows optimizing profitability in the long run.

Binance offers a competitive but relatively complex pricing grid. On the spot market, standard fees are 0.1% per transaction. Discounts are available for users holding BNB (the platform’s native token) or based on their VIP level, determined by monthly trading volume. For derivatives, fees vary by pair and market funding conditions. Although rates remain industry average, the overall fee reading may be unintuitive for beginners.

On Bybit EU, the pricing grid remains simple and readable. Standard spot fees are set at 0.1%, with a VIP program allowing progressive discounts based on trading volume. The absence of leveraged products also simplifies the pricing structure for European users.

Binance has a broad but sometimes complex grid to grasp. Bybit EU favors a clear and readable pricing structure, particularly suited for European investors seeking transparency and simplicity.

Advanced tools: For active or automated management

Beyond applied fees and product offerings, it is the tools provided to users that often make the difference. Whether to automate transactions, refine strategies, or save time, each platform offers a set of features to meet various needs.

Binance offers a comprehensive, yet sometimes scattered toolset. Configurable trading bots are available from the main interface, along with copy trading features and integrations with external platforms via API. These options cover a wide spectrum, from amateur traders to algorithmic users. However, the organization of these tools may lack coherence, making the experience more complex to manage. Some advanced functions require navigating several menus or using third-party apps to leverage fully.

Bybit, on the other hand, favors efficiency and accessibility. The copy trading tool allows following experienced traders in a few clicks, with clear profiles and detailed performance histories. The interface is fluid and designed for users wanting quick access to essentials without sacrificing data quality.

For more technical strategies, Bybit offers a high-performance API compatible with major market automation tools. Bots can be integrated to automate spot strategies or conditional orders, with an API compatible with top market tools. This modular approach lets everyone customize how they trade without reinventing the technical architecture.

In conclusion, if Binance has the broadest offer, Bybit stands out due to clarity of its tools and their practical efficiency. Binance attracts with its ecosystem’s richness, suitable for those wishing to explore a wide variety of products within one platform, but this diversity can sometimes reduce readability.

Bybit focuses on efficiency, with a clean interface, a powerful trading engine, and well-integrated tools, particularly suited for active users or those who prioritize clarity. It also complements its ecosystem with products oriented toward practical benefits, such as its crypto card offering up to 10% cashback on spending. For European investors in 2026, Bybit EU stands as a coherent solution: local regulation, fluid interface, clear fees, and an environment optimized for the spot market. A positioning that fully meets the new demands of the European market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more