Chainalysis Report Reveals $75B in Illicit Crypto as Governments Eye Digital Reserves

A new report by blockchain analytics firm Chainalysis reveals that more than $75 billion in cryptocurrency linked to illicit activity could soon be within reach of law enforcement. The findings come as governments consider forming official crypto reserves, raising questions about how seized digital assets could fit into national financial strategies.

In brief

- Chainalysis identifies $75B in crypto tied to illicit activity, with $40B controlled by darknet market operators.

- Bitcoin makes up 75% of illicit funds, though stablecoins are becoming more common in criminal transactions.

- Governments see seized crypto as a potential source for state-backed digital reserves and financial strategy.

- Despite the headlines, crypto crime fell to 0.14% of blockchain activity in 2024, down from previous years.

Chainalysis Uncovers $75B in Crypto Tied to Illicit Activity, Most in Bitcoin

Governments exploring national cryptocurrency reserves may already have access to billions in recoverable on-chain assets, according to the latest research by Chainalysis.

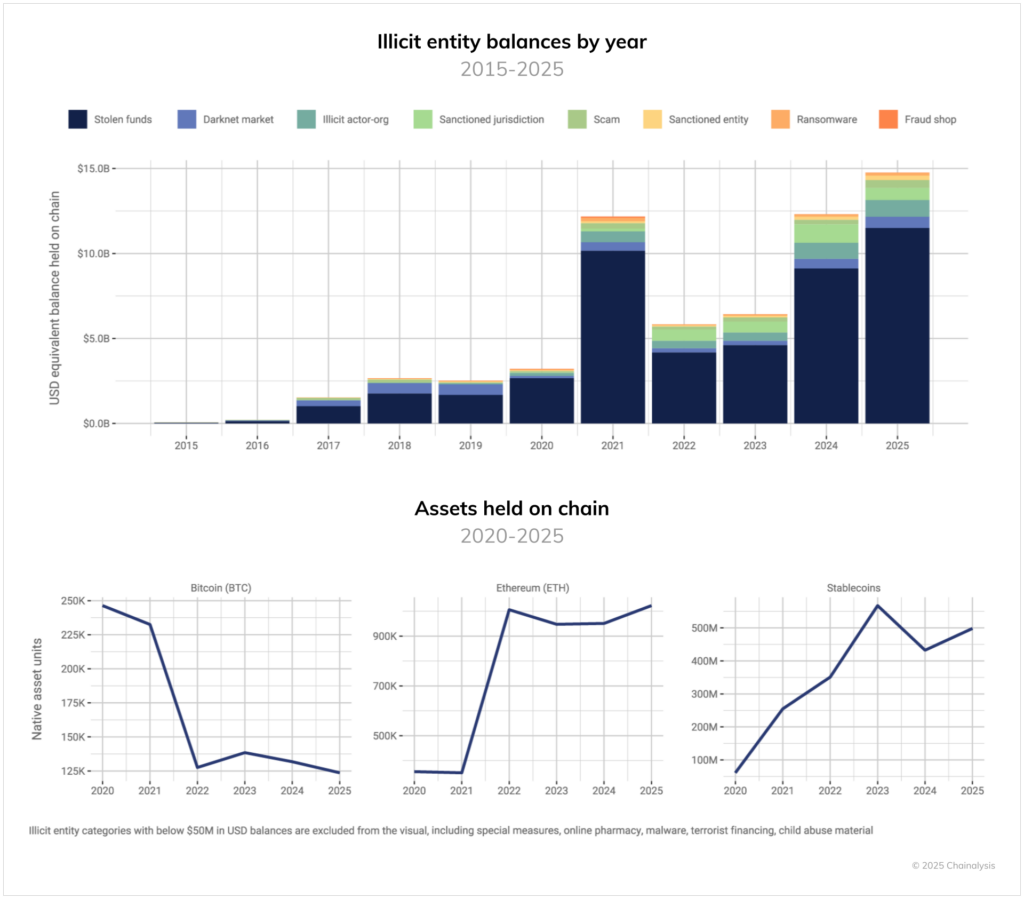

In a Thursday report, the analytics firm estimated that more than $75 billion worth of cryptocurrency is tied to illicit activity. This includes the $15 billion held directly by illicit entities and over $60 billion in wallets with indirect exposure to them.

The firm said darknet market operators and vendors control over $40 billion in crypto assets, underscoring the scale of digital funds potentially recoverable through law enforcement action.

Chainalysis noted that Bitcoin accounts for about 75% of the total illicit value, though stablecoins are playing an increasingly significant role in such activities. The findings come as countries, such as the United States, consider how to integrate digital assets into their financial systems, including the establishment of state-backed reserves.

The report cited the Trump administration’s creation of the Strategic Bitcoin Reserve and Digital Asset Stockpile—initiatives aimed at building government crypto holdings through budget-neutral means, such as asset forfeitures.

Major Digital Asset Seizures Signal New Era in Financial Enforcement

According to Chainalysis, these developments highlight a new frontier in financial enforcement and national asset management. The analysis noted that billions in illicit crypto are openly traceable on public blockchains. This, in turn, has created a major opportunity for authorities to recover funds through coordinated enforcement efforts.

The cryptocurrency ecosystem presents law enforcement with an unprecedented opportunity: billions of dollars in illicit proceeds are sitting on public blockchains and are theoretically seizable if authorities can coordinate action.

Chainalysis Report

Chainalysis co-founder and CEO Jonathan Levin said the new estimates significantly expand the potential for asset forfeiture and could influence how governments approach building blockchain-based reserves in the future.

Recent enforcement actions illustrate this potential. In March, the U.S. Department of Justice (DOJ) announced the disruption of a Hamas terrorist financing scheme, seizing roughly $200,000 in USDT used to fund the group’s operations.

Separately, a Chinese national was convicted in the United Kingdom following an international fraud investigation that led to what police believe is the world’s largest cryptocurrency seizure: 61,000 BTC valued at approximately £5 billion ($6.7 billion).

In Canada, authorities confiscated nearly $40 million in digital assets from the exchange TradeOgre, which was accused of operating without registration and facilitating money laundering. The move drew criticism from parts of the crypto community, arguing that regulators had exceeded their authority.

Crypto Crime Falls to Just 0.14% of Blockchain Activity, Chainalysis Reports

While blockchain-based crimes have increased in number, Chainalysis found that their overall share of crypto activity remains relatively small. The firm’s 2025 Crypto Crime Report estimated that illicit transactions represented only 0.14% of all blockchain activity in 2024, continuing a decline seen in previous years.

In contrast, the United Nations Office on Drugs and Crime (UNODC) estimates that between 2% and 5% of global GDP is laundered each year through traditional finance.

Analysts note that blockchain’s transparency often makes crypto crime appear more widespread than it actually is, since every transaction is publicly visible and easier to trace than cash-based activity. Every transaction is recorded on public ledgers, making illicit movements easier to detect and more frequently reported than those involving cash or traditional banking.

As nations evaluate their approach to digital assets, Chainalysis’s findings suggest that the line between law enforcement and asset management is narrowing—indicating that recoverable crypto could soon play a role in shaping national reserve strategies.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.