Chen Zhi Arrested: Mastermind Behind $12B Crypto Scam Captured

The arrest of Chen Zhi, alleged mastermind of a crypto scam of unprecedented scale, marks a turning point in the fight against digital financial crime. With more than 12 billion dollars worth of bitcoins seized, this case raises questions about the security of digital assets and the effectiveness of international regulations.

In brief

- Chen Zhi, founder of Prince Holding group, orchestrated a massive crypto fraud through scam centers in Cambodia, using the ‘pig butchering’ method.

- 127,271 bitcoins ($11.6 billion) were seized by the United States, marking the largest confiscation in the history of the Department of Justice.

- Bitcoin remains the preferred asset of crypto scammers because of its anonymity and ease of cross-border transfer, despite regulators’ efforts.

Chen Zhi, the mastermind behind a historic crypto scam

Chen Zhi, founder of the Prince Holding group, is accused of orchestrating a massive scam through scam centers in Cambodia. Indeed, he used forced labor to manipulate victims around the world with the “pig butchering” method. A technique that involves gaining victims’ trust before stripping them of their crypto funds.

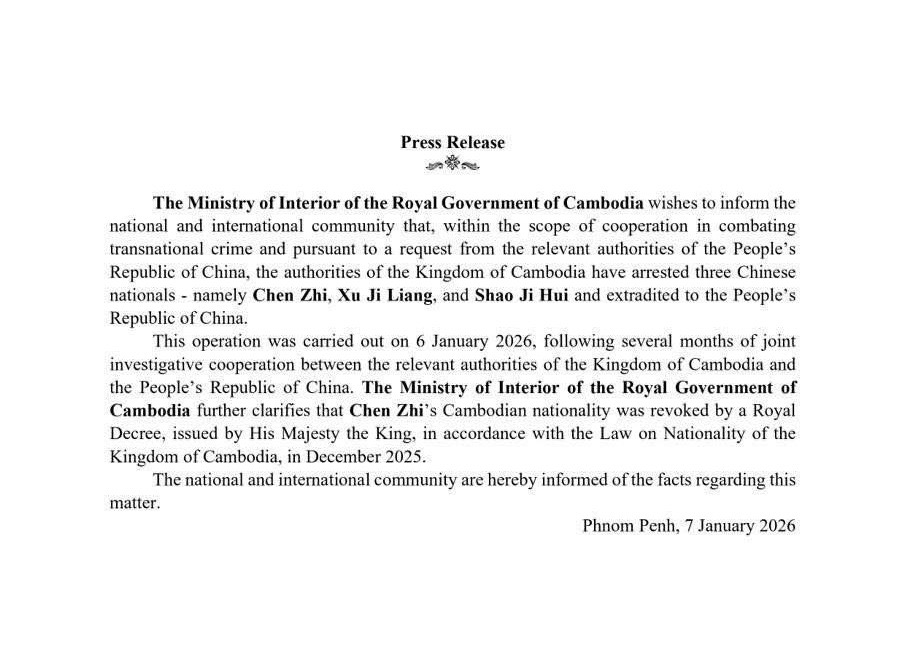

Arrested on January 6, 2026, in Cambodia, Chen Zhi was extradited to China the next day after his Cambodian nationality was revoked. This operation resulted from international collaboration between Cambodian, Chinese, and Western authorities, illustrating the determination to dismantle transnational criminal networks. His arrest highlights the failures of regulatory systems but also the need for enhanced cooperation between states to fight these crypto frauds.

$12 billion in crypto embezzled

U.S. authorities have seized 127,271 bitcoins, estimated at $11.6 billion, as part of the largest confiscation in the history of the Department of Justice. These funds come from massive crypto frauds orchestrated by Chen Zhi’s network. Additionally, sanctions imposed by the United States and the United Kingdom against Prince Holding have led to the freezing of real estate assets in Europe and Asia.

According to Chainalysis, crypto balances linked to criminal activities exceed $75 billion! With a 300% increase in funds held by illicit entities since 2020. These figures reveal the scale of crypto scams and the urgency of stricter regulation to protect investors and users.

Bitcoin, the preferred asset of scammers?

Unfortunately, bitcoin is the favored digital asset among fraudsters due to its anonymity and ease of transfer. As a result, scams like those orchestrated by Chen Zhi exploit these characteristics to:

- Conceal the origin of funds;

- Evade authorities.

Similar cases, such as the PlusToken or WoToken scams, show that BTC is often at the heart of “pig butchering” frauds.

Despite persistent challenges in international cooperation, regulators will need to strengthen their crypto tracking tools. For users, it is crucial to remain vigilant and prioritize regulated platforms. Moreover, companies in the sector must also strengthen their security protocols to limit fraud risks and protect their clients.

At a time when the U.S. Senate is preparing unprecedented crypto legislation this January, Chen Zhi’s arrest thus underscores the urgency to strengthen regulations around cryptocurrencies. As frauds multiply, how can authorities and sector players better collaborate to protect investors?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.