CMF Turns Red : Pi Network Near Historic Low

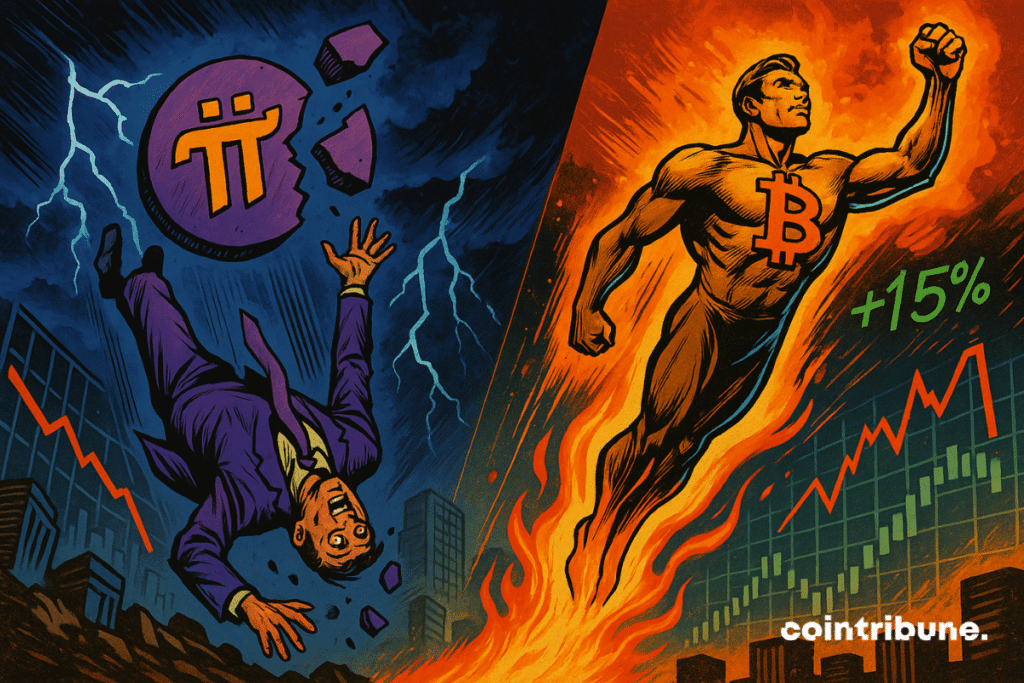

While bitcoin flirts with yearly highs, some cryptos are experiencing a clear downturn. Pi Network, once praised for its participatory and mobile-first model, sees its valuation wobble under the effect of degraded technical indicators and a marked climate of distrust. The project, long supported by its community, now faces a harsher market reality, where every structural weakness is immediately penalized. Between selling pressure and uncertainties about its future, the crypto is playing big as it approaches a critical threshold.

In Brief

- Pi Network is approaching its all-time low, with a price around $0.499, just 20 % above its floor level.

- Technical indicators turn red, notably the Chaikin Money Flow (CMF), which signals a sharp decline in inflows.

- The correlation between Pi Coin and Bitcoin drops sharply to 0.07, revealing a worrying disconnection during the market’s bullish phase.

- The absence of bullish momentum and clear catalysts jeopardizes any attempt at a sustainable rebound in the short term.

A Severely Degraded Technical Dynamic

After the heavy artillery for Pi2Day with two new features, Pi Network’s current situation is marked by unfavorable technical conditions as its price dangerously approaches its lowest levels. Indeed, the crypto is about to reach its all-time low, at $0.499, due to a loss of investor confidence and a negative Chaikin Money Flow (CMF).

The CMF, a key indicator in money flow analysis, “is approaching the zero line”, which indicates a shift toward outgoing flow dominance; in other words, capital is leaving the project. This illustrates a clear deterioration in market confidence.

Here are the major technical elements defining this bearish sequence :

- Current price of Pi Network : around $0.499, only 20 % above its historical floor of $0.400 ;

- Critical support level : located at $0.493, in case of a breakdown, the price could slip toward $0.450, or even retest its all-time low ;

- The CMF (Chaikin Money Flow) indicator : near zero, signaling increasing outflows, synonymous with investor withdrawal ;

- Resistance to watch : $0.518, only a recovery above this level would allow considering a bullish dynamic.

In the current environment, marked by a lack of catalysts and a very cautious general sentiment, these technical indicators struggle to offer an optimistic short-term outlook.

A Sharp Decorrelation from Bitcoin : Pi Network’s Isolation During the Bull Run

While bitcoin is reaching historically high price levels, Pi Network’s momentum is following a radically different path. The correlation between the two assets is now almost nonexistent.

Thus, the correlation between Pi Network and bitcoin has fallen to only 0.07, compared to significantly higher levels in the past. This statistical break is meaningful. Pi Network crypto no longer benefits from the market’s driving effect, a rare situation in a cycle where altcoins generally profit from bitcoin’s momentum.

This growing decorrelation reflects a structural disinterest from investors in the project. Whereas other altcoins benefit from the market’s bullish wave, Pi Network remains disconnected from the current cycle.

This loss of alignment exposes the asset to progressive isolation, making it less and less integrated into traditional crypto investment strategies. The lack of correlation means Pi Network does not benefit from bitcoin’s growth bitcoin.

In the medium term, this isolation could have profound consequences. The absence of bitcoin-related dynamics deprives Pi Network of visibility as well as new capital inflows. In a market dominated by leverage logics on major assets, a crypto that no longer reacts to bitcoin’s impulses becomes a speculative bet difficult to justify. To hope to reverse the trend through a possible turnaround, the project will need to regain market confidence, clarify its value proposition, and above all, restore a minimal correlation with sector dynamics.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.