Crypto Enters The Battlefield In EU-Russia Conflict

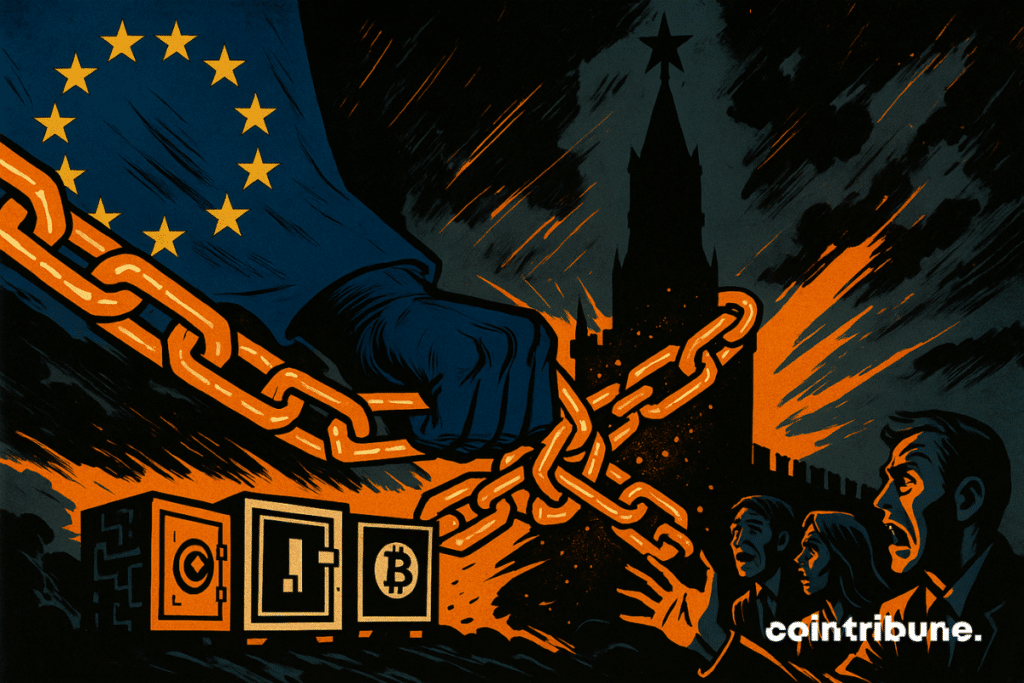

As the conflict in Ukraine drags on, the European Union opens a new front: that of cryptos. For the first time, Brussels plans to directly sanction crypto platforms, integrating these decentralized infrastructures into its economic measures against Moscow. A discreet but strategic shift, integrating cryptos into the realm of international pressure tools.

In brief

- The European Union prepares its 19th sanctions package and targets crypto platforms for the first time.

- Ursula von der Leyen announces a total ban on crypto transactions for Russian residents.

- Measures also target foreign banks linked to alternative payment systems and special economic zones.

- Moscow is accused of using Bitcoin and Tether to circumvent sanctions, with amounts reaching several tens of millions of dollars per month.

The EU Launches an Unprecedented Embargo on Cryptos

While many observers believe that a war is inevitable between Europe and Russia, the European Union formally includes crypto platforms in its economic sanctions framework, for the first time since the start of the Russo-Ukrainian conflict.

On September 19, the President of the European Commission, Ursula von der Leyen, presented the contours of the 19th sanctions package, stating : “for the first time, our restrictive measures will target crypto platforms and ban crypto transactions”.

The stated objective is clear: to close the doors to digital transactions that could be used to circumvent existing financial sanctions. This new wave also includes restrictions against foreign banks involved in Russian alternative payment systems, as well as the prohibition of transactions with entities operating in Russia’s special economic zones.

This framework marks a turning point in European strategy, now determined to close loopholes in the digital ecosystem. The sanctions package, still awaiting approval by the 27 member states, includes several structuring measures :

- The total blocking of crypto transactions for Russian residents, regardless of the platform used ;

- An explicit inclusion of crypto platforms within the scope of targeted entities by restrictive measures ;

- The prohibition of financial relationships with foreign banks supporting Russian alternative payment systems ;

- A restriction on economic operations with the special economic zones of the Russian Federation.

“As evasion tactics become more sophisticated, our sanctions will evolve to stay one step ahead,” justified von der Leyen, stressing the ongoing evolution of European sanctions.

The increase in Russian drone attacks against Ukraine, including violations of Polish and Romanian airspace, also contributed to the urgency of a tightening. For Brussels, the challenge is now to lock down the digital channels that Moscow could still exploit.

Crypto : an Escape Lever for Russia, a Resilience Tool for Ukraine

As the EU tightens the noose, several recent investigations have revealed the growing role of cryptos in Russia’s economic operations under sanctions.

Last March, some Russian oil companies were making bitcoin (BTC) and Tether (USDT) transactions amounting to several tens of millions of dollars each month to evade restrictions.

Indeed, in July, the US Department of Justice indicted Iurii Gugnin, aka George Goognin, a Russian national living in New York, for laundering over 540 million dollars through his companies Evita Investments and Evita Pay, serving as intermediaries for sanctioned Russian entities. Crypto-based sanction evasion is thus a tangible and documented reality, partially justifying the EU’s response.

Faced with this instrumentalization of cryptos by Russia, Ukraine adopts a radically different stance. Since February, Kiev has been working on establishing a national bitcoin reserve, with a draft law in its final phase, as confirmed in May by MP Yaroslav Zhelezniak.

This initiative aims to strengthen the country’s financial resilience, relying on an asset seen as protection against inflation and monetary crises. “We will soon submit a sector-driven bill allowing the creation of crypto reserves,” Zhelezniak announced at the Crypto 2025 conference in Kiev.

The entry of cryptos into the scope of European sanctions only highlights the rapid evolution of their geopolitical status. Far from being mere speculative assets, they are becoming instruments of economic warfare, potentially playing a central role in geostrategic conflicts. As technologies become ubiquitous, their regulation is emerging as a crucial challenge for states. While the EU attempts to plug the gaps, Ukraine is betting on bitcoin as a vector of sovereignty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.