Crypto ETFs Rebound as Bitcoin, Ether and Solana See Fresh Inflows After Volatile Week

Strong inflows returned to major crypto ETFs at the end of the week after several days of uncertainty across digital asset markets. Bitcoin, Ether, and Solana products all posted gains on Friday, hinting at early stabilization following sharp swings and heavy withdrawals earlier in the week. Sentiment remains cautious, but renewed allocations to key products suggest that some investors are selectively re-entering the market.

In brief

- Bitcoin ETFs add $238M Friday but still face a heavy $1.2B weekly outflow as Bitcoin dips to its lowest level since April.

- Ether ETFs return to positive territory with $55.7M in inflows, driven mainly by Fidelity’s strong demand for FETH.

- Solana funds lead altcoin ETFs with $510M in inflows and a ten-day streak, showing stronger resilience than other products.

- Traders cautiously rebuild Ether long positions as funding rates rise, while Bitcoin sentiment hits record pessimism levels.

ETF Investors Return Late Week as Bitcoin Drops to Lowest Price Since April

Bitcoin ETFs closed the week with firmer momentum, drawing $238.4 million in net inflows on Friday after steep losses a day earlier. Fidelity’s FBTC led with $108 million, followed by $22.8 million for Bitwise’s BITB, $39.6 million for ARK’s ARKB, and $35.8 million for Invesco’s BTCO. Grayscale’s GBTC—long pressured by consistent redemptions—also recorded $61.5 million in inflows.

BlackRock’s IBIT continued to face weakness, posting a $122 million outflow. Despite Friday’s recovery, the broader picture remained negative.

Bitcoin ETFs ended the five-day stretch with $1.2 billion in net outflows, one of their heaviest weekly totals since launch. Thursday accounted for more than $902 million in withdrawals as Bitcoin slipped to $81,000, its lowest level since April, prompting rapid unwinding of short-term bets. IBIT lost $355.5 million on the day, FBTC shed $190.4 million, and GBTC saw $199.4 million withdrawn.

Even so, cumulative figures remain substantial. Spot Bitcoin ETFs hold $110.11 billion in assets as of Nov. 21, supported by $57.64 billion in total net inflows and $11.02 billion in trading volume. Their combined holdings represent 6.53 % of Bitcoin’s market value.

Fidelity Lifts Ether ETFs Back Into Positive Territory After Heavy Redemptions

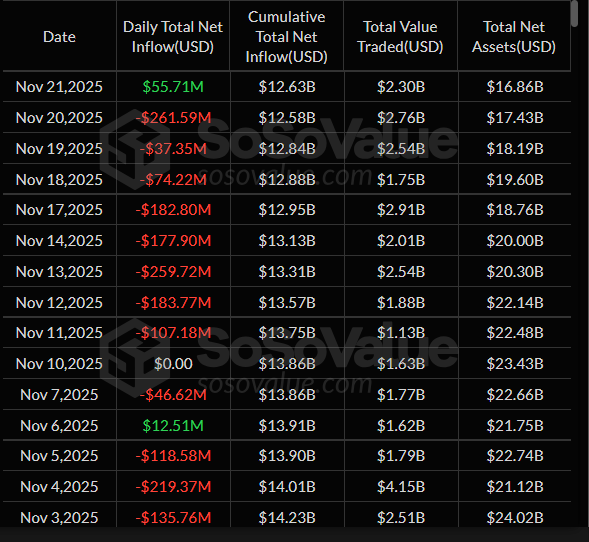

Ether ETFs snapped an eight-day losing streak on Friday, bringing in $55.7 million in net inflows. Fidelity again set the pace, with FETH attracting $95.4 million. Most other issuers saw stable or modestly positive activity, while Grayscale’s ETHE was unchanged.

Grayscale’s mini-ETH ETF added $7.77 million, and Bitwise’s ETHW gained $6.26 million. BlackRock’s ETHA was the main outlier, recording a $53.68 million outflow, though strong demand for FETH was enough to keep the broader category positive for the first time in more than a week.

Several points outline recent Ether ETF trends :

- Outflows from Nov. 11–20 removed $1.28 billion from Ether funds ;

- Friday’s rebound came almost entirely from Fidelity’s FETH ;

- ETHA recorded the largest withdrawal of the day ;

- Derivatives traders have begun reopening long positions ;

- Funding rates have edged higher, though conviction remains limited.

Longer-term Ether metrics remain steady. As of Nov. 21, cumulative inflows stand at $12.63 billion, with $2.30 billion in trading volume and $16.86 billion in assets. These positions represent 5.10% of Ethereum’s market value.

Solana Funds Lead Altcoin Market While Ether Traders Tentatively Reenter

Solana ETFs continued to outperform other altcoin products. Since launch, the five Solana funds have collected $510 million in net inflows. Bitwise’s BSOL accounts for $444 million of that total, drawing the largest share of investor attention. The Solana group has now logged ten consecutive days of inflows, extending its lead over other altcoin ETFs that have struggled to sustain demand.

Ether traders are cautiously stepping back in despite recent turbulence. Ether dropped 15% between Wednesday and Friday, wiping out roughly $460 million in leveraged long positions.

Even so, derivatives data show that top traders are gradually increasing their exposure. Funding rates rose from 4% to 6%, pointing to early attempts to steady the market after the pullback. Ether remains down 47% from its August all-time high, keeping many traders on guard for further swings.

Meanwhile, Bitcoin’s sentiment index from 10x Research is at a record low—levels often reached near tactical bottoms. While such readings do not imply an immediate recovery, analysts note they frequently precede short-term rebounds once selling pressure begins to fade.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.