Crypto Market Turns Cautious as Bitcoin Slips and Fear Index Hits Extreme Lows

A sharp shift in sentiment has taken hold across crypto assets after a week of sell-offs, weaker macro signals, and thinning liquidity. Markets now sit in a cautious posture, with fear climbing as large-cap tokens like Bitcoin retreat toward multi-month lows.

In brief

- Bitcoin drops to $96K as extreme fear grips markets, with major tokens slipping and sentiment turning sharply bearish.

- Analysts cite profit-taking, thin liquidity, and macro uncertainty as key drivers behind widespread crypto weakness.

- Fed rate cut odds near 50% and delayed economic data add uncertainty, reducing conviction among crypto traders.

- Some investors see the pullback as a healthy reset, with stable selling pressure suggesting controlled market digestion.

Crypto Market Weakens Across the Board With Bitcoin Sliding to $96K

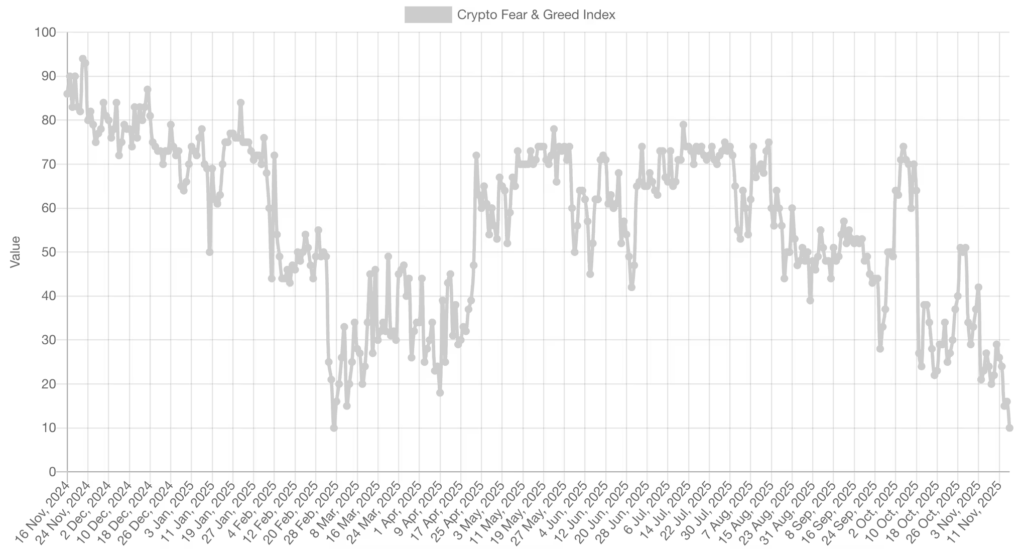

Crypto sentiment has deteriorated significantly, with the Fear & Greed Index falling to 10—a level considered “extreme fear” and the weakest reading since late February. Investors are reacting to continued losses across major tokens, most notably Bitcoin’s slide to just below $96,000. This marks the second time this month that Bitcoin has fallen under the $100,000 level.

Bitcoin slipped more than 5% over the past week and now trades at $96,436, a level last seen in early March. Traders note that Bitcoin has been outperformed by 65% of the top 100 crypto assets over the past year and is now trading below its 200-day simple moving average. Market sentiment around Bitcoin remains firmly bearish, consistent with the latest fear index reading.

Ethereum shows a similar pattern, trading at $3,236 after posting losses over the month, week, and day. Broader market weakness is also evident in the CoinDesk 20 Index, which declined by approximately 5.8% over the week.

Long-Term Holders Trim Positions as Market Awaits Clearer Macro Signals

Analysts attribute the current downturn to several overlapping pressures. Jake Kennis, Senior Research Analyst at Nansen, cited profit-taking by long-term holders, institutional outflows, macro uncertainty, and liquidations of leveraged positions.

The selloff is a confluence of profit-taking by LTHs, institutional outflows, macro uncertainty, and leveraged longs getting wiped out. What is clear is that the market has temporarily chosen a downward direction after a long period of consolidation/ranging.

Jake Kennis

Mid-week trading reflected a growing set of concerns:

- Profit-taking increased after Bitcoin’s latest failure to regain the $100,000 level.

- Institutional flows weakened amid ongoing uncertainty around interest rates.

- Liquidity stayed thin across major exchanges following October’s crash.

- Traders reacted to reduced odds of a near-term Federal Reserve rate cut.

- Delayed economic data from the White House added to market uncertainty.

Rate expectations have shifted, with CME’s FedWatch tool now placing the odds of a 25-basis-point cut at around 50%. At the same time, prediction markets such as Kalshi and Polymarket show similar probabilities. With several key economic indicators potentially delayed due to the recent government shutdown, traders have fewer macroeconomic signals to guide their positioning.

Liquidity issues remain a major factor, as order-book depth has not yet recovered from the October crash. Lower liquidity can magnify market swings, making it harder for buyers and sellers to transact without sharp price adjustments.

Not all sentiment is negative, however, as some traders view the recent pullback as a needed reset after months of sideways action. According to them, stabilizing volumes and steady selling pressure are signs that the market is absorbing declines rather than capitulating. Several technical levels continue to hold, and larger holders appear to be waiting for confirmation before entering new positions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.