Crypto Spot Trading Slumps as Bitcoin ETFs Surge with Record Institutional Inflows

Spot trading activity across crypto exchanges slowed in September, hitting its weakest level in months, even as institutional demand for Bitcoin surged through exchange-traded funds. The contrasting trends highlight a shift in market behavior, with speculative trading losing momentum while long-term investment flows gain strength.

In brief

- Global crypto spot trading dropped to $1.67T in September, marking a 9.7% decline from August’s $1.85T total.

- Binance led trading with $636.5B but saw declining volumes, reflecting a broader market slowdown.

- DEX volumes dipped slightly, though PancakeSwap bucked the trend with a surge to $79.8B in trades.

- U.S. Bitcoin ETFs saw $3.53B in September inflows, led by BlackRock’s IBIT with $1.8B in new investments.

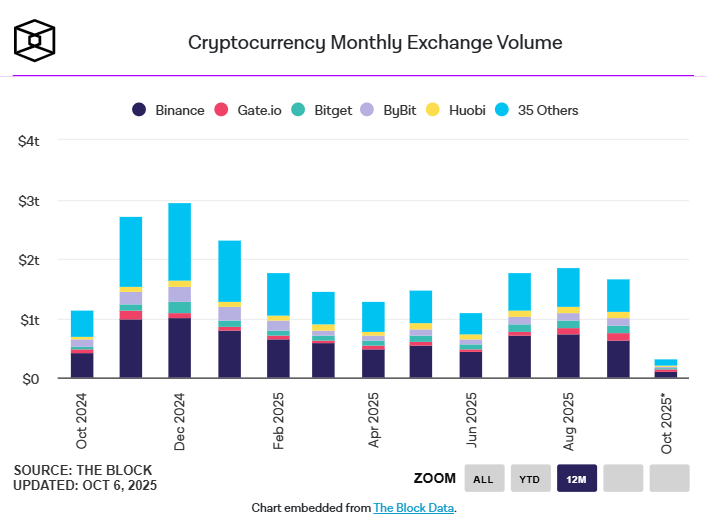

Crypto Exchange Trading Volumes Hit Three-Month Low

Global cryptocurrency exchanges experienced a slowdown in trading activity in September, with total spot volumes declining to $1.67 trillion. According to insights from The Block, this figure stands as the lowest level since June. In addition, it represents a 9.7% decline from August’s $1.85 trillion and signals a pause in momentum after two months of steady trading.

Binance remained the dominant exchange, handling $636.5 billion in trades during September, down from $737.1 billion in August. Bybit followed with $132.1 billion, while Gate.io and Bitget posted $124 billion and $117.9 billion, respectively. Despite Binance’s continued lead, its declining volume reflected a broader market cooldown affecting both centralized and decentralized platforms.

Trading on decentralized exchanges (DEXs) also dipped slightly. Total DEX volume reached $363.4 billion in September, a marginal drop from $368.8 billion the previous month. Uniswap, the largest decentralized platform, saw its volume fall sharply from $143 billion to $106.5 billion. PancakeSwap, however, bucked the trend, rising to $79.8 billion from $58.7 billion, marking one of the few platforms to see growth during the period.

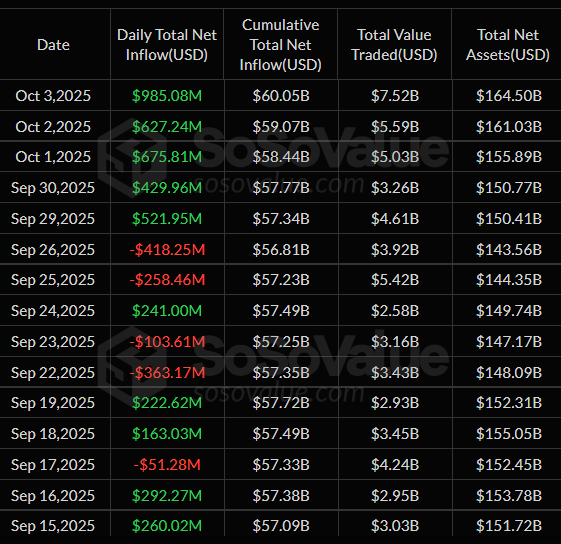

U.S. Bitcoin ETFs Attract $3.24B Amid Renewed Institutional Demand

While exchange trading volumes softened, U.S. spot Bitcoin exchange-traded funds (ETFs) showed renewed investor interest. After recording net outflows of $751.1 million in August, U.S. spot Bitcoin ETFs saw net inflows of $3.53 billion in September, according to SoSoValue data. The reversal signaled growing institutional confidence in the asset class.

Notably, this strong momentum carried into October. In just the past week, spot Bitcoin ETFs attracted $3.24 billion in new capital—the second-largest weekly inflow since their launch in January 2024.

The only week with higher inflows was the one ending November 22, 2024, at $3.38 billion. The strong demand reversed the prior week’s $902 million in outflows, bringing total four-week inflows close to $4 billion.

BlackRock’s iShares Bitcoin Trust (IBIT) led the surge, capturing $1.8 billion of last week’s inflows. IBIT now manages $96.2 billion in assets, maintaining its lead over competitors. Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $692 million in new investments, representing about 38% of IBIT’s total.

Trading activity was also concentrated in IBIT, which recorded several billion dollars in daily share transactions, compared with FBTC’s peak of $715 million. The influx of ETF investment came as Bitcoin touched a fresh all-time high of $125,000 on Sunday, surpassing its previous record of around $124,000.

The rally reinforced the Uptober narrative, with Bitcoin already up more than 10% for the month. Friday alone saw $985 million in ETF inflows, the second-highest daily total on record, underscoring growing market enthusiasm.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.