CZ Confident Bitcoin Will Hit $200K, Altcoin Season Will Come Eventually

Bitcoin is showing signs of renewed strength as its price steadies after an extended period of market weakness. As conditions stabilize, Binance co-founder and former chief executive Changpeng Zhao (CZ) has maintained a highly optimistic long-term outlook, confident that Bitcoin is on course to reach $200,000 and stressing that the only uncertainty is timing. He also noted that an altcoin season is likely to arrive over time.

In brief

- CZ is confident that Bitcoin will eventually reach $200,000 and stresses that the only question is when this will happen

- He also mentions that an altcoin season is likely to arrive eventually, though it’s hard to predict when or which tokens will benefit.

- He emphasizes that meme coins with genuine significance tend to survive, while the majority fade over time.

CZ Maintains Firm Conviction on Bitcoin’s Trajectory

CZ shared his outlook during a recent ask-me-anything (AMA) session hosted on Binance Square. During the discussion, he emphasized that his view reflects a long-term belief rather than a near-term market call. According to CZ, Bitcoin reaching $200,000 is not a matter of speculation but a conclusion he sees as unavoidable over time. He later reinforced this position on X, where he underlined that the broader direction of Bitcoin’s value remains obvious to him.

This perspective aligns with views expressed by other market analysts. Fundstrat Global Advisors managing partner and head of research Tom Lee has also outlined a scenario in which Bitcoin advances toward the $200,000 to $250,000 range. Speaking during a CNBC interview, Lee explained that such price levels would represent a clear break from Bitcoin’s traditional four-year market cycle, which would normally suggest weaker performance during the current phase.

Lee attributed this shift to structural changes taking place across the financial system, noting that :

- Rising institutional involvement is playing a central role in supporting Bitcoin’s recovery.

- This is complemented by ongoing development of blockchain-based products by major Wall Street firms, which further strengthens market infrastructure.

- Alongside these developments, increasing support from the U.S. government for the digital asset sector is reinforcing confidence and creating favorable conditions for the cryptocurrency.

Market Data Shows Diverging Investor Behavior

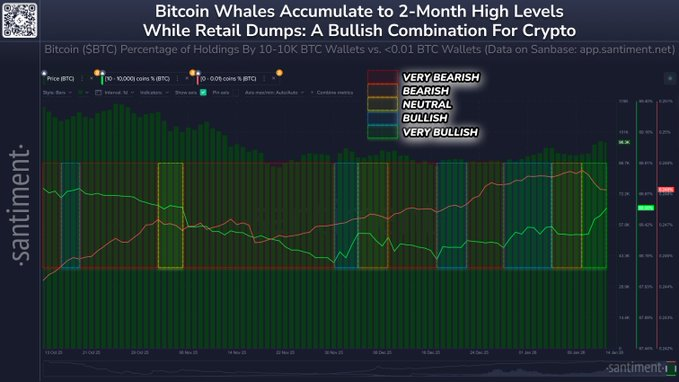

Alongside these broader views, Bitcoin has posted a short-term recovery, briefly climbing to $97,000 for the first time since mid-November before easing back toward $96,000. On-chain data suggests that this rebound is being shaped by a clear split between large and small holders. Analytics platform Santiment reported that since January 10, wallets holding between 10 and 10,000 Bitcoin have accumulated an additional 32,693 BTC, increasing their combined holdings by 0.24%.

At the same time, wallets holding less than 0.01 Bitcoin have moved in the opposite direction. Over the same period, these smaller holders reduced their exposure by 149 BTC, a 0.30% decline. This pattern indicates steady accumulation by larger investors while retail participation pulls back, a setup often associated with strengthening market conditions.

Bitcoin ETFs Activity and Altcoin Outlook

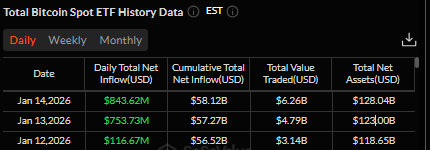

Investor interest is also evident in the ETF market. Bitcoin exchange-traded funds recorded total net inflows of $843.62 million in the latest session, marking the third consecutive day of positive flows following earlier outflows this year. The sustained activity points to renewed confidence among institutional participants.

While remaining bullish on Bitcoin, CZ offered a more measured view of the broader market. He noted that an altcoin season is likely to emerge over time but emphasized that its timing, duration, and which tokens will benefit remain uncertain.

Supporting this perspective, data from BlockchainCenter shows the altcoin season index at 37, indicating that the market has not yet entered an altcoin phase. The report also shows that the current streak without a season is 486 days, with 111 days since the last recorded altcoin season.

Extending this perspective, CZ also addressed meme coins, stating that only those with genuine historical or cultural foundations tend to endure, while more than 90% ultimately fade away.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.