CZ’s Gold Challenge To Schiff Stirs Crypto Community

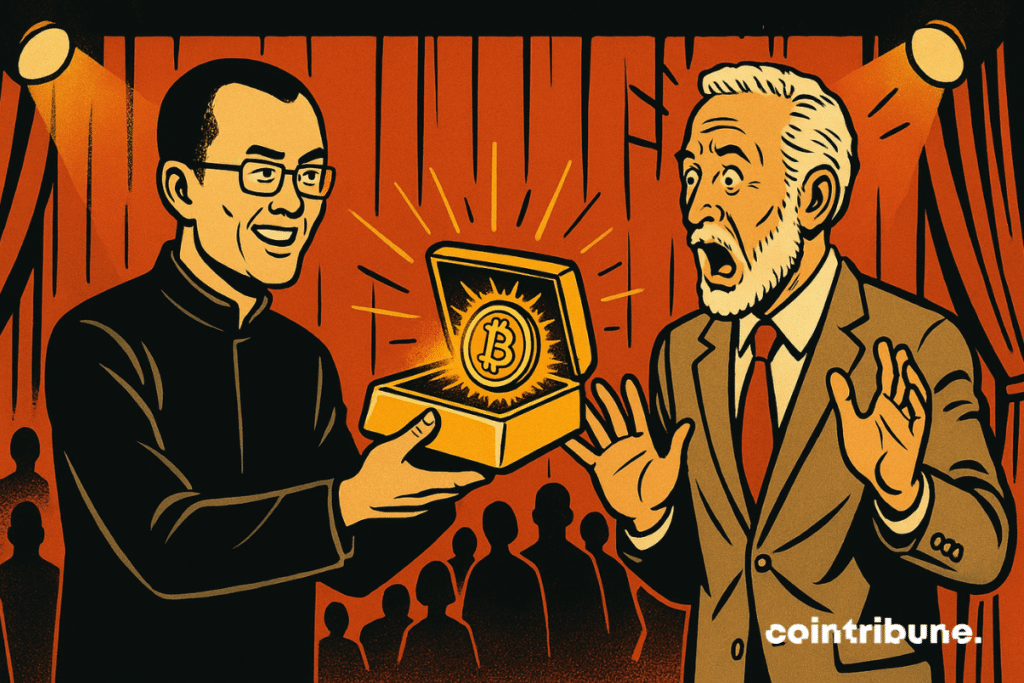

During Binance Blockchain Week, Peter Schiff was invited by Changpeng Zhao to authenticate a gold bar live. Unable to confirm its authenticity, the economist simply replied : “I don’t know.” A brief but revealing scene, which reignites the debate between physical gold and bitcoin, and raises questions about the verifiability of assets in a world increasingly oriented towards decentralization and blockchain transparency.

In brief

- During Binance Blockchain Week, Peter Schiff was challenged by CZ to authenticate a gold bar live.

- Unable to confirm its authenticity, Schiff responded ‘I don’t know’, causing surprise and laughter in the room.

- This moment revived the debate between defenders of physical gold and supporters of Bitcoin as a store of value.

- CZ took advantage of the exchange to emphasize Bitcoin’s immediate verifiability, unlike gold, even tokenized.

A public duel between gold and bitcoin on the Binance Blockchain Week stage

While bitcoin is losing ground to gold, on the Binance Blockchain Week stage, Peter Schiff, economist and staunch gold advocate, found himself in an awkward situation facing CZ, the co-founder of Binance.

The latter handed him a 1,000 gram gold bar marked as follows : “Kyrgyzstan, 1,000 grams, fine gold, 999.9”, with a serial number. Then came the simple but unsettling question : “Is it real gold?”, asked CZ. “I don’t know”, replied Peter Schiff.

This response caused laughter and applause from the audience, mostly composed of bitcoin supporters and Web3 actors. Schiff’s discomfort is all the more notable as he actively promotes the tokenization of gold, presenting it as a credible alternative to bitcoin in DeFi environments.

This demonstration reveals a series of concrete contrasts between the two assets, around the central theme of verifiable trust :

- Bitcoin is immediately verifiable through cryptographic means accessible to any user with a full node ;

- A gold bar requires specialized, often costly or destructive, tools to guarantee its authenticity ;

- Gold relies on a centralized trust system, including custodian, issuer, and auditor ;

- Bitcoin requires no trusted third party for control, auditing, or transferring.

This exchange crystallizes a fundamental debate : trust in assets. For CZ, this scene illustrates bitcoin’s superiority as a verifiable store of value by everyone, anytime. In October, CZ criticized tokenized gold, stating that the holder must trust the issuer, which led to Thursday’s confrontation with Peter Schiff.

On his side, Peter Schiff continues to defend the idea that tokenized gold could, in his view, combine the advantages of physical gold and blockchain. However, the scene seems to reveal a weakness difficult to ignore: the verification of gold, even in a digital context, remains dependent on the physical asset and the actors who certify it.

The impossible instant verification of physical gold: a structural problem

The moment of hesitation on stage was not due to a lapse or lack of expertise. It referred to a difficulty well known to industry professionals: verifying gold is a complex, costly process, and rarely instantaneous.

According to the standards of the London Bullion Market Association (LBMA), only “fire assaying”, a metal melting technique, provides 100 % certainty about the precious metal content. However, this method is considered destructive by the LBMA, as it involves melting the sample.

Other methods such as XRF spectroscopy, ultrasound tests, or eddy current tests are deemed incomplete or limited in accuracy, especially for thick objects. None of these tests, the LBMA notes, can currently be considered a fully reliable non-destructive verification solution.

This is where one of the major friction points between physical gold and bitcoin lies. While tokenization of gold promises a certain fluidity in digital use, it remains structurally dependent on the quality and integrity of the underlying asset.

A token representing gold is only valuable if the gold is real, properly stored, and the issuing third party is trustworthy. This implies a custody chain, frequent audits, and centralization that run counter to blockchain’s founding principles.

Bitcoin, on the other hand, relies on an intrinsically verifiable architecture, accessible to all via a full node or blockchain explorers. It depends on no third party, requires no physical audit, and guarantees immediate traceability through its cryptographic ledger.

The exchange between CZ and Schiff highlights ongoing tensions between traditional finance and innovations driven by DeFi. While gold retains its aura, its verification remains opaque compared to bitcoin’s algorithmic transparency. Such contrast illustrates new trust requirements in the digital economy.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.