David Namdar Calls BNB the “Most Overlooked Blue Chip” as It Hits New All-Time High

BNB’s latest rally has pushed the token to new highs, sparking strong reactions from market leaders and investors. With growing adoption across DeFi, gaming, and on-chain trading, analysts view the rise as more than just a price move—it signals deepening network strength and credibility.

In brief

- BNB surges past $1,300, marking a 128% yearly gain and outperforming 97% of top crypto assets.

- Analysts say BNB’s rise reflects deep ecosystem maturity, strong fundamentals, and network utility.

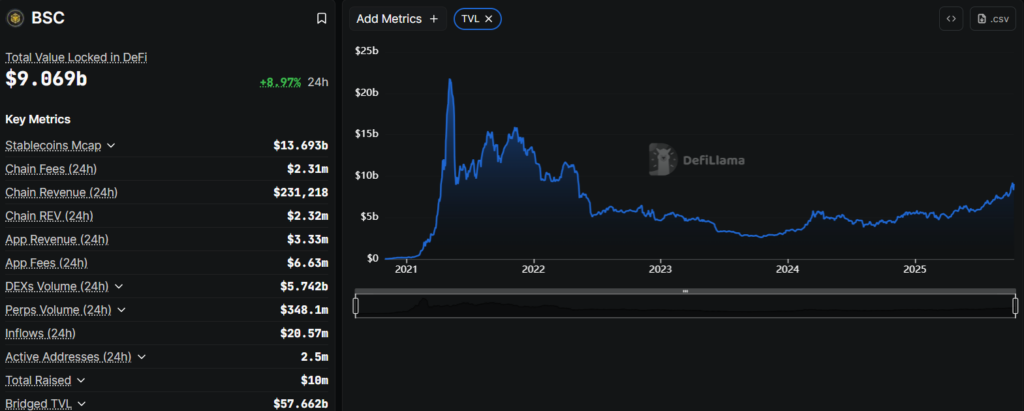

- BNB Smart Chain now holds $8.66B TVL, with over 20M daily transactions and 2.5M active users.

- Institutional interest grows as PayPay and CEA Industries boost corporate and regional adoption.

BNB’s Surge Marks a New Era of Maturity and Credibility for the Binance Ecosystem

BNB has reached a new all-time high above $1,300, drawing renewed attention from investors and industry figures. David Namdar, CEO of Nasdaq-listed CEA Industries, described BNB as “the most overlooked blue chip” in the market, noting that the rally reflects years of underrecognized fundamentals finally coming to light.

In a recent interview, Namdar stated that BNB’s surge is not a short-lived peak but rather evidence of the network’s growing credibility and maturity. He emphasized that the market is beginning to recognize the credibility, scale, and utility of the BNB ecosystem.

Namdar also highlighted the network’s rising transaction capacity, expanding user base, and steady growth across the DeFi and gaming sectors.

Price Rally Backed by Strong On-Chain Metrics and Record DeFi Usage

At the time of writing, BNB is trading at $1,308 after a 16% jump in the past 24 hours.

On-chain data also highlights the following:

- Bullish Market Sentiment: Investor outlook on BNB remains positive, supported by sustained price momentum.

- Strong Annual Growth: BNB has surged 128% over the past year.

- Top Performer: The token has outperformed 97% of the top 100 cryptocurrencies in the same period.

- Technical Strength: BNB continues to trade above its 200-day simple moving average, signaling long-term bullish support.

- Consistent Momentum: The asset recorded 20 green days in the last 30 days, maintaining a 67% positive trading streak.

Data from DeFiLlama show that the BNB Smart Chain (BSC) is the third-largest blockchain by total value locked (TVL), commanding $9.69 billion in assets. In the past 24 hours alone, the network recorded 2.52 million active users and processed over 20.7 million transactions.

Namdar said these figures validate what he calls the “scale-plus-utility” thesis, adding that usage and transaction fees continue to trend upward alongside new product launches and ecosystem expansion.

BNB Chain activity and fees have been trending up, with Messari and BNB Chain’s own updates showing heavy usage across BSC and opBNB alongside consistent product innovation and ecosystem delivery.

David Namdar

While broader market trends and renewed liquidity have supported digital assets this year, BNB’s latest surge appears largely driven by its own ecosystem strength.

Market data point to sustained growth in PancakeSwap volumes and rising daily activity on opBNB. Additionally, the expanding mix of decentralized applications reinforces the network’s underlying momentum beyond broader market factors.

PayPay Takes 40% Stake in Binance Japan, Strengthening Global Reach

The token has further benefited from Binance’s expanding global footprint. BNB now operates across multiple layers of the crypto economy, spanning infrastructure, wallets, payments, and Web3 applications. Its pursuit of new regulatory licenses and local partnerships across Europe, the Middle East, and Asia has strengthened investor confidence.

In one recent example, Japan’s PayPay—backed by SoftBank—acquired a 40% stake in Binance’s Japanese subsidiary. As of September 2025, Binance Japan became an equity-method affiliate of PayPay, underscoring growing institutional and regional interest in Binance’s operations.

Meanwhile, Changpeng Zhao’s venture capital firm, YZi Labs, unveiled a $1 billion fund to accelerate development and innovation within the BNB ecosystem.

Corporate Adoption and Retail Frenzy Fuel BNB’s On-Chain Boom

Nasdaq-listed CEA Industries also announced that it now manages the world’s largest corporate BNB treasury. According to its latest disclosures, the firm holds 480,000 BNB tokens, with total crypto and cash assets worth $663 million.

BNB’s momentum is also reflected in a new wave of on-chain activity dubbed “BNB Meme Season.” The network’s DeFi lead, Marwan Kawadri, noted that BNB is rapidly establishing itself as a central hub for on-chain trading, supported by record activity levels and rising decentralized exchange volumes.

Data from Bubblemaps show that over 100,000 traders joined the recent memecoin trend, with around 70% reporting profits. Some market participants earned millions, including one wallet that recorded gains exceeding $10 million.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.