DCA Crypto: Automate Your DCA with Bybit

Navigating the unstable world of cryptocurrencies requires method and composure. Among the strategies favored by long-term investors, Dollar-Cost Averaging (DCA) stands out as a major ally: investing a fixed amount at regular intervals to smooth prices and limit risks. But what happens when this already reassuring approach becomes fully automated? Bybit, one of the most dynamic crypto platforms right now, offers a DCA bot designed for those who want to invest smartly without constantly monitoring the market. Accessible, customizable, easy to configure, this tool changes the game. In this article, discover how Bybit’s DCA bot works, why it is an effective lever to invest stress-free, and how it can transform your long-term crypto investment approach.

Bybit’s DCA Bot: Presentation and Complete Guide

Automating an investment strategy has never been easier. The Bybit DCA bot is an intuitive and fully customizable tool that executes periodic crypto purchases without manual intervention. It is aimed at those who want to invest regularly while limiting risks related to market fluctuations.

The operation is based on a clear logic: you select a certain number of digital assets to acquire, define the amount to invest each cycle, and set the purchase frequency. Once started, the bot executes orders on behalf of the user according to set parameters. This allows for a robust DCA strategy without constantly monitoring the market.

The configuration interface is accessible directly from the Trading Bot tab on the platform. The user can:

- Select up to five cryptos simultaneously (BTC, ETH, SOL, etc.).

- Set the desired purchase frequency: daily, weekly, monthly, or custom.

- Choose the fixed amount to invest each cycle.

- Set a total investment cap to not exceed a budget.

The system automatically deducts funds from the Funding Account and transfers them to the Bot Account before each purchase. This process avoids forgetfulness and ensures orders are placed on time, even without the user present. Once purchases are executed, cryptos are stored in a dedicated wallet with full transparency on the bot’s performance.

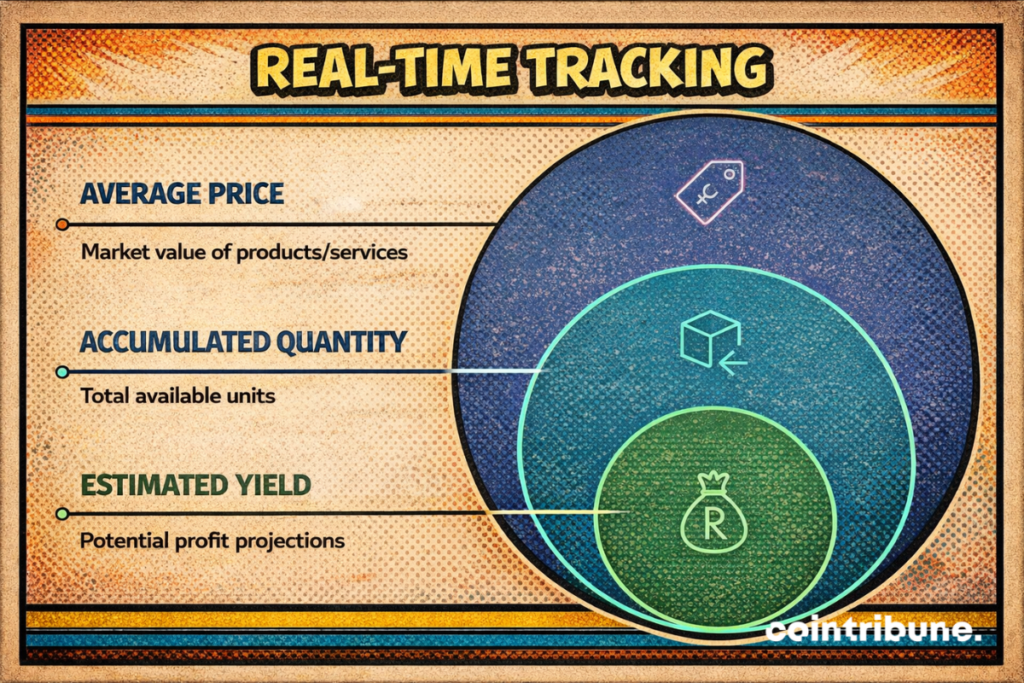

After launching the bot, you can access a dashboard that aggregates key data: average purchase price, quantity bought, estimated returns, number of purchases made. This information offers precise monitoring of the ongoing strategy.

This bot is particularly suited for long-term investors who want to accumulate cryptos progressively without succumbing to impulsive purchases. It offers a disciplined, structured method, less exposed to market stress.

Manual Buying vs Automated DCA: Factual Comparison

When considering investing in cryptos, two approaches arise: manually buying based on the market or programming an automated DCA strategy. These methods respond to different logics and do not offer the same advantages.

Manual buying allows for full reactivity. The user chooses the exact time to enter the market based on their analysis or specific signals. This method suits experienced traders who have time and skills to anticipate short-term movements. However, it requires availability, constant analysis ability, and exposes to emotional decisions.

Automated DCA, on the other hand, entirely removes the pressure related to timing the purchase. It distributes capital over multiple cycles, reducing the impact of poor timing. This approach relies on regularity and aims to optimize the average entry price, especially in a highly volatile context.

Let’s take a concrete example: a investor with 500 USDC wants to buy a cryptocurrency. They can:

- Invest the entire amount immediately (single purchase).

- Or invest 100 USDC weekly for five weeks via a DCA bot.

If the market drops during this period, gradual buying allows obtaining a larger quantity of cryptos for the same capital with a lower average price. Conversely, a single purchase would have locked in the transaction at a potentially high price.

Another advantage of automated DCA: it avoids missed orders. The investor does not need to log in weekly to place orders. They won’t miss opportunities or be influenced by news. The process is neutral, disciplined, and fully configurable.

Automation comes with a constraint: it relies on a fixed logic. The user must ensure the initial strategy remains suitable even if the market evolves.

Ultimately, automated DCA suits profiles who favor stability, simplicity, and long-term, while manual buying is for those who seek flexibility and short-term performance.

Technical Specificities of the Bot: What to Know Before Starting

Behind its ease of use, the Bybit DCA bot relies on a series of technical parameters designed to offer maximum flexibility while ensuring secure operation. Understanding these elements helps optimize the strategy and avoid common mistakes.

First, the bot operates exclusively on the spot market. This means no leverage is used and there is no liquidation risk, unlike derivatives products. This approach significantly lowers risk level, making it suitable for cautious profiles.

The bot’s operating account is separate from the main wallet. At each purchase cycle, funds are automatically taken from the Funding Account to the Bot Account. This separation offers better budget control and ensures only planned sums are used for scheduled purchases.

The base currency used for investment is USDC. Cryptocurrencies bought are then kept in the dedicated wallet unless the user opts for automatic conversion upon closing.

If needed, users can at any time:

- Modify the invested amount or purchase frequency,

- Temporarily pause the bot without losing configuration,

- Close the bot, with two options: keep the accumulated cryptos or sell them automatically into stablecoins. Details about potential fees are available in the detailed fees applied by Bybit.

If the total investment cap is reached or the available balance in the Funding Account becomes insufficient, the bot stops automatically. An email or push notification is sent to inform the user. These features make the bot not only automated but also reversible and adjustable. The user keeps control at all times without manual intervention at every step.

Who Can Benefit from Automated DCA? Profiles, Goals and Typical Strategies

The Bybit DCA bot is not aimed at a single type of investor. Its modular design meets diverse needs, from cautious beginners to seasoned investors seeking to automate part of their portfolio.

It is particularly relevant for users who:

- Invest for the long term, without timing the market.

- Cannot monitor real-time prices or act at fixed times.

- Want to regularly accumulate assets like BTC, ETH, SOL, or others.

- Have strict budget management with predefined investment caps.

- Want to diversify their market entries without stress or constant calculations.

For a passive accumulation investor, the bot is a solid alternative to manual management. It ensures investment discipline hard to maintain against emotions or market news.

It can also suit more active profiles who want, for instance:

- To complement an active trading strategy with a base of regular DCA.

- To apply a dynamic allocation approach, where some assets are increased progressively.

- To use DCA as a method of progressive position taking on an asset considered undervalued.

The bot suits both those starting with modest capital and those wishing to implement a monthly strategy with several thousand dollars. Its flexibility makes it a progressive support tool adapted to portfolio evolution and individual goals.

Integrate Bybit DCA into a Global Investment Strategy

DCA is not an isolated strategy. It becomes truly valuable when part of a broader portfolio allocation approach. Used wisely, Bybit’s DCA bot can become a pillar of a structured investment plan.

In a long-term logic, it is possible to use DCA to regularly reinforce fundamental portfolio positions like BTC or ETH while keeping a free portion for more opportunistic operations. This distribution combines stability and flexibility.

Some investors couple DCA with fundamental analysis. When a digital asset is deemed undervalued, DCA can be used to accumulate it gradually. This method avoids positioning too early or too late while remaining exposed to potential gains.

Others integrate DCA to a diversification logic. Using the bot to buy multiple cryptos at once allows balancing risk among different sectors: smart contracts, layer 1, scaling solutions, etc. Bybit allows selecting up to five assets simultaneously, supporting this approach.

DCA can also play a defensive role. In periods of high uncertainty, continuing to invest small sums via a bot maintains moderate exposure without compromising the entire capital. It strengthens investment regularity without excessive exposure. Finally, it is possible to combine DCA with other tools like crypto ETFs, savings products, or even life insurance strategies invested in digital assets. This complementarity smooths overall performance and better manages market cycles. The Bybit cashback card can also be part of a complete crypto strategy. In all cases, DCA does not replace analysis. It should be integrated into a coherent plan with clear objectives, risk management, and regular monitoring of selected assets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more