Diversify Your Crypto Portfolio with Kraken

Investing in digital assets now appeals to a much broader audience than just tech enthusiasts. Even cautious investors are turning their attention to this emerging asset class, seen as a serious alternative in the face of growing instability in traditional financial markets. Cryptocurrencies bring a new form of diversification built on innovation, decentralization, and growth potential. In this fast-evolving environment, Kraken stands out as a reliable bridge between traditional finance and the crypto world. This article explores why Kraken is a relevant tool to diversify your portfolio within a secure, educational, and structured framework.

In brief

- Cryptos are becoming a recognized diversification tool against the limits of classic strategies based on stocks and bonds.

- Kraken offers secure and regulated access to digital assets, thanks to a robust infrastructure and strict compliance with international standards.

- The platform facilitates crypto investing through an intuitive interface, simplified fiat purchases, and tools suited for all levels.

- Kraken enables building a long-term strategy through DCA and Auto-Earn, two solutions that automate investment and passive income.

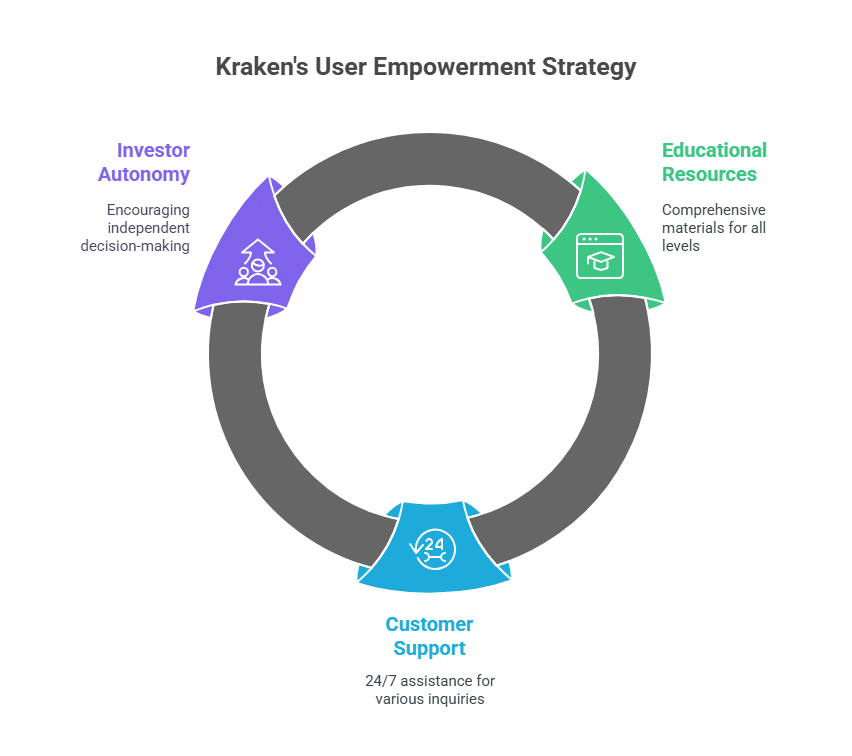

- Combining education, 24/7 customer support, and transparency, Kraken supports individuals and institutions in a controlled and responsible crypto adoption.

Why include cryptos in a diversification strategy?

Diversification is a fundamental principle of any investment strategy. Yet in a rapidly changing economic world, traditional tools are reaching their limits. Cryptocurrencies offer a credible alternative, provided they are supported by a secure and suitable framework.

The limits of classic diversification

For a long time, balanced portfolios relied on a mix of stocks, bonds, and cash. This model, seen as robust, helped reduce risk by leveraging market cycles. But recent years have challenged this approach.

Geopolitical tensions, persistent inflation, interest rate volatility, and macroeconomic uncertainty have raised questions about traditional indices like the S&P 500 or Nasdaq. Moreover, the strong correlation between certain asset classes has diminished the benefits of diversification.

Some investors view exclusive reliance on the euro, the dollar, or bond markets as exposure to structural risk. They can now explore new allocation levers, including innovative asset classes such as cryptocurrencies.

The benefits of digital assets in a portfolio

Cryptocurrencies, and digital assets more broadly, offer unique features that justify considering their inclusion in a diversification strategy.

First, their partially uncorrelated behavior with traditional financial markets allows for better distribution of overall portfolio risk. During certain stock market tensions, digital assets may follow their own dynamics.

Second, their global adoption is steadily growing. Countries, businesses, and institutions are beginning to recognize the strategic value of Bitcoin, Ethereum, and other major cryptos. Some investors believe this structural evolution strengthens their legitimacy as investment assets.

Finally, the potential for innovation remains considerable. The underlying blockchain technology is enabling new solutions: peer-to-peer payments, smart contracts, decentralized applications (dApps), and asset tokenization. This technical momentum adds to economic considerations, making crypto a potentially powerful diversification lever.

Kraken: A reliable, regulated platform to invest in crypto

Entering the crypto world requires choosing a trustworthy platform. Kraken stands out for its strength, experience, and security. It offers a reassuring environment, essential for investors coming from traditional finance.

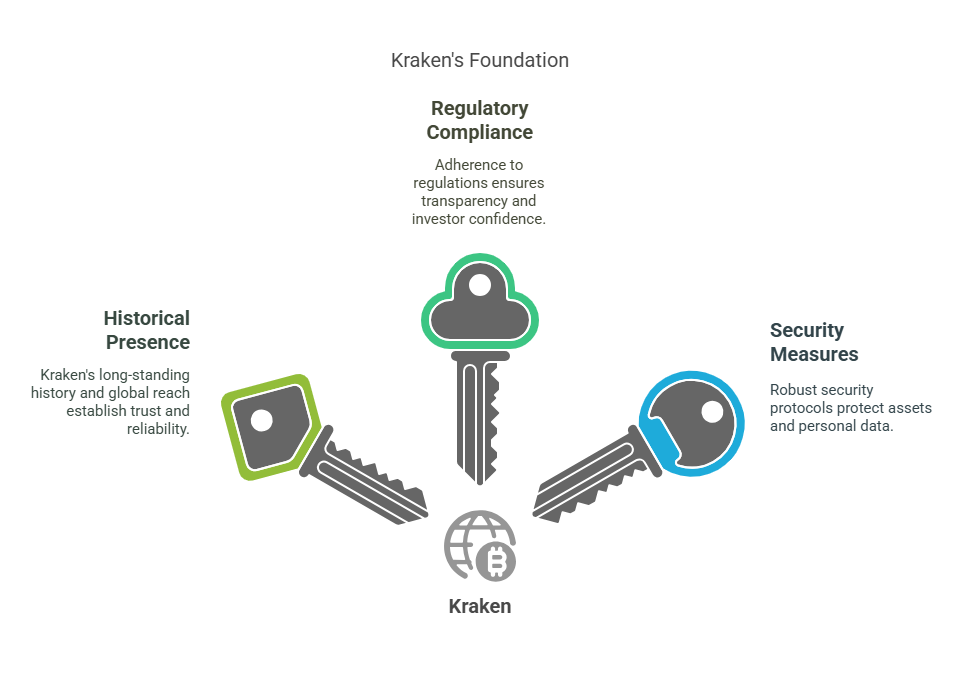

A historical company with global recognition

Founded in 2011, Kraken is one of the pioneers of the crypto sector. Today, it ranks among the world’s most respected platforms. Operating around the world, it serves a diverse audience: individuals, professionals, companies, and investment funds.

Its longevity reflects an ability to adapt to industry changes without compromising on security or compliance. Kraken has always placed great importance on adhering to local regulations. The exchange holds a license under the MiCA regulation, authorization under MiFID II, and is licensed as an Electronic Money Institution (EMI).

Security that meets investor expectations

Security is central for anyone looking to invest in digital assets. Kraken addresses this by building robust infrastructure on all levels:

- Cold wallets (offline) to store funds;

- Strict identity verification (KYC);

- Protection against phishing or unauthorized access;

- Ongoing system monitoring and regular penetration testing;

- Two-factor authentication (2FA) on all accounts.

These measures aim to protect both funds and personal data. They apply to both small retail investors and institutions, demonstrating Kraken’s ability to serve all profiles with the same reliability.

How to invest in crypto with Kraken?

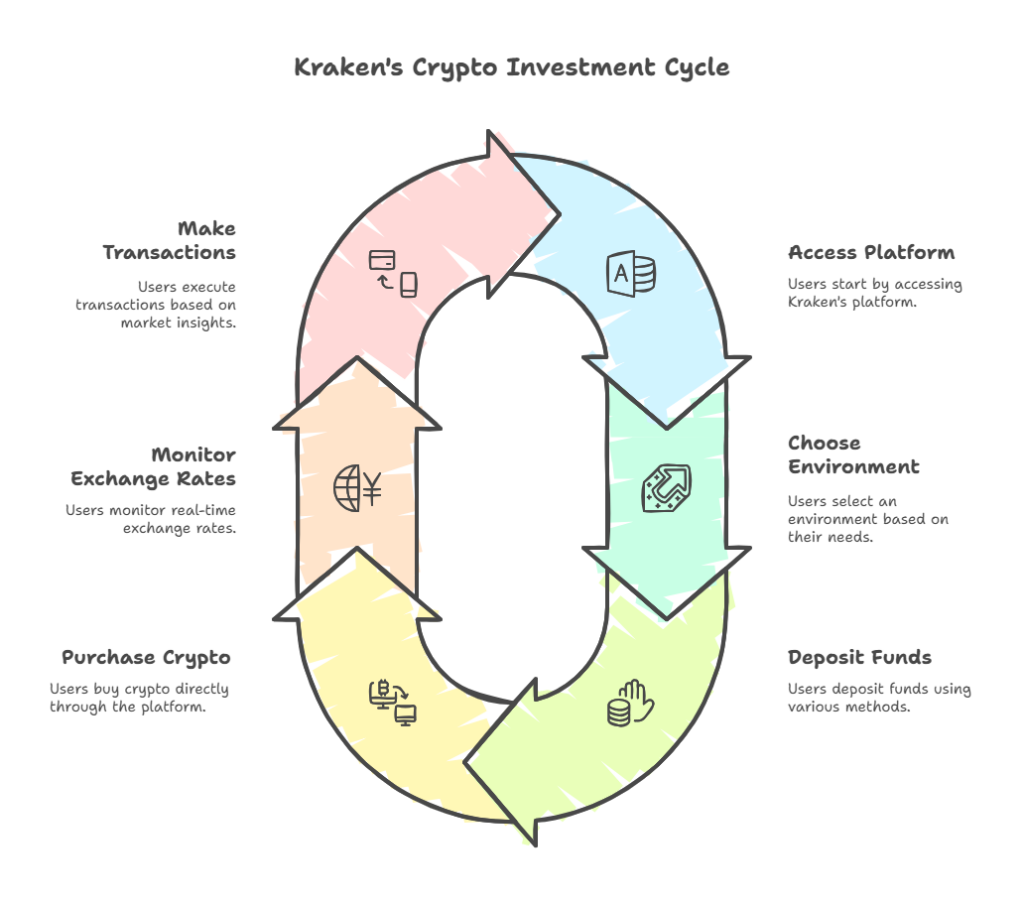

Kraken makes crypto investing accessible to all. With an intuitive platform, integrated educational tools, and multiple payment methods, it allows investors to enter the space gradually and without technical barriers.

A clear interface and accessible tools

Kraken offers multiple environments tailored to different needs. The main website is a smooth gateway for buying or selling crypto in just a few clicks. The mobile app lets users track markets, check portfolios, and place orders from their phones via a simplified interface.

For advanced users, Kraken Pro and Kraken Desktop provide technical analysis tools, deeper market data, and professional-grade features. This modularity allows each user to customize their experience based on skill level, without a rigid structure.

Easy purchases in Euros, Dollars, and more

A major strength of Kraken is the simplicity of depositing funds and buying crypto. Users can purchase Bitcoin, Ethereum, or other assets directly via bank card or Krak, without needing to go through stablecoins or third-party platforms.

The built-in converter also enables real-time exchange rate monitoring (BTC/USD, ETH/EUR, etc.) and instant transactions. This feature helps prevent common beginner errors while offering competitive conditions.

By removing complexity, Kraken opens crypto access to all investor profiles, including those used to traditional banking interfaces.

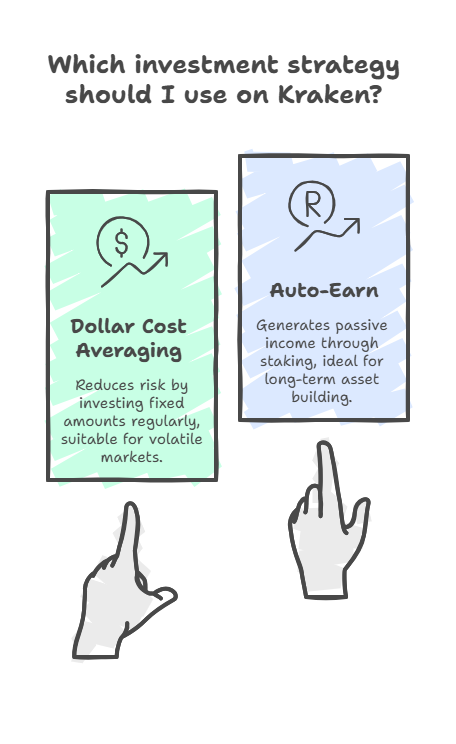

Building a consistent investment strategy with Kraken: Auto-Earn and DCA

Kraken offers simple, accessible solutions for regular crypto investment, shielding users from short-term volatility. Two key tools meet this need: DCA and Auto-Earn.

Dollar Cost Averaging (DCA): Smoothing risk over time

Dollar Cost Averaging is based on a simple principle: invest a fixed amount at regular intervals, regardless of market conditions. This reduces the risk of poor timing.

On Kraken, DCA is easy to set up. Users choose the amount, frequency, and crypto, then let the system execute purchases automatically.It avoids emotional buying during market highs or panic selling during dips. DCA helps build a crypto portfolio progressively without deploying a large lump sum at once.

This investment discipline reinforces strategy resilience and promotes a long-term mindset.

Kraken Auto-Earn: Generating rewards

Alongside DCA, Kraken Auto-Earn allows users to earn rewards on their crypto. This service automatically places selected assets into staking protocols, with full transparency on interest rates.

Its simplicity is a major advantage. Users activate the function from their dashboard, select the cryptos (Bitcoin, Ethereum, etc.), and view expected rewards. No external transfers are needed.

This strategy may suit a long-term asset-building approach. Kraken’s crypto staking program offers up to 17% returns and serves as a gateway to DeFi with no technical expertise required.

Solutions for businesses and institutional investors

Kraken isn’t just for individuals. It also offers tailored services for businesses, asset managers, and institutions wanting to integrate crypto into their global strategy.

Kraken Institutions: A complete offer for professionals

The Kraken Institutions program offers a wide range of professional services to meet the demands of large organizations. It includes three pillars: strategic support, secure infrastructure, and operational guidance.

Companies benefit from:

- Secure custody solutions;

- 24/7 support for deploying crypto strategies.

Kraken also provides tools for managing large portfolios, handling high trading volumes, and optimizing transaction costs. Investment funds, corporate treasuries, and family offices find a dedicated space here for their needs.

Integrating crypto into a broader investment plan

Many companies already incorporate crypto into financial operations, from bitcoin treasury holdings to B2B payments or token investments in blockchain projects. Kraken supports this transition to Web3. It facilitates decentralized tool adoption and builds bridges between traditional finance and the digital economy.

Use cases are growing, especially in Europe, where firms choose Kraken as a strategic partner to structure their crypto exposure.

Accounting for crypto investment taxation

Crypto investing must follow a clear legal framework. Kraken helps users manage tax obligations with suitable tools and easy access to information.

Tax Regimes in Europe

Capital gains from cryptocurrency transactions are taxable in many European countries and must be declared annually. Specific rules vary depending on the investor’s status, such as individual or professional.

Kraken recommends seeking independent tax advice and is able to provide simple access to relevant account records. .

Kraken’s transaction transparency

To help users remain compliant, Kraken provides a complete transaction history. Each trade, conversion, or withdrawal appears in an exportable table, streamlining work for accountants or tax filing tools.

The platform also includes features for easier tracking: filters by date, asset type, amount, or fiat equivalent. This transparency boosts user trust and ensures regulatory consistency without extra effort.

Education, support, and investor autonomy

Kraken emphasizes user autonomy. To that end, it offers a wealth of educational resources and top-tier customer support.

Kraken learn center: Educate before investing

The crypto world can be complex. Kraken addresses this with a comprehensive educational portal: Kraken Learn. It features articles, tutorials, videos, and guides on blockchain basics, tokens, DeFi, and investment strategies.

These materials are suitable for all levels. Beginners gain strong foundations, while advanced users can explore technical or legal topics in depth.

24/7 customer support: Quality assistance

Alongside its educational efforts, Kraken offers 24/7 customer support. Users can reach a multilingual team via live chat or support tickets. The service covers technical issues, security questions, and general support.

No user is left unanswered. This human and qualified support reflects Kraken’s commitment to guiding users through every stage of their investment journey, from first purchase to advanced portfolio management.

Kraken offers traditional investors a clear, reliable, and structured way to explore the crypto space. Thanks to its accessible tools, educational resources, and secure environment, the platform paves the way for thoughtful portfolio diversification. It enables exposure to digital assets without compromising the rigor required in responsible wealth management. Kraken supports both cautious savers and seasoned professionals, building a solid link between traditional finance and DeFi.

FAQ

No, access to purchase or staking features requires an initial deposit. However, registration is free and allows exploring the interface before committing.

Yes, every user automatically has a Kraken wallet. It allows storing, sending, and receiving cryptocurrencies securely, without external tools.

Yes, some jurisdictions are restricted due to local regulations. The list of accepted countries is available on Kraken’s official website.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more