Dollar Supremacy Threatened: The United States Bets Everything On Stablecoins To Counter Erosion

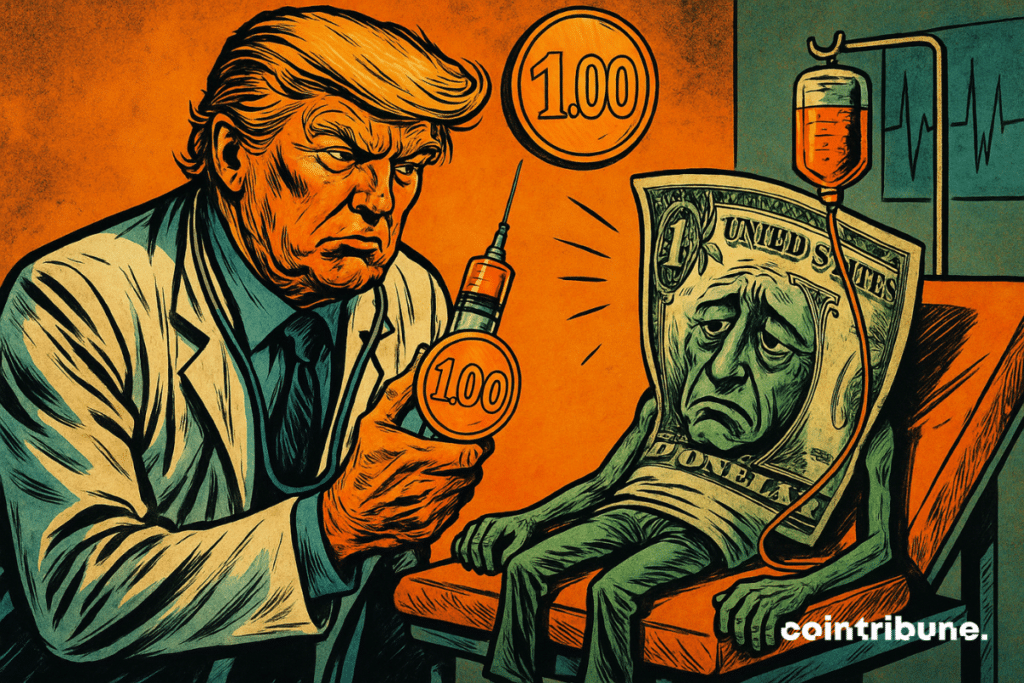

Can the global de-dollarization be stopped by bombarding the BRICS with tariff threats? Trump seems to believe so. With customs sanctions, he tries to discourage monetary alternatives. But this intimidation has its limits. Especially when the dollar slowly collapses, despite its flamboyant moves. Result: Washington activates an emergency plan. A digital plan. And its name sounds like a technological promise: stablecoins.

In brief

- The dollar falls despite high rates, marking its worst semester since the 1970s.

- Trump pushes the GENIUS Act to regulate dollar-pegged stablecoins.

- Stablecoins target emerging countries hit by inflation and lack of strong currencies.

- The BRICS prepare an alternative system, challenging the dollar via a multipolar monetary model.

Dollar weakening, ambitions on hold

Long the undisputed king, the dollar falters. Beyond having fallen to its lowest level in three years since January, it is experiencing one of its worst starts in fifty years. According to ABC News, the greenback could record its worst semester performance since 1973, with a drop of over 10%. Even high bond yields are no longer enough to reassure.

A viral tweet from the Global Markets Investor account puts it bluntly:

The dollar continues to fall despite high yields on Treasury bonds. There may no longer be enough demand for American assets. This calls into question its role as the world reserve currency.

The problem is deeper than a simple market correction. Since 2000, the dollar’s share of global reserves has dropped from 70% to 55%, according to Sygnum. The Fed is also losing its grandeur. Its successive U-turns, silences, and public criticisms – including those from Trump – weaken it.

The paradox is cruel: to defend its currency, America imposes sanctions, strengthens its tariffs… but weakens global confidence. More worryingly, even giants like Buffett openly talk about a dollar “going to hell” (a currency going to hell). And alternatives are gaining ground, slowly but surely.

Stablecoins: Washington plays its crypto card

In the face of the confidence drain, the United States brandishes a digital tool. The goal? Make the dollar desirable in the blockchain economy. The project has a name: GENIUS Act. This text, adopted by the Senate and supported by Trump, David Sacks, and Scott Bessent, aims to regulate and legitimize stablecoins backed by the dollar.

These stable cryptos are becoming a new monetary policy instrument. The idea: capture USD demand in emerging countries where inflation is eroding local economies. And it works. The Sygnum report emphasizes this:

Global demand for dollar stablecoins is a geopolitical opportunity to maintain US monetary dominance.

Fireblocks, Sygnum, and other institutional players are already setting up instant settlement networks using stablecoins. Meanwhile, Abu Dhabi Global Market is preparing a stablecoin pegged to the dirham, proof that the momentum is global.

But criticism is mounting. Italy, through its finance minister, warned in April that the US policy on cryptocurrencies, particularly regarding dollar-backed stablecoins, is even more dangerous. A striking argument but revealing of European unease.

For Trump, this digital bet is also electoral: to show that the United States can adapt and regulate the monetary future. But the BRICS want to surpass it, not follow it.

What if stablecoins accelerate the decline of the dollar?

The problem is that none of this solves the core issue. The dollar is losing its grandeur, and stablecoins might only be a bandage on a deeper wound.

The Sygnum report reminds us that:

If the decentralized economy expands, dollar dominance can be reinforced by stablecoins. However, their impact will remain limited without massive adoption in Southern countries.

The BRICS are not mistaken. Their strategy is not to replace the dollar but to establish a multipolar system. The yuan, euro, ruble, and even some local cryptocurrencies are gaining ground.

The facts, figures, and stakes:

- The dollar still represents 55% of global reserves but was at 70% in 2000;

- The GENIUS Act, passed in the Senate, aims to regulate all dollar-issued stablecoins;

- The BRICS are developing multi-currency systems to avoid dependence on the greenback;

- Fireblocks and Sygnum launch an instant settlement network using stablecoins;

- Italy warns of dependence on these stable cryptos: “a greater danger than tariffs“.

If the digital dollar becomes ubiquitous in the crypto universe, that will be a victory. But it will have to convince beyond the blockchain. Because in the long term, stable cryptos risk making visible the decline they seek to mask.

Even Elon Musk warns against a sudden dollar collapse if budget fundamentals are not restored. Robert Kiyosaki, Arthur Hayes, Donald Trump himself… all now mention a possible monetary cataclysm. It is no longer a BRICS fantasy. It is an American reality.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.