Ethereum Soars 50% In Just One Week!

Ethereum soars with a 50% increase in one week, reigniting enthusiasm in the crypto market. Technical indicators align, inflation slows, and a rate cut becomes plausible. Could this explosive context drive ETH to $4,000 as some predict? The current momentum looks promising.

In brief

- Ethereum climbs 50% in one week, supported by a favorable macroeconomic environment.

- Technical indicators and slowing inflation support forecasts of a possible rally toward $4,000.

- Despite the surge, Ethereum’s future remains uncertain, notably facing structural criticisms like those from Charles Hoskinson.

Pectra was not enough, but Ethereum accelerates

While Pectra failed to push ETH’s price up, Ethereum surprises with autonomous flight. The 50% rise in one week happens in a context of a marked return of risk appetite. The crypto benefits from a more favorable macroeconomic environment, particularly in the United States where expectations of rate cuts boost the entire market.

At $2,680, Ethereum exceeds short-term expectations, although this rebound appears uncorrelated with internal technical advances. The Pectra effect, though promising structurally, has not yet echoed in order books. The current enthusiasm seems more driven by global dynamics and a massive repositioning on digital assets after months of waiting.

A crypto performance surpassing the market

The current dynamic of Ethereum reflects clear outperformance compared to other major cryptos. In the last week alone:

- The price of ETH rose by more than 50%;

- Bitcoin gained only 12% in the same period;

- Solana and Dogecoin show single-digit growth;

- ETH transaction volume is significantly up;

- Technical indicators confirm a strong upward trend.

This movement is also fueled by U.S. inflation figures: a CPI increase of only 0.2% in April, renewing hope for a Fed rate cut. Moreover, it reflects a strategic repositioning by investors toward undervalued altcoins. The strength of the rebound, coupled with renewed institutional interest, heralds a new phase of accumulation. The crypto market regains its colors, but Ethereum asserts itself as the catalyst of this collective awakening.

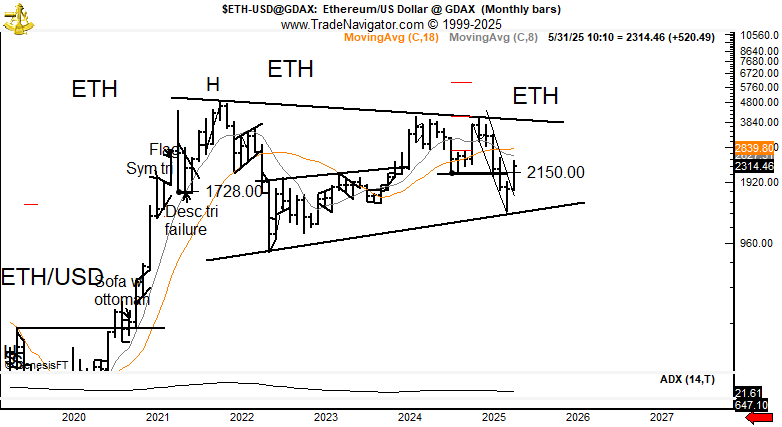

ETH: Is Peter Brandt’s prophecy underway?

Famous critic and trading veteran Peter Brandt is bullish on Ethereum. He predicts a rise towards $4,000, supported by a chart analysis identifying a major bullish pattern. According to him, a “moon shot” is underway, signaling a long-term move. This scenario receives unexpected support from Raoul Pal, former Goldman Sachs executive, who speaks of a fundamental cycle reversal for cryptos.

With a 50% gain in a few days, Ethereum seems to validate these expectations. Breaking key technical resistances could propel the crypto to this symbolic threshold. But caution: this rise comes with structural volatility. Prudence remains key, even if prospects open again to a clearer sky.

Ethereum’s current ascent rekindles hope, but one question remains: is this surge enough to avert the grim fate predicted by Charles Hoskinson? The Cardano founder predicts Ethereum’s demise within 15 years. The battle is far from won for the world’s second-largest crypto.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.