Ethereum loses 6.4 billion dollars in leverage

In 2025, Ethereum experiences a striking paradox: while the market undergoes a historic collapse of 6.4 billion dollars in speculative positions, crypto whales take advantage to accumulate record amounts of ETH. What does this dynamic hide?

In brief

- Ethereum suffers a massive loss of 6.4 billion dollars in leverage, causing its price to fall.

- Despite the current correction of Ethereum, whales are accumulating record amounts of ETH.

- Network upgrades and institutional adoption could prepare Ethereum for a new growth phase.

Ethereum: a loss of 6.4 billion dollars in leverage

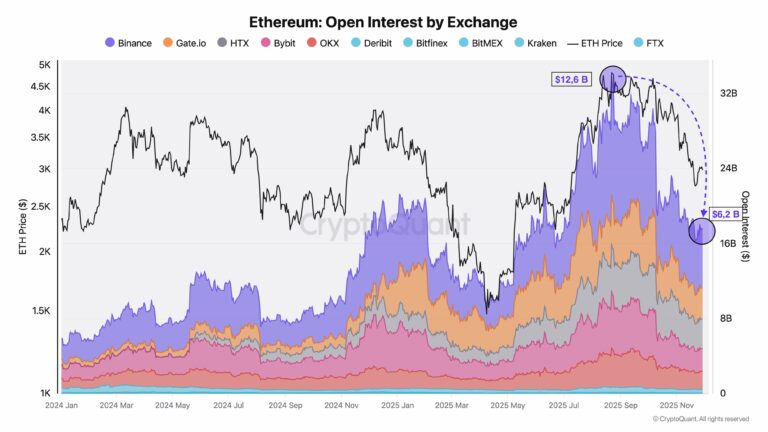

Since August 2025, the Ethereum ecosystem has been going through an unprecedented deleveraging phase. Open Interest, a key indicator of speculative activity, has collapsed by 51% on Binance, dropping from 12.6 to 6.2 billion dollars. Platforms like Gate.io and Bybit have followed the same trend, with massive liquidations of overleveraged positions. Result: the ETH price has fallen by 43%, sliding from 4830 to 2800 dollars in a few months.

Yet, in this context of widespread decline, an opposite phenomenon is emerging. Whales, those large crypto holders, are accumulating ETH at a frantic pace. In November alone, 394,682 ETH, worth 1.37 billion dollars, were purchased by these actors between 3247 and 3515 dollars. This paradox raises questions: why such accumulation when the market seems in crisis?

Why do ETH whales buy despite the drop?

Ethereum’s 6.4 billion dollar leverage drop is not a sign of weakness but a necessary market reset. Historically, crypto cycles show that market bottoms form only after a complete cleansing of excessive speculative positions. This deleveraging eliminates excesses, creating a more stable environment less vulnerable to sudden crashes.

Whales, often institutional actors or experienced investors, see this purge as an opportunity… A calculated strategy. Furthermore, upcoming updates like Fusaka promise to improve scalability and reduce fees, thus strengthening the network fundamentals. Moreover, the growing regulatory clarity, such as SEC confirmation that ETH is not a security, reassures investors.

Ethereum: a giant in transition, but still essential

This deleveraging situation and accumulation by the whales could maintain downward pressure on the ETH price in the short term, especially if the 2700 dollar support does not hold. For December 2025, analysts expect stabilization around 2800–3200 dollars, with rebound potential if network upgrades and institutional adoption materialize.

However, the outlook for 2026 is a bit more optimistic and will depend on several factors including:

- Holding the support at 2700–3000 dollars;

- The impact of network improvements;

- The evolution of institutional flows.

If these elements align, Ethereum could enter a new growth phase, potentially towards 4000–5000 dollars.

Does this 6.4 billion dollar leverage drop mark the end of a cycle or the beginning of a new era for Ethereum? Crypto whales, by massively accumulating, seem to bet on the latter. Just like bitcoin, this week is crucial to close out 2025.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.