Ethereum Outperforms As Bitcoin Struggles

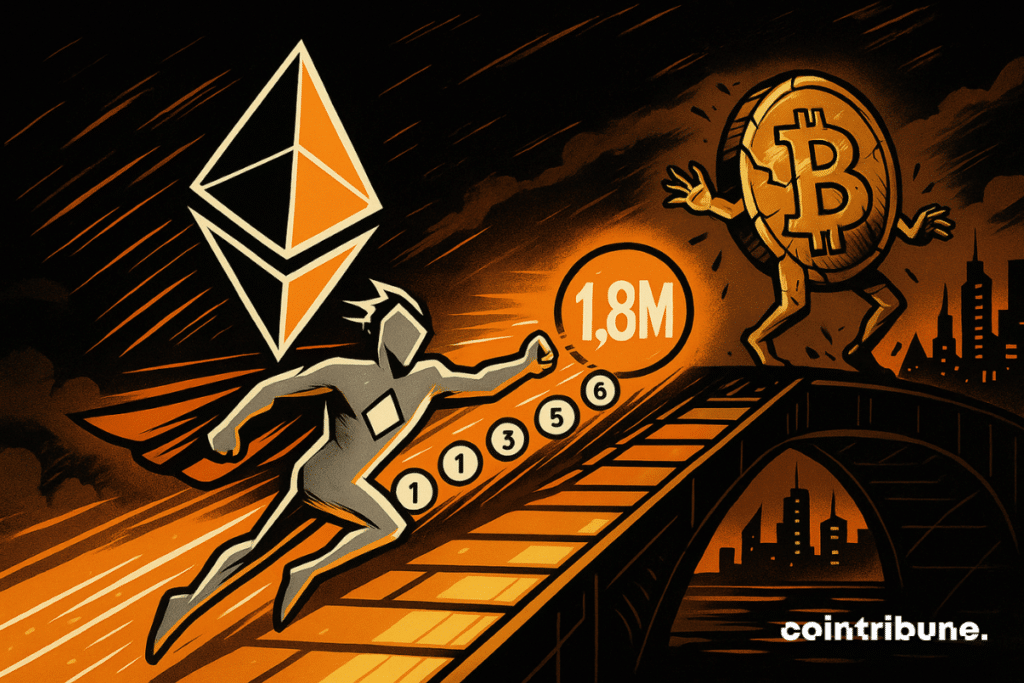

August was marked by two opposing signals in the crypto market. Ethereum reached an unprecedented peak of activity, confirming the growing interest of investors in its ecosystem. Conversely, Bitcoin suffered a brutal shock after the massive liquidation of 24,000 BTC by a single actor. This contrast is not just a technical divergence. It illustrates an ongoing rearrangement, between regulatory innovations, strategic repositioning of players, and the evolution of the balance of power between major assets.

In brief

- Ethereum breaks an annual record with 1.8 million transactions in a single day in August.

- Nearly 30 % of the ETH supply is now staked, a sign of investor confidence.

- A whale sells 24,000 BTC for $2.7 billion, triggering a market crash.

- Bitcoin dominance falls from 60 % to 57 %, giving Ethereum room to gain ground.

Ethereum : activity records and regulatory turning point

In August, the Ethereum network crossed a technical and symbolic threshold by recording more than 1.8 million transactions in a single day, setting a record for the past year.

This activity peak occurs in a context where the Ethereum ecosystem seems to be entering a phase of strategic consolidation. The growing volume of transactions is accompanied by a notable phenomenon: the share of staked Ether now reaches nearly 30 % of the total supply, illustrating investors’ current preference for passive income rather than short-term selling.

Here are the main points noted :

- 1.8 million transactions processed on August 5 : an unprecedented level this year for the Ethereum network ;

- Nearly 30 % of the Ether supply is locked in staking, a strong signal of confidence from long-term holders ;

- The US SEC issued a statement on liquid staking, clarifying its legal position on this mechanism;

- The announcement fuels speculation about a potential Ethereum ETF with staking, an option that could sustainably change the balance of institutional investments in crypto.

This sequence of converging signals (increase in on-chain activity, massive staking, and the start of regulatory clarity) indicates a progressive repositioning of Ethereum as an institutionalized crypto asset, potentially eligible for structured financial products.

Unlike a purely speculative dynamic, these movements reflect a long-term commitment from holders, who now bet on regulated stability and performance rather than short-term volatility. If this trend continues, Ethereum could position itself as the preferred technological and economic support in a market seeking maturity.

Bitcoin : a brutal liquidation that shakes the market

On August 24, Bitcoin suffered a sudden and significant shock, caused by the sale of 24,000 BTC by a whale, valued at an estimated $2.7 billion. This move triggered a flash correction in the market, leading to the liquidation of about $500 million in leveraged positions in just a few minutes.

Such an event contributed to a decline in Bitcoin’s dominance, which dropped from 60 % to 57 % over August. This is a notable setback in a market where the balance between major assets is closely watched.

This relative decline of Bitcoin is accompanied by renewed attention on Ethereum, reinforced by recent regulatory signals. The QCP firm considers that if an Ethereum ETF incorporating staking were to be approved, it could fuel the sentiment that “ETH will soon outperform the others”, in other words that Ether could outperform Bitcoin in the coming months.

Bitcoin liquidity remains vulnerable to isolated moves, which could discourage some institutional investors. Furthermore, the decline in dominance could signal a new phase of rebalancing between major assets, where performance will no longer be dictated solely by ecosystem size, but by its ability to generate yield, adapt to new regulations, and attract institutional flows. If Ethereum confirms its current trajectory, the crypto landscape could enter a new era of much more sophisticated arbitrage.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.