Ethereum Recovery Lacks Strength as Key Resistance Holds Firm

Ethereum is attempting to stabilize after heavy weekend selling, but confirmation of a durable bottom remains elusive. While price action has cooled following Sunday’s drop, the broader market structure still reflects a corrective phase rather than the beginning of a sustained uptrend. Meanwhile, momentum remains subdued, and derivatives positioning suggests the recent bounce was largely driven by short-term reactions rather than fresh accumulation.

In brief

- Ethereum rejected near $2,025 as momentum stays weak on lower timeframes.

- $44.5M in liquidations show long positions drove the initial selloff.

- Recent upside fueled mostly by short covering, not fresh long exposure.

- Key liquidity levels at $1,929 and $2,107 shape ETH’s next move.

ETH Rejected Near $2,025 While Long Liquidations Dominate Selloff

Recent technical updates indicate that bearish scenarios remain in play unless Ethereum produces a clear five-wave impulsive advance or reclaims the weekend high near $2,107. So far, the rebound from last week’s low lacks the expansion typically associated with sustainable reversals. Price action appears choppy and compressed, particularly on lower timeframes.

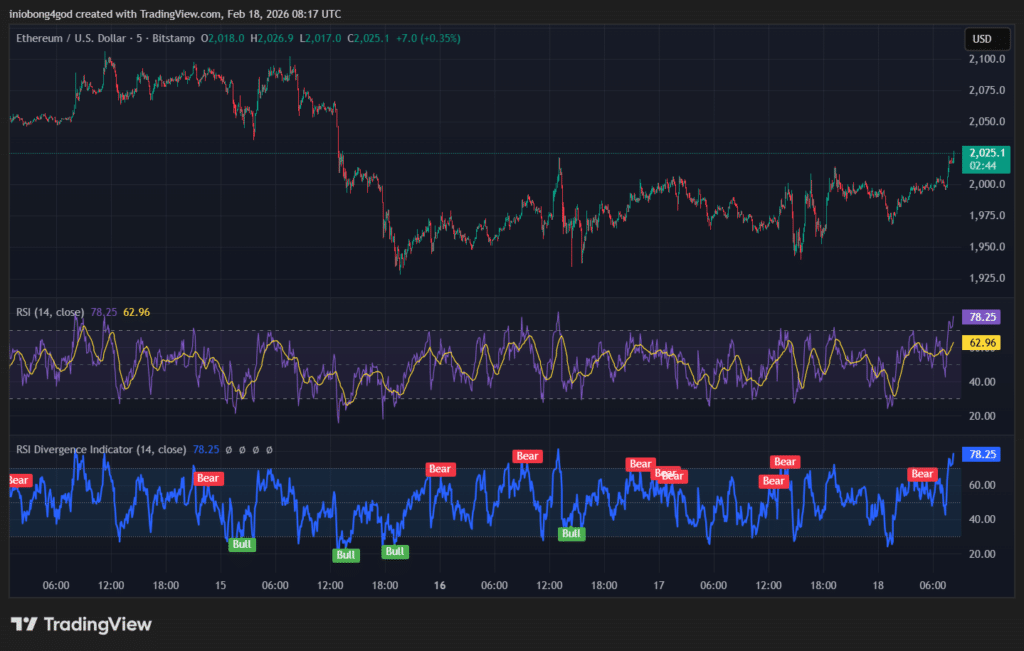

On the 5-minute chart, Ethereum has traded sideways following the selloff, repeatedly facing rejection around the $2,015–$2,025 area. Breakout attempts have failed to gain traction. Momentum indicators echo this hesitation. Relative Strength Index readings have fluctuated between 42 and 57, unable to break above the 60–65 zone that often signals trend strength.

Short-term bearish divergences have emerged near local highs, while bullish divergences near lows have not translated into sustained upside movement. Range-bound behavior continues to dominate.

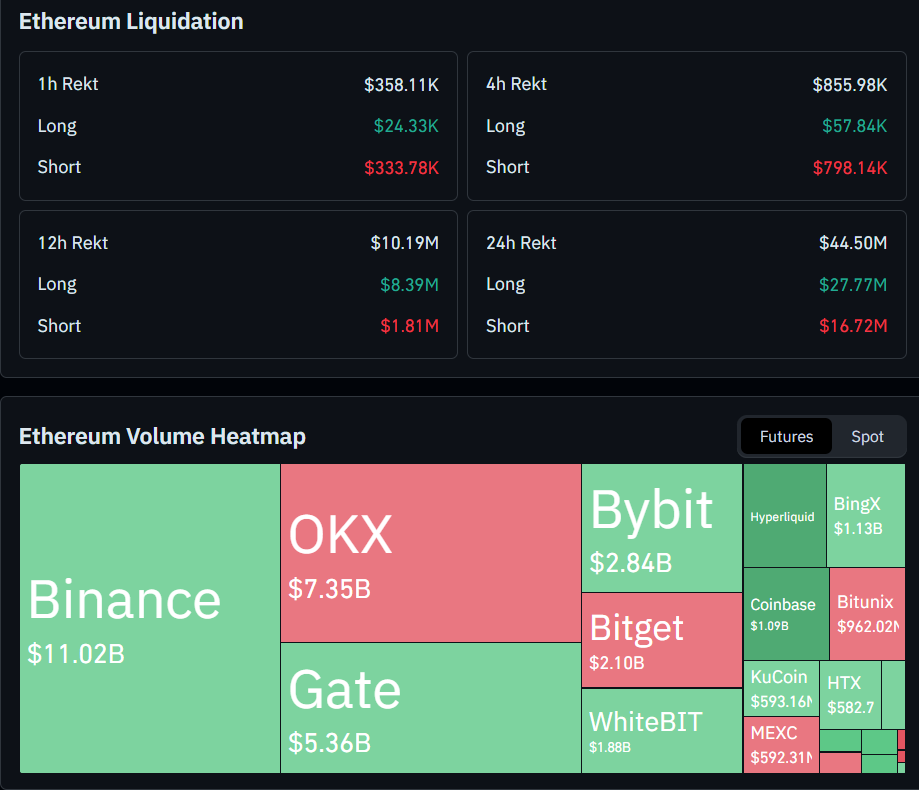

Derivatives data paint a similar picture of fragility. Over the past 24 hours, total Ethereum liquidations reached $44.5 million. Long positions accounted for $27.77 million of that figure, while short liquidations totaled $16.72 million. The 12-hour data show a similar imbalance, suggesting that the initial move lower was driven by forced long exits.

ETH Liquidation Imbalance Points to Temporary Upside Pressure

Short-term data, however, reveal a shift. Within the last hour, roughly 93% of liquidations were short positions, amounting to about $333,000 compared to just $24,000 in long liquidations. The 4-hour window shows $798,000 in short liquidations versus $57,000 in longs. Such activity indicates that the recent upside was fueled largely by short covering rather than aggressive new long exposure.

Key derivatives signals currently shaping Ethereum’s structure include:

- Long liquidations dominated the broader 24-hour window, confirming heavy selling pressure during the initial drop.

- Short liquidations increased sharply on shorter timeframes, pointing to a reactive squeeze higher.

- Open interest has not expanded meaningfully, suggesting limited fresh capital entering the market.

- Funding conditions remain sensitive, reinforcing the role of leverage in recent moves.

Futures markets remain the primary driver of activity. Binance leads futures volume with approximately $11.02 billion in activity, followed by OKX at $7.35 billion and Gate at $5.36 billion. Such concentration in derivatives trading implies that leverage continues to dictate short-term price swings.

When futures dominate flows, markets often react quickly to liquidity pockets, resulting in fast intraday reversals rather than stable directional trends.

Liquidity Magnets at $1,929 and $2,107 Define Ethereum’s Next Move

Liquidity reference points formed over the weekend now frame the short-term outlook. Ethereum printed relatively weak extremes near $1,929 on the downside and $2,107 on the upside. Both levels are likely to attract price in the days ahead. A sweep of the $1,946–$1,929 zone could clear resting liquidity and potentially set the stage for a stronger reversal attempt toward the weekend high.

Conversely, continued strength without first revisiting those lower levels may open room for short setups, particularly if price stalls near $2,107. H1 liquidity around $2,015 also plays a critical role. Sustained acceptance above that area may allow continuation higher, while rejection could renew downside pressure.

For now, Ethereum trades in a technically sensitive zone following a liquidation flush. Weak hands have exited, and short-term shorts have been squeezed, yet structural confirmation remains absent. Until price action shifts from reactive to impulsive, recovery attempts remain vulnerable to renewed selling pressure.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.