Ethereum Regains Top Spot in USDT as Tron’s Dominance Slips

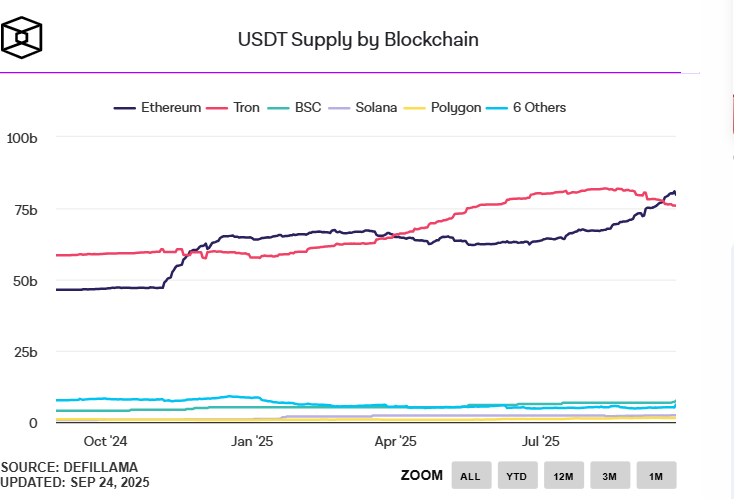

After losing its top position to Tron in March, Ethereum has surged back to reclaim its place as the leading network for USDT, with its supply reaching $80 billion. Although both networks maintained high supply levels of roughly $75–$80 billion for most of the year, this reversal signals a key shift in infrastructure preferences.

In brief

- Ethereum’s USDT supply hits $80B, surpassing Tron after months of close competition in the stablecoin market.

- Daily transactions on Ethereum are near 1M, showing strong use of USDT for payments and settlements.

- Institutions favor Ethereum’s DeFi and infrastructure over Tron’s lower fees, boosting its dominance.

- Other chains like BSC, Solana, Polygon, and Arbitrum hold under $10B USDT each, far behind Ethereum and Tron.

Ethereum Reclaims Lead in USDT Transactions

Data from The Block shows Ethereum processing nearly 1 million transactions per day, suggesting that participants are not just holding USDT, but actively using it for payments and settlements.

Earlier in the year, Tron held a clear lead in USDT dominance as Ethereum’s usage declined. Since late April, however, Ethereum has experienced a steady resurgence, eventually overtaking Tron in August.

Despite their close competition, the ongoing shift highlights how even small advantages in dominance can influence capital flows.

With each holding less than $10 billion, other chains—including BNB Chain (BSC), Solana, Polygon, and Arbitrum—account for smaller portions of the total supply. Although these networks are seeing healthy growth, their combined share remains a fraction of the total compared to Ethereum and Tron.

Institutions and DeFi Fuel Stablecoin Shift from Tron

Ethereum’s resurgence suggests that users are prioritizing its established DeFi ecosystem and institutional-grade infrastructure over Tron’s lower transaction costs. Experts believe that this flip is also driven by renewed activity in DeFi protocols, as well as institutional adoption through ETFs and corporate treasuries.

This shift comes as mainstream financial institutions increasingly tap into stablecoin payment infrastructure. Firms such as PayPal (with PYUSD) and other major players are integrating stablecoins into their frameworks. Many of these companies are leaning towards Ethereum’s more established institutional presence.

With total USDT supply exceeding $100 billion across chains, the contest between Ethereum and Tron remains central to stablecoin market dynamics. Industry watchers are monitoring whether Ethereum can consolidate its lead or if Tron will reclaim the top spot in the months ahead.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.