Ethereum Sees Unprecedented Stablecoin Growth, Crossing 1M Weekly Users

Stablecoins continue to dominate blockchain activity, with Ethereum remaining at the center of this growth. Recent data show that stablecoin transactions on Ethereum are hitting record highs, highlighting the rising adoption and the network’s expanding role as a global settlement layer. Despite short-term price volatility, network fundamentals remain strong.

In brief

- Stablecoin transactions on Ethereum reach record highs, with over 1 million weekly unique senders for the first time.

- Ethereum’s stablecoin growth reflects rising global adoption, especially in regions facing currency instability.

- On-chain markets like RWAs, perpetuals, and predictions now rely heavily on stablecoins for settlement activity.

- Despite ETH’s price swings, strong fundamentals and growing stablecoin use reinforce Ethereum’s market dominance.

Stablecoins Drive Ethereum’s Expansion as On-Chain Markets Multiply

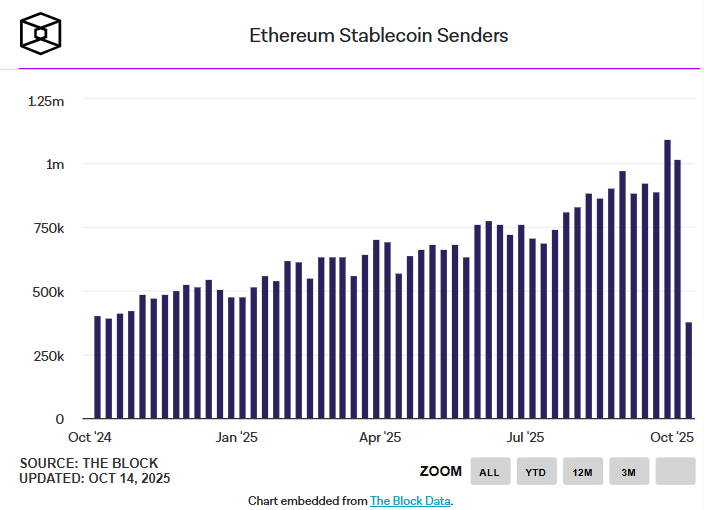

Stablecoin activity on Ethereum has reached unprecedented levels, with the number of unique weekly senders climbing sharply over the past year. From January 2020 to July 2024, the network averaged around 400,000 weekly senders. However, since August 2024, that figure has grown steadily, up more than 1.7% per week on average.

In 2025, the average number of weekly unique senders is about 720,000, surpassing 1 million for the first time in the past two weeks.

This surge reflects the accelerating adoption of stablecoins worldwide. In regions struggling with currency instability or capital restrictions, stablecoins have become a practical substitute for the U.S. dollar. Beyond personal use, they now underpin a wide range of on-chain markets.

Perpetual contracts, prediction markets, and tokenized real-world assets (RWAs) commonly settle in stablecoins, creating continuous transaction flows. Each new decentralized application that integrates stablecoin functionality brings more active addresses to Ethereum.

As the primary Layer 1 settlement platform, Ethereum benefits directly from this momentum. It handles onboarding, rebalancing, and payout activities—all translating into higher transaction volumes and a growing base of active participants.

ETH Recovers From $3,500 Slump as On-Chain Data Shows Ongoing Strength

Ethereum has experienced price swings in the past weeks. On October 11, 2025, ETH plunged from $4,100 to $3,500 within hours amid geopolitical tensions and over $1 billion in liquidations. During the session, the market saw several movements as large holders accumulated, while smaller investors exited.

The latest on-chain data shows that:

- Ethereum has rebounded and is currently trading around $4,000.

- The Fear and Greed Index stands at 38 (Fear), reflecting continued caution among traders.

- ETH has recorded only 13 green days in the past 30 days, signaling limited short-term momentum despite its broader recovery.

Despite short-term uncertainty, Ethereum remains technically strong, showing a 58% year-over-year increase. Technical charts indicate it is currently trading above its 200-day moving average. As stablecoins become essential to global payments and settlement, Ethereum’s position as their primary settlement layer appears stronger than ever.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.