Ethereum staking heats up: Bitmine adds +259 million $, the queue nears one million

The giant Bitmine has just deposited 259 million dollars in ETH into the Ethereum network, causing an unprecedented congestion of the validators queue. With nearly one million ETH waiting, this announcement reveals a strong trend: the institutional adoption of crypto staking.

In brief

- Bitmine adds +82,560 ETH (259 million $), and the Ethereum validators queue now nears one million.

- 29% of the total ETH supply is locked in staking, reflecting growing institutional adoption.

- This historic congestion raises questions about Ethereum’s scalability and its future in 2026, between yield opportunities and centralization risks.

Crypto: Bitmine boosts Ethereum staking with 259 million dollars in ETH

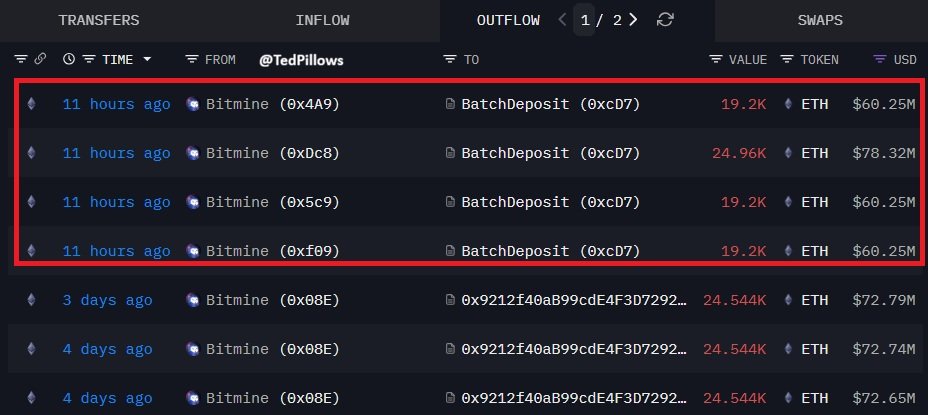

After an initial deposit of 219 million dollars in Ethereum staking in December, Bitmine repeats the operation by staking this time 82,560 ETH, equivalent to 259 million dollars! This operation instantly increased the validator queue, which now reaches 977,000 ETH, with an estimated activation delay of 17 days. A record that illustrates the growing enthusiasm for staking, now seen as a stable income source against crypto market volatility.

This move fits into a long-term strategy, where Bitmine shifts from a speculative logic to seeking passive yields. The data confirms this dynamic from an institutional perspective. Indeed, 35.5 million ETH, or 29% of the total supply, is now locked in staking. A symbolic threshold that strengthens Ethereum’s credibility as an institutional investment asset. This also raises questions about the crypto network’s liquidity in the long term.

Ethereum: what data say about staking demand

The saturation of the Ethereum validators queue following the 259 million dollars staking deposit by Bitmine is no coincidence. Historically, staking activity spikes have often preceded price increases. In June 2025, a similar phenomenon was followed by a doubling of the ETH price. Analysts therefore see this as a bullish signal for 2026, especially since institutional demand remains strong.

Bitmine is not alone: other players like Coinbase or Kraken are strengthening their positions, accelerating the transition to an ecosystem dominated by large players. This concentration raises questions about staking accessibility for small investors, as technical and financial barriers rise.

Ethereum in 2026: towards massive adoption and a new era for staking?

Ethereum is entering a critical phase. Indeed, the crypto network must prove it can handle the influx of staking requests while maintaining scalability, notably through upgrades planned in 2026. The challenges are numerous:

- Reduce waiting times;

- Optimize rewards;

- Ensure security against the growing centralization of validators.

For investors, this dynamic offers opportunities but also risks. The increased scarcity of circulating ETH could support prices. But, too much concentration in the hands of actors like Bitmine could also weaken the ecosystem. For Tom Lee, this trend could boost ETH to 250,000 dollars! A bold prediction, but one based on a growing correlation between staking, circulating supply scarcity, and Ethereum’s valuation.

Bitmine’s announcement confirms Ethereum’s shift towards an institutional era, where staking becomes a strategic lever. The question remains whether the crypto network can balance growth and decentralization. And you, would you be willing to stake your ETH in this context? The debate on balancing yield and risks is more open than ever.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.