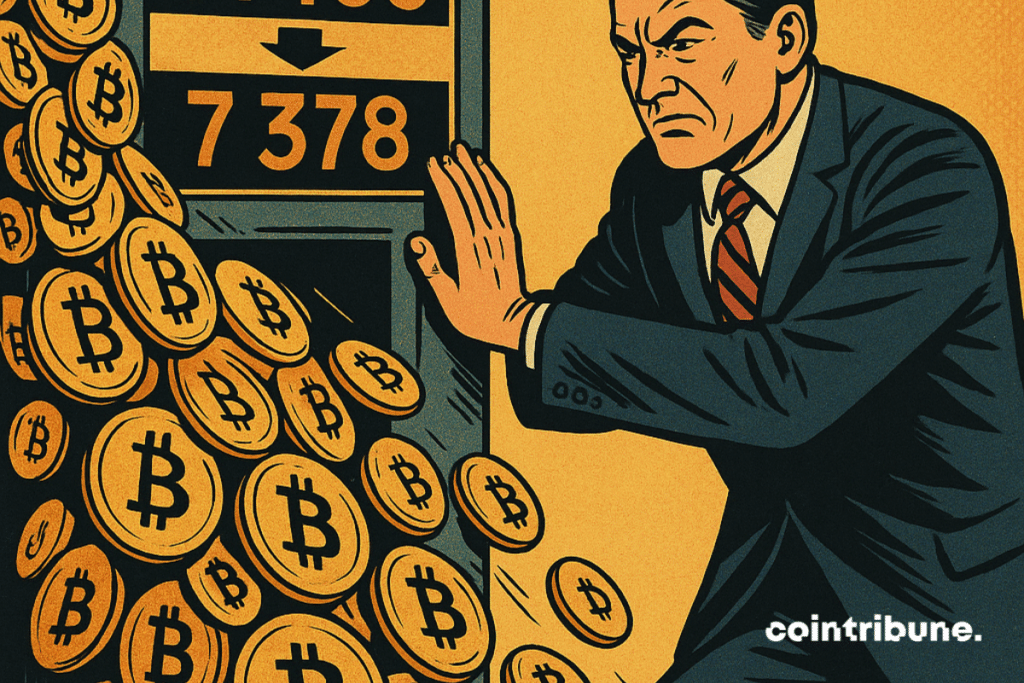

From 31,466 to 7,378 Bitcoin per Month: MicroStrategy Scales Back Its Buying Spree

September was a pivotal month for the crypto ecosystem. Bitcoin declined despite MicroStrategy’s continuous accumulation. Meanwhile, stablecoins reached new highs, reinforcing their central role in the markets. Finally, the number of crypto millionaires hit a record, signaling adoption that remains strong.

In brief

- In September, bitcoin declined, but MicroStrategy continued its accumulation with more than 7,300 BTC purchased.

- Stablecoins surpassed 295 billion dollars in capitalization, confirming their central role in crypto liquidity.

- The number of crypto millionaires jumped to 241,700, illustrating increasingly broad adoption despite volatility.

A mixed month for bitcoin

September was not kind to the price of bitcoin. Yet, Michael Saylor and his company MicroStrategy were not intimidated.

The company added more than 7,378 BTC to its reserves, worth over 837 million dollars. A massive operation on the surface, but which actually marks a slowdown compared to July, when MicroStrategy had acquired over 31,000 BTC.

This more measured strategy translates a certain prudence. For Saylor, the market remains in a construction phase. The price of bitcoin may seem boring in the short term, but this relative stability constitutes, according to him, an ideal opportunity for institutions wishing to take position. In short, a lull that could precede a new bullish wave.

At the same time, bitcoin ETFs in the United States continue to attract capital. In September, over 240 million dollars flowed into these financial products, strengthening the position of actors like BlackRock, which generated 260 million in revenue in two years thanks to its ETFs.

Stablecoins take a central place

While bitcoin goes through a consolidation month, stablecoins continue their ascent. Their total capitalization surpassed 295 billion dollars. Just in the last week of September, the market swelled by 5 billion. Growth that illustrates the increasing demand for digital assets perceived as safe and convenient in a context of high volatility.

Regulators are beginning to adjust their positions. In the United States, the CFTC is exploring the use of stablecoins as collateral on derivatives markets. In Australia, regulatory easing facilitates their distribution. But in Europe, the tone remains stricter: the Bank of Italy warned about risks linked to stablecoins issued by various entities and operating in different countries. A caution that reflects Brussels’ desire to strengthen control over this rapidly growing sector.

This dynamic clearly shows that, facing a less vigorous bitcoin, stablecoins are establishing themselves as the preferred tool to facilitate exchanges and increase the liquidity of crypto markets.

A new generation of crypto millionaires

Another significant fact of the month: the number of crypto millionaires continues to grow. They are now 241,700 worldwide, a 40% increase in one year. This progression illustrates both the leverage effect of past bullish cycles and the lasting appeal for digital assets.

The multiplication of these fortunes could influence the perception of governments and regulators, who see a new class of sometimes very influential investors emerging. For some, it is an additional proof of the growing adoption of crypto. For others, it is a sign of an increased risk of speculative bubbles fueled by this influx of capital.

September confirmed one thing: even in an apparently “calm” market, BTC continues to be strategically accumulated by major players, while stablecoins establish themselves as the backbone of the ecosystem. Behind this apparent stagnation, perhaps the next big impulse is preparing.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.