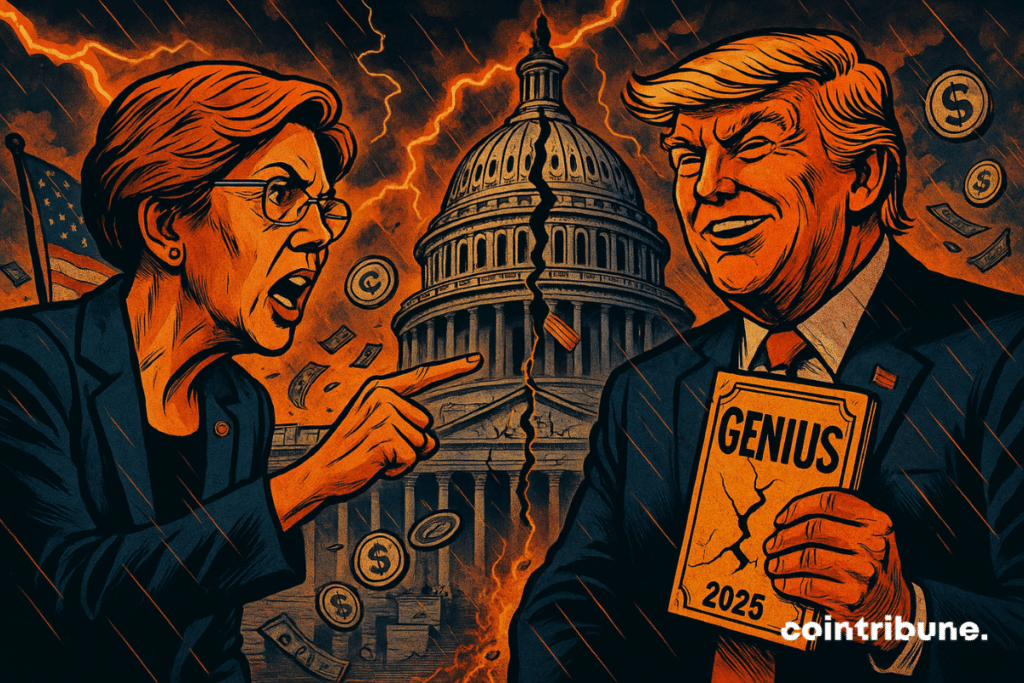

Elizabeth Warren Criticizes the GENIUS Act for Favoring Private Interests in Stablecoin Regulation

Trump is back, the American political scene feels like a monarchic remake. For some, it’s euphoria. For others, a tangible unease. For several months, Elizabeth Warren, a leading Democrat, has been tirelessly repeating the same warning: troubling ties link Trump, his close associates, and the crypto world. And with the enactment of the GENIUS Act, the fire reignites. The atmosphere is tense, the stakes colossal. Because behind this law, Warren sees a dangerous transfer of power between public institutions and private interests.

In brief

- The GENIUS Act imposes a lightened regulation on American giants in the stablecoin market.

- Elizabeth Warren denounces conflicts of interest linked to Trump and World Liberty Financial USD.

- The absence of concrete protections raises concerns amid risks of manipulation or systemic collapse.

- Other cryptos like PYUSD have also shown the technical fragility of the stablecoin sector.

Stablecoins and the GENIUS law: a slippery slope with Trumpian scents

The GENIUS law, signed in July 2025 by Donald Trump, requires stablecoin issuers to have full backing in dollars or equivalent assets. It demands audits for sector giants (more than 50 billion dollars in capitalization). But what Warren condemns is the veneer.

In a letter addressed to the Treasury, she speaks of a regulatory framework lightened for crypto banks.

She targets directly one stablecoin in particular: USD1, issued by World Liberty Financial, a company associated with the Trump family. This token, according to Warren, embodies an obvious conflict of interest.

Jeff Merkley and she have also requested detailed documents about a 2 billion dollar USD1 transaction between an Emirati company and Binance.

An example among others? Perhaps. But in the senator’s eyes, the GENIUS Act could be a golden key for the powerful to rewrite the rules of the financial game… to their advantage.

Crypto and systemic risks: an open-air financial Trojan horse

What this law also reveals is the ambiguity of stablecoins: between regulation and poorly controlled freedoms. The case of Paxos is striking. In October, 300 trillion dollars in PYUSD (PayPal’s stablecoin) were created by mistake. Everything was then burned, but the incident shook the crypto world.

Warren made it a symbol. She states:

This incident demonstrates the serious risks that operational failures can pose to an issuer, market integrity, and potentially financial stability. Treasury owes the public an explanation for how it intends to address those risks and, if it cannot, the authority it needs from Congress to do so.

The senator adds that the GENIUS Act failed to establish fundamental protections to prevent stablecoins from blowing up our financial system. She also criticizes the omission of common-sense amendments to guarantee users the same protections as those offered by an app like Venmo or a traditional bank account, while maintaining the authority of the Consumer Financial Protection Bureau over law enforcement.

In this matter, crypto is not the enemy, but the revealer. Proof that faulty regulation could precipitate crises… starting from a simple bug.

Power, money, and private currencies: towards a democratic crisis?

The real heart of the debate, for Warren, is ethics. And democracy.

Who creates the money? Who controls it? Beneath the technological veneer, these are fundamentally political questions.

Yet, the GENIUS law remains silent on key points:

- No ban on digital giants issuing their own currency;

- No extension of CFPB protections to stablecoin users;

- No clarification on the use of the Stabilization Fund to save issuers in crisis;

- No official rejection of an agreement with El Salvador that could favor Tether.

And above all, a deleterious climate where the rules seem written by those who benefit from them.

For Elizabeth Warren, stablecoins are slowly becoming the favorite digital weapon of cartels, authoritarian regimes, and illicit networks. She demands that the US Treasury act immediately. The time is no longer for observation but for action, with concrete measures to fill the gaps of an overly permissive regulation.

Stablecoins: key figures to understand the debate

- The stablecoin market is now worth over 150 billion dollars;

- The Emirates/Binance transaction involved 2 billion USD1;

- The Paxos incident: 300 trillion PYUSD minted by mistake;

- Audits only concern issuers > 50 billion $;

- The CFPB remains out of the game for stablecoin users.

In reality, the distrust between Warren and the crypto world is not new. Long before the vote on the GENIUS Act, Ripple’s legal head had already accused the senator of blocking the sector’s progress. One more proof that behind the question of stablecoins lies a much deeper debate: that of monetary power in a changing world.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.