Grayscale Raises Cardano Allocation Above 20% Despite Price Slump

Grayscale Investments has increased Cardano’s ADA weighting in its Smart Contract Fund to 20.12%, up from 19.50%, marking another consecutive allocation boost. ADA now accounts for more than one-fifth of the portfolio, reinforcing its role as a core holding within the multi-asset vehicle. The move comes during a period of sustained price weakness for the token. Even so, the portfolio positioning suggests continued conviction in Cardano’s long-term role among leading smart contract networks.

In brief

- Grayscale increased ADA weighting to 20.12%, reinforcing its core portfolio role.

- ADA fell 67% in six months, yet allocation rose during the correction phase.

- Active addresses remain elevated despite cooling user participation trends.

- Whale wallets above 100K ADA expanded, signaling steady supply absorption.

Grayscale Boosts Cardano Exposure Amid Deep Correction Phase

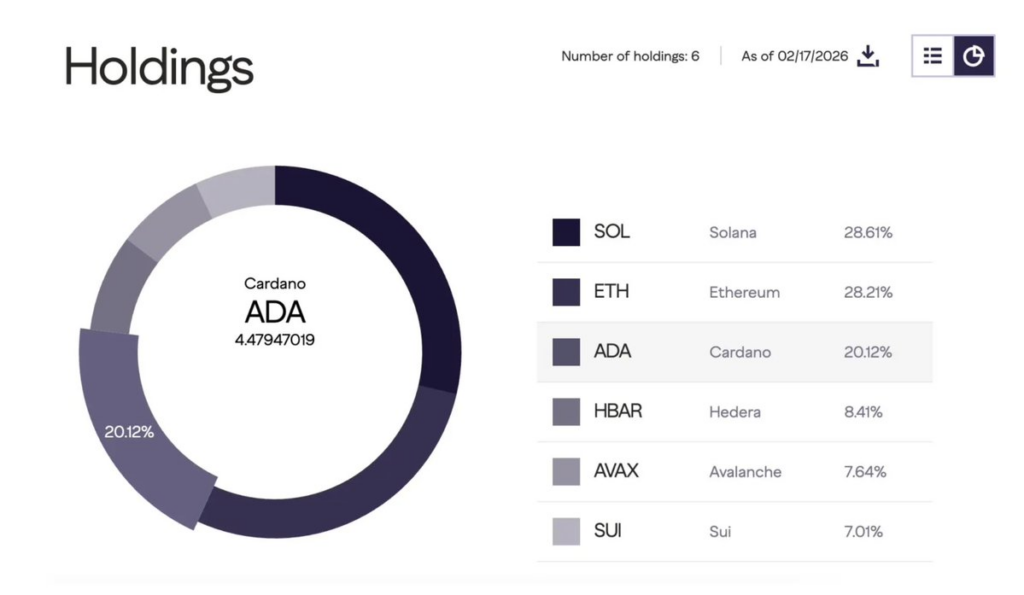

As of latest reports, the fund’s allocations are structured as follows:

- Solana (SOL): 28.61%

- Ethereum (ETH): 28.21%

- Cardano (ADA): 20.12%

- Hedera (HBAR): 8.41%

- Avalanche (AVAX): 7.64%

- Sui (SUI): 7.01%

With ADA firmly above the 20% threshold, Cardano remains the third-largest position, trailing only Solana and Ethereum.

Over the past six months, ADA has declined 67.19%, underperforming Ethereum’s 55.50% drop and Solana’s 54.83% slide. Rather than signaling weakening conviction, the higher weighting may reflect accumulation during a deeper correction phase. Institutional managers often increase exposure to assets that have compressed more aggressively when long-term fundamentals remain stable, allowing entry at lower cost levels.

Valuation metrics across smart contract platforms further frame the decision. A comparison of network fees versus diluted market capitalization shows Ethereum and Solana at the top of the valuation spectrum due to strong fee generation.

Cardano sits within the mid-to-upper valuation cluster alongside Avalanche and Sui. Despite price weakness, its fee-to-market-cap relationship remains aligned with peers. That positioning suggests ADA is not materially out of step with ecosystem activity.

On-Chain Divergence Points to Stabilization Potential for ADA

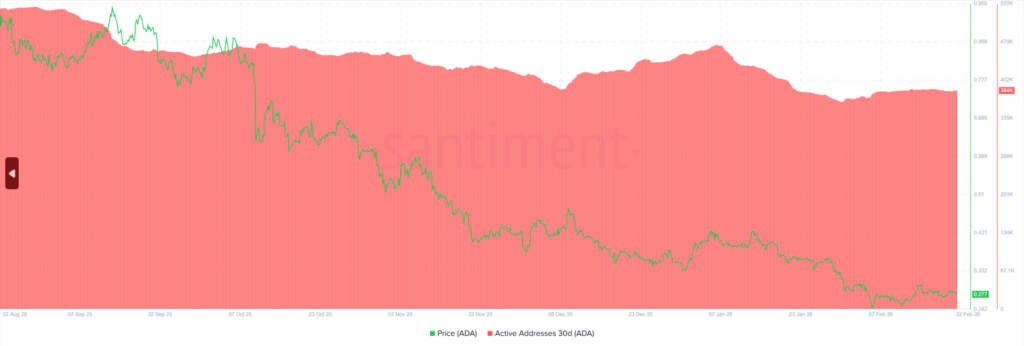

On-chain trends show that while price has trended lower, network participation has not fallen at the same pace. Thirty-day active address data shows some cooling in user activity, but counts remain structurally higher than earlier cycle levels. When price and participation move out of sync, it often signals that macro conditions, rather than internal network deterioration, are driving market pressure.

Several structural factors support the current allocation stance:

- Active addresses remain elevated relative to prior bear cycle baselines.

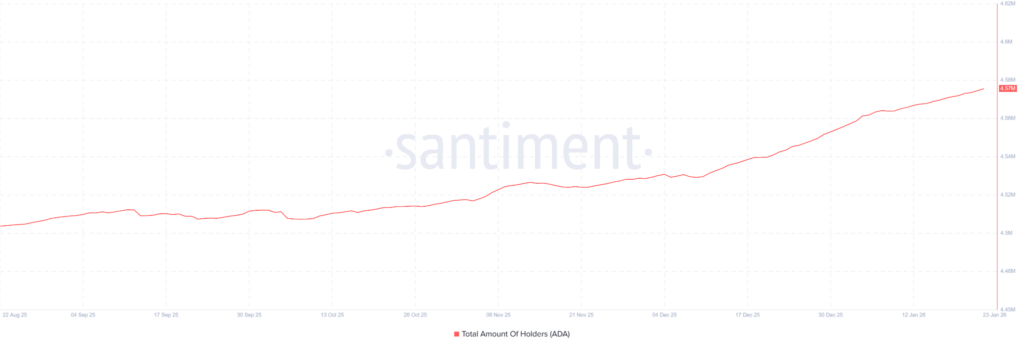

- Whale wallets holding over 100,000 ADA continue to increase.

- Fee generation remains competitive within the layer-1 segment.

- Market cap compression has outpaced network usage declines.

Large holder behavior adds another dimension. Wallets containing more than 100,000 ADA have steadily accumulated throughout the correction. Rising high-balance address counts during falling prices typically indicate supply absorption by longer-term participants rather than broad distribution. Such patterns often precede stabilization phases, when selling pressure begins to thin.

Grayscale Reaffirms Cardano’s Role in Smart Contract Exposure

Grayscale’s Smart Contract Fund offers regulated exposure to major programmable blockchain networks beyond Bitcoin. Allocation shifts within the vehicle tend to reflect internal assessments of liquidity, market structure, and ecosystem development.

Crossing the 20% mark carries weight because it signals that ADA remains a strategic position rather than a minor diversification sleeve.

Ethereum and Solana continue to command the largest shares of the portfolio. Even so, Cardano’s expanding allocation suggests that institutional capital views the network as structurally relevant within the broader smart contract segment. Price action alone has not displaced its standing within a diversified layer-1 basket.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.