How Kraken Keeps Your Crypto Safe

Security remains one of the main concerns for investors in the cryptocurrency space. Recent scandals, large-scale hacks, and losses due to poor private key management have fueled skepticism toward certain platforms. In this context, transparency and robust infrastructure have become critical criteria. Kraken has emerged as a benchmark in digital asset protection thanks to its rigorous approach and proven security systems. This article highlights the concrete mechanisms Kraken has implemented to ensure fund safety, along with tangible, verifiable proof for users.

In brief

- Kraken ensures institutional-grade security through a compartmentalized architecture, regular audits, and over 95% of assets stored offline in multisignature cold wallets.

- Account access is protected by mandatory two-factor authentication, behavioral monitoring, and advanced options like address whitelisting.

- Kraken stands out for its transparency via a proof of reserves system based on a Merkle Tree, allowing each user to cryptographically verify that their funds are fully covered.

- The platform strictly complies with international regulations (PSAN, MiCA, MiFID II, FinCEN) and applies enhanced procedures against money laundering, fraud, and suspicious activities.

- A dedicated cybersecurity team, Kraken Security Labs, combined with 24/7 customer support, guarantees proactive protection and immediate assistance in case of threats or incidents.

Built-in security from the platform’s architecture

Crypto security doesn’t depend solely on the user. It starts with the technical strength of the platform. Kraken has built its infrastructure on strict principles to ensure fund protection, even under critical conditions.

Resilient infrastructure by design

From the beginning, Kraken implemented a compartmentalized architecture capable of containing isolated incidents. Each system component is separated and independently monitored, limiting propagation in the event of a breach.

The cryptography used adheres to the industry’s highest standards, with regular security audits conducted by specialized firms. These audits aim to detect vulnerabilities before they can be exploited.

Both Kraken Pro and Kraken Desktop operate within this secured environment, sharing the same infrastructure as the main site while offering professional-grade tools without compromising security.

Cold storage for the majority of digital assets

A key pillar of Kraken’s strategy is its extensive use of offline storage. Over 95% of the crypto assets deposited on the platform are stored in cold wallets, completely disconnected from the internet.

This eliminates risks linked to remote attacks. Kraken further reinforces this layer with:

- Private keys stored in fully air-gapped environments;

- Multi-signature (multisig) systems requiring multiple authorizations per transaction;

- Restricted physical access with multi-factor authentication.

This level of precaution ensures ultra-secure storage, even against the most sophisticated threats.

Strictly limited use of hot wallets

Hot wallets, online wallets, are used solely for routine withdrawals. Kraken deliberately limits their usage to avoid unnecessary exposure. They are monitored in real time, with pre-set thresholds to detect abnormal transfers. Suspicious activity triggers an automatic block and instant alert to technical teams.

This constant oversight ensures the small fraction of assets online remains under tight surveillance, without compromising user experience.

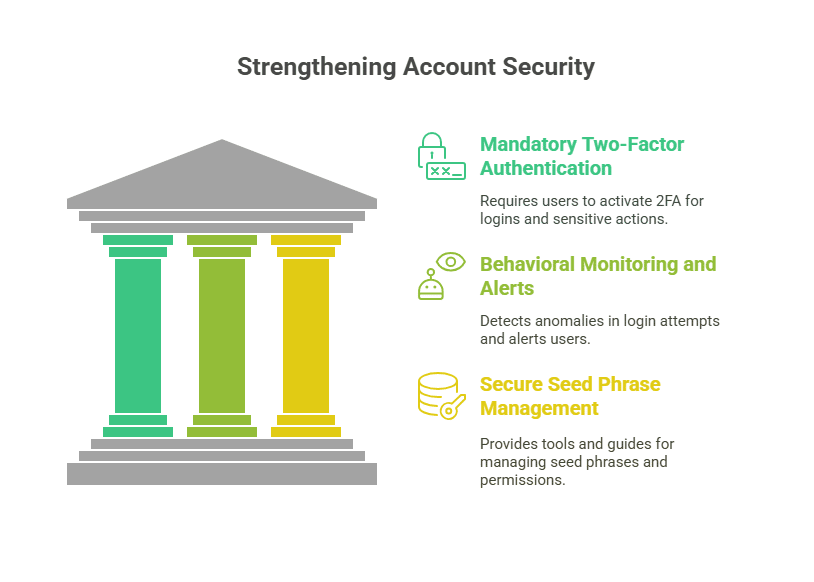

Securing user account access

Even with solid infrastructure, account safety depends on access controls. Kraken has implemented a range of protections to block unauthorized access or manipulation.

Mandatory Two-Factor Authentication (2FA)

Upon account creation, Kraken requires users to activate 2FA using apps like Google Authenticator or physical keys (e.g., Yubikey) to validate logins and sensitive actions. This double layer ensures that even if a password is compromised, access remains blocked without the user’s personal device.

This measure secures logins, withdrawals, personal data changes, and fund transfers.

Behavioral monitoring and automated alerts

Kraken integrates behavioral analysis to detect anomalies. Each login attempt is checked for location, device, and activity type.

If something appears unusual, the session is suspended and the user receives an immediate alert, enabling swift action to secure the account.

This proactive system helps defend against phishing, identity theft, or social engineering.

Secure seed phrase and permission management

Kraken strongly encourages users to maintain good security hygiene. It provides practical guides on managing seed phrases, used to recover private wallets.

Advanced options include account lockouts, whitelisting of withdrawal addresses, and full access to login history.

These tools give users total control while minimizing unauthorized access risks.

Concrete Proof: Kraken’s transparency in reserves

In crypto, trust is built on verifiable facts, not promises. Kraken has pioneered proof-of-reserves systems, allowing users to audit fund availability themselves.

Understanding proof of reserves

Proof of Reserves is a cryptographic mechanism proving that a platform actually holds all client-deposited funds. Unlike traditional audits, it relies on encrypted, verifiable data.

It matches user balances with assets held in the exchange’s wallets, guaranteeing that funds aren’t lent out or pledged elsewhere.

Kraken: a proof-of-reserves pioneer

Kraken uses a Merkle Tree-based system, a cryptographic verification method ensuring individual privacy and data integrity. Users can access published proof-of-reserve reports, which include aggregated balances, cryptographic hashes, and methodology. The source code is public for full transparency.

Kraken was among the first platforms to adopt and standardize this approach, especially after sector-wide trust crises.

How to verify your own balance

Every user can verify their balance against the latest proof-of-reserves report. Kraken provides a step-by-step guide using the Merkle hash linked to each account. No technical expertise is required. In a few simple steps, users can confirm their funds are properly backed by platform-held assets.

This reassures cautious investors and illustrates Kraken’s strong commitment to transparency and security.

Compliance, monitoring & external risk defense

Crypto asset security also relies on legal compliance and proactive threat detection. Kraken enforces strict regulatory and risk mitigation policies to protect all users.

Strict regulatory compliance

Kraken was one of the first platforms to align with international crypto regulations. For instance, it complies with PSAN rules in France, under the supervision of the AMF.

In the U.S., Kraken is registered with FinCEN for anti-money laundering compliance. It also adheres to requirements across numerous jurisdictions, offering legally sound services for investors in Europe, the U.S., and beyond. The platform also holds authorization under MiFID II, a license under the MiCA regulation, and accreditation as an Electronic Money Institution (EMI).

This legal framework is crucial, especially for traditional investors seeking crypto exposure.

Anti-Fraud and Anti-Money Laundering (AML) Measures

Transaction transparency is central to fraud prevention. Kraken has strengthened its KYC procedures to verify user identities at signup. Strict document checks, IP analysis, and suspicious activity reporting help reduce the risks of money laundering, illicit funding, or identity theft.

Additionally, Kraken uses blockchain analysis tools to track suspect transactions, halting harmful actions before damage occurs.

User education and awareness

Account safety also depends on user behavior. Kraken has created educational programs to raise awareness of common risks.

Campaigns cover phishing, public Wi-Fi use, seed phrase protection, and social media scams. Educational content is published on the official site and shared via communication channels. Kraken reminds users that education is a vital defense against scams, empowering them to avoid human error.

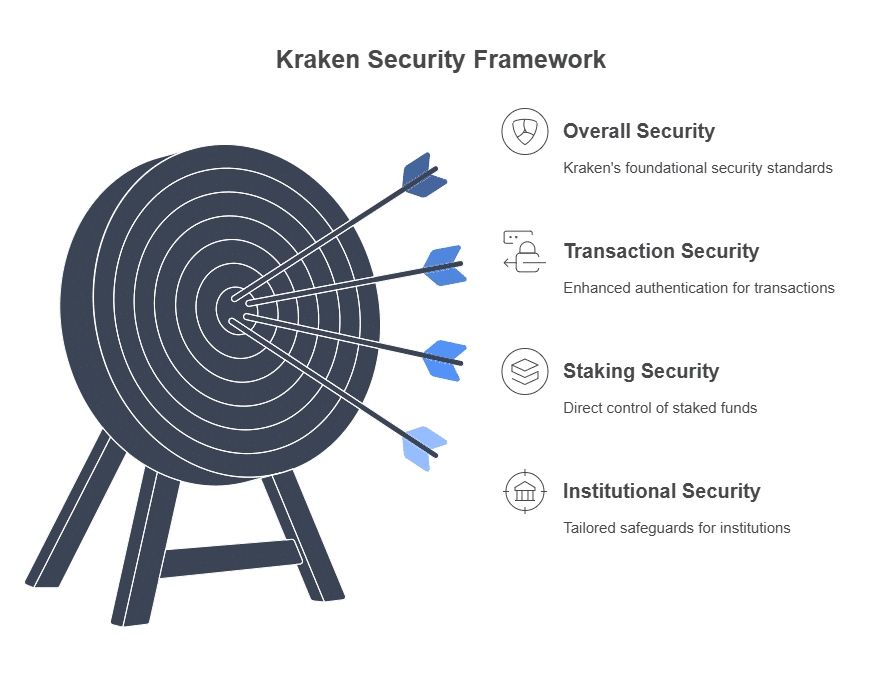

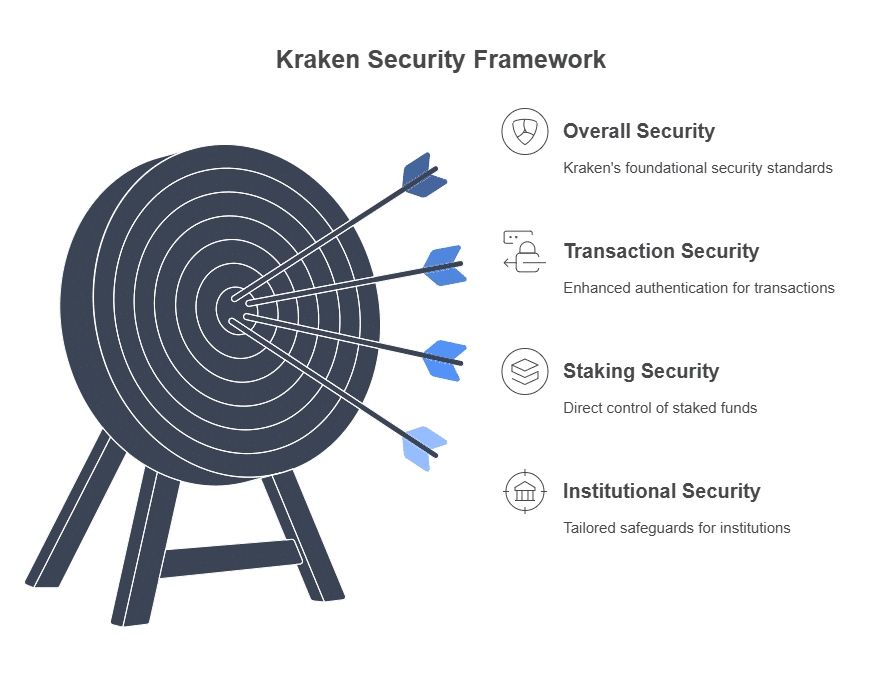

Securing all Kraken services

Kraken’s security standards apply across all services, from payments and staking to institutional support. This systemic approach ensures consistent asset protection regardless of the service.

Kraken Pay and secured transactions

With Kraken Pay, users can transfer between fiat and crypto with ease. Transactions occur directly between accounts without third-party services. Each transaction requires enhanced authentication. No operation can proceed without prior user validation, drastically reducing fraud risk.

Transfers via Kraken Pay are protected by the platform’s overall security infrastructure, minimizing exposure to external threats.

Kraken Auto-Earn: Secure staking with fund protection

The Auto-Earn service allows users to earn yield through crypto staking. Unlike platforms that delegate assets to third parties, Kraken retains full control of staked funds.

This approach ensures maximum security. Users maintain ownership while earning potential rewards. Kraken clearly outlines yield conditions, lock-up periods, and supported cryptocurrencies.

Funds in Auto-Earn are safeguarded with the same rigor as standard assets, within a secure, transparent staking framework.

Kraken Institutions: Enhanced protection for large volumes

Kraken also offers tailored services for businesses, funds and institutional clients, with additional safeguards for high-volume management:

- Encrypted API channels with custom private keys;

- Multi-signature cold storage infrastructure;

- Tools for audit, reporting, and internal controls.

Companies can integrate Kraken into asset management workflows without exposing their strategies to technical or organizational risk.

Dedicated security team and responsive customer support

Beyond tools and protocols, Kraken relies on a specialized human team to anticipate, detect, and manage security incidents, combining technical expertise and human responsiveness.

Kraken Security Labs: An elite task force

Kraken operates its own cybersecurity team, Kraken Security Labs. This elite unit conducts continuous internal audits, identifies vulnerabilities, and implements technical fixes. They also publish ecosystem-wide security alerts. Their work extends beyond Kraken: they contribute to the broader crypto industry via research, public reports, and open-source patches.

This expertise reinforces Kraken’s status as a trusted, industry-wide security leader.

24/7 human support for incident response

Alongside its technical team, Kraken provides 24/7 customer support. Users can chat with agents anytime in case of doubts, anomalies, or intrusion suspicions.

Staff are trained for critical incidents and follow strict procedures to lock accounts, isolate transactions, or intervene rapidly in compromised situations. This service is a major asset for less tech-savvy investors.

Together, the expert team and human assistance underscore Kraken’s full commitment to user protection.

Kraken stands out as a security leader in the crypto world. Its infrastructure is built on strong technical foundations, reinforced by user-verifiable mechanisms. Thanks to a combination of cold storage, enhanced authentication, and transparent reserves, Kraken meets the expectations of the most cautious investors. Its proactive approach, both technical and human, creates a trusted environment. Kraken is a reliable partner for any digital asset investment strategy.

FAQ

In case of lost access, Kraken offers a secure recovery procedure via its support. The user must provide supporting documents and go through several verification steps. The process is designed to prevent any fraudulent recovery.

Yes, Kraken holds limited insurance covering certain types of losses due to security breaches. This coverage does not apply to user errors or losses due to compromised passwords.

No, each account must have its own 2FA method. This ensures strict separation between accounts, enhancing the user’s overall security.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more