Hyperliquid Strategies Launches $1B Plan to Expand HYPE Token Holdings

Hyperliquid Strategies is taking a major step to strengthen its presence in the decentralized finance (DeFi) ecosystem. The firm plans to raise up to $1 billion to expand its holdings of the Hyperliquid (HYPE) token, which powers the world’s largest decentralized derivatives platform.

In brief

- Hyperliquid Strategies to raise $1B via 160M share offering advised by Chardan Capital Markets.

- Funds will expand HYPE token holdings and support general corporate initiatives post-merger.

- HYPE token surged 10% to $39.73, outperforming a declining crypto market amid mixed technicals.

- Hyperliquid leads DeFi perps with $317.6B in October volume, capturing a 70% market share.

Chardan Capital to Advise Hyperliquid Strategies on $1B Share Offering

According to Wednesday’s S-1 registration filing, Hyperliquid Strategies intends to issue up to 160 million shares of common stock. The proceeds will be used primarily to purchase additional HYPE tokens and for general corporate purposes. Chardan Capital Markets will serve as the financial advisor for the offering.

The company is emerging from a merger between Nasdaq-listed biotech firm Sonnet BioTherapeutics and Rorschach I LLC, a special purpose acquisition company (SPAC). Once the merger is finalized, David Schamis will serve as CEO, while Bob Diamond, former CEO of Barclays, will take on the role of chairman.

Treasury Play Pushes HYPE Higher Amid Mixed Technicals

Unsurprisingly, news of the filing triggered a surge of more than 10% in the HYPE token, which climbed to $39.73. Interestingly, this rally came even as the broader crypto market slipped 0.6% during the same period.

Despite the sharp uptick, underlying market data paint a more cautious picture:

- Market Sentiment: Hyperliquid’s price outlook remains bearish, reflecting investor caution.

- Investor Mood: The Fear & Greed Index stands at 27 (“Fear”), signaling weak market confidence.

- Performance Metrics: The token recorded 13 green days out of 30 (43%), suggesting limited short-term strength.

- Token Supply: Only 34% of the total HYPE supply is in circulation, pointing to limited liquidity.

- Technical Indicator: Despite subdued sentiment, HYPE continues to trade above its 200-day simple moving average, indicating that long-term support remains intact.

Once the merger is complete, Hyperliquid Strategies is expected to hold 12.6 million HYPE tokens valued at roughly $470 million, along with $305 million in cash earmarked for additional token purchases.

This position would make Hyperliquid Strategies the largest corporate holder of HYPE, underscoring its alignment with the Hyperliquid network—a platform anchoring one of the most active decentralized derivatives exchanges globally.

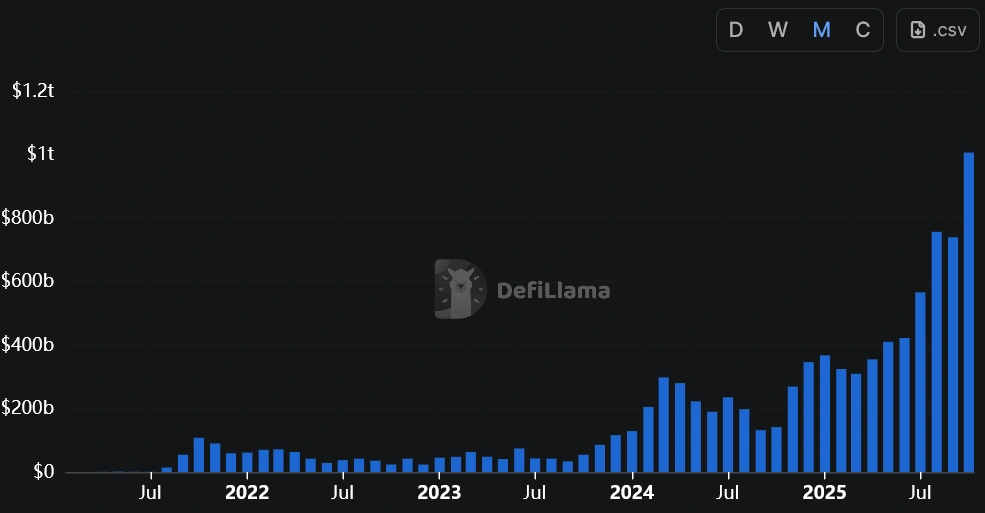

Hyperliquid Outpaces Competitors as October Perpetual Volumes Hit $1 Trillion

While such treasury-driven strategies can boost share prices in the short term, analysts have questioned their resilience during altcoin market downturns. Even so, Hyperliquid’s core fundamentals remain strong, supported by high trading activity and growing user engagement.

The platform leads the market in perpetual futures (“perps”), derivatives that enable 24/7 trading and leveraged exposure to digital assets.

Here are some key market data to note:

- Decentralized perpetual trading volumes surpassed $1 trillion in the first 23 days of October, breaking September’s $772 billion record, according to DeFiLlama.

- Hyperliquid maintained its lead with $317.6 billion in trading volume during the same period.

- Competitors: Lighter recorded $255.4 billion, Aster $177.6 billion, and edgeX $60.6 billion.

- Market Share: Hyperliquid now commands an estimated 70% share of the decentralized perpetuals market, reinforcing its dominance in the sector.

Hyperliquid continues to set new benchmarks in DeFi, reporting $248 billion in 24-hour trading volume in May 2025 and a record $106 million in revenue in August—further solidifying its leadership in decentralized derivatives.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.