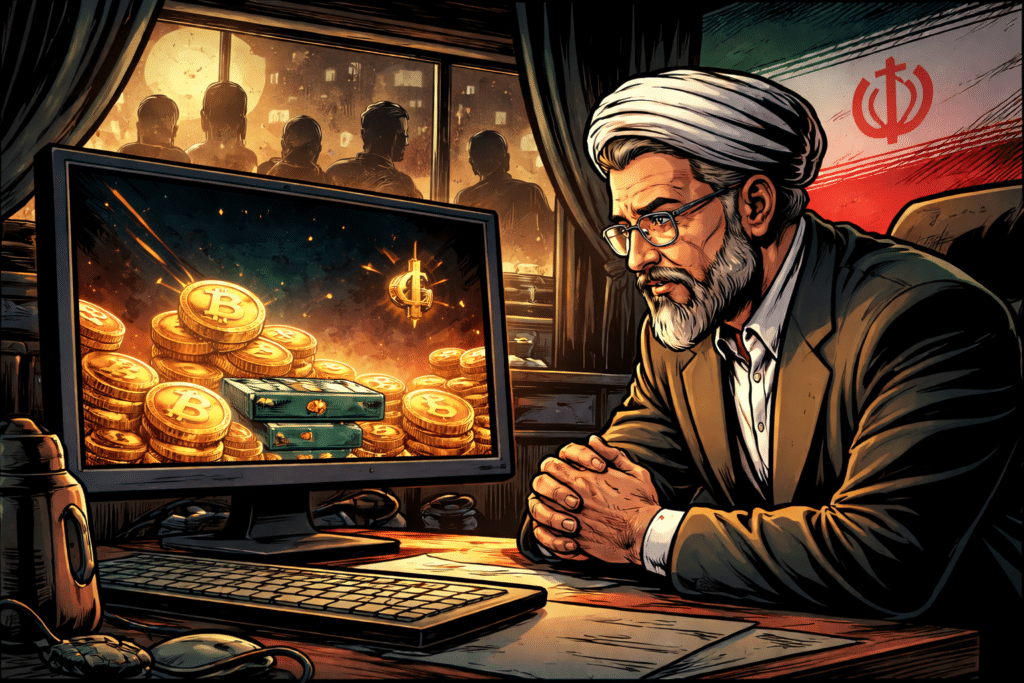

Iran Embraces Bitcoin To Escape Inflation

The Iranian crypto economy experienced a spectacular acceleration in 2025, reaching around 7.78 billion dollars, according to Chainalysis data. This growth is far from being purely technical. It is closely linked to social movements, economic constraints, and digital disruptions that have shaken the country.

In brief

- Iran’s crypto economy exceeded 7.8 billion dollars in 2025, driven by Bitcoin use during major popular protests

- But this growth is accompanied by tightened control and a regulatory gray area that maintains uncertainty.

A crypto boom at the heart of unrest

The growth of the crypto market in Iran in 2025 is not just a number. It symbolizes the adaptation of a population under economic and political pressure. As protests intensified at the end of the year, Iranians turned to Bitcoin and other cryptos as means to safeguard their savings. The country even offered advanced arms sales in crypto.

In a context where the national currency, the rial, significantly depreciated against the dollar, crypto offered a form of “value anchor” to those who still had access to the global internet. This dynamic was particularly visible when Bitcoin withdrawals surged during massive network shutdowns.

The intensive use of crypto during protests illustrates a pragmatic reality: faced with a loss of confidence in the national monetary system, many seek digital alternatives. Bitcoin, by its decentralized nature, meets this demand.

Understanding the scale of the Iranian crypto asset market

These 7.8 billion dollars must be put into context. This figure reflects all transactions, withdrawals, and movements on the blockchain related to Iranian addresses. It is not just trading. Indeed, an entire economic layer has formed around cryptos.

The growth observed in 2025 was faster than the previous year. This means that the role of cryptos is becoming increasingly significant in the Iranian economy. And that, even if this sector remains fragmented and influenced by political events.

This growth does not mean a monetary revolution is underway. It rather shows that, in crisis situations, individuals turn to alternative tools to protect their wealth. Bitcoin, despite its volatility, appears as a potential option when the traditional financial system is under pressure.

Several factors combine to explain this rise of crypto in Iran. First, social pressure. In 2025, large protest movements broke out in several cities, confronting the population with prolonged instability.

Next, the rampant inflation of the rial pushed Iranians to seek safe havens for their money. Restrictions imposed by the central bank on stablecoins show that authorities fear the growing impact of cryptos on the formal economy.

Finally, frequent internet access cuts pushed some to use more resilient means to send and receive value. Bitcoin, in particular, operates on a distributed network that is not controlled by a single actor or government.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Enseignante et ingénieure IT, Lydie découvre le Bitcoin en 2022 et plonge dans l’univers des cryptomonnaies. Elle vulgarise des sujets complexes, décrypte les enjeux du Web3 et défend une vision d’un futur numérique ouvert, inclusif et décentralisé.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.