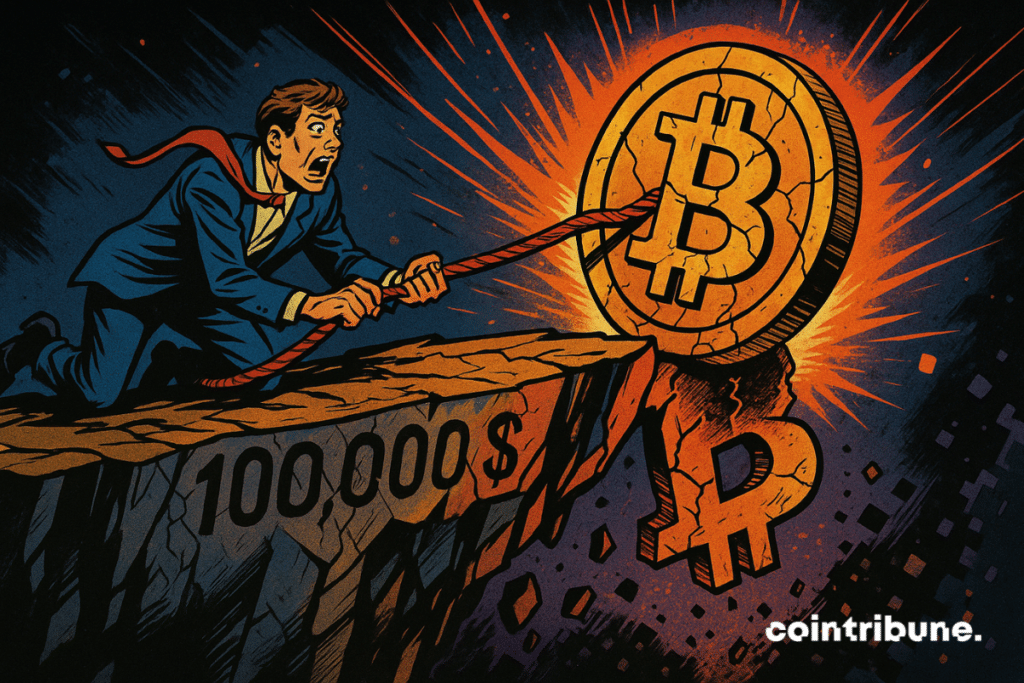

Market Jitters Pull Bitcoin Toward Critical Support

The $100,000 threshold, long perceived as a solid floor for Bitcoin, is faltering. Falling to $108,938, the asset slips towards a critical zone. Geoffrey Kendrick, analyst at Standard Chartered, now speaks of an imminent break of this symbolic level. The scenario of a drop below $100,000 is gaining ground, reigniting tensions in an already pressured market.

In brief

- Bitcoin drops to $108,938, threatening the psychological threshold of $100,000.

- Geoffrey Kendrick, analyst at Standard Chartered, believes a break below $100,000 is now “inevitable.”

- This decline comes amid geopolitical tensions, directly impacting financial markets.

- For Kendrick, a drop below $100,000 could be the last buying opportunity before a new bullish cycle.

Standard Chartered Issues Warning : Towards a Break Below $100,000?

This Wednesday, October 22, in a publicly released note, Geoffrey Kendrick, head of crypto research at Standard Chartered, expressed clear concern about the recent market development, in a context of extreme volatility on bitcoin.

“I now believe a drop below $100,000 seems inevitable“, he stated, while specifying that this decline could be “short-lived“. This warning comes barely two weeks after bitcoin reached a new all-time high at $126,000. Since then, the leading crypto has fallen nearly 14 % amid increased fragility in global financial markets.

This downturn did not happen in isolation. It coincides with a renewed tension between Washington and Beijing, after Donald Trump threatened a significant increase in tariffs against China.

These remarks triggered a wave of liquidations in the markets, considered the largest since bitcoin’s creation. The BTC price hit a weekly low of $104,000, dragging down the entire crypto market.

According to Coinglass data, nearly $186.52 million were liquidated in derivative markets in just 24 hours, over $155 million from long positions. This selling pressure increases the market’s vulnerability.

A Strategic Buying Opportunity ?

Kendrick’s analysis fits into a tactical market view. He does not just predict an imminent drop, but also sees a potential entry point : “spoiler alert, this will be a buying opportunity“, he argues in his note.

He even insists: “stay agile and ready to buy if the price drops below $100,000. This could be the last time bitcoin falls below this threshold“. This perspective contrasts with the general cautious climate, but resonates with some major players’ decisions.

This is particularly true for Strategy. The firm led by Michael Saylor used the recent drop to acquire an additional 168 BTC at an average price of $112,051 per unit. The company now holds 640,418 BTC, equivalent to $69 billion.

If the crypto price returned to its recent high, this position would be worth over $80 billion. This move demonstrates that some institutional investors see this retracement phase as a strategic long-term opportunity, regardless of immediate volatility.

This type of position reflects the conviction that despite cyclical fluctuations, bitcoin’s fundamentals remain solid. A break below $100,000, if it occurs, could actually serve as a catalyst for a new wave of accumulation, especially by players with liquidity ready to be deployed. However, this hypothesis relies on a fragile balance. If the drop is accompanied by widespread loss of confidence, the expected rebound could be delayed.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.